Even the biggest Grinches on Wall Street might need to rethink their outlook for the final trading days of 2023.

US stocks rallied on surprising consumer confidence numbers and strong earnings from Nike and FedEx. This is cause for some holiday cheer, signaling that good financial news can be found during tumultuous times.

The above chart shows Mish’s Modern Family members and their 20-day and 50-day moving averages over the last two months.

The “Modern Family” comprises six key ETF symbols that provide a comprehensive guide to the stock market. Each family member is recovering in price today, with IBB leading and KRE being the weakest link.

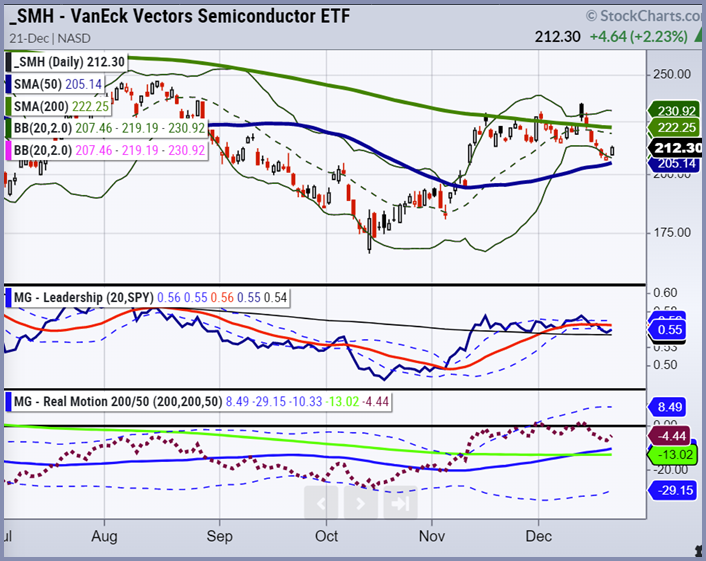

Semiconductors have been a significant drag on Wall Street. We’ll examine Sister Semiconductors (SMH) and see what she says about it now.

Mish’s Modern Family is a reliable gauge for measuring overall macro factors and analyzing family members and their relationships can help to see less obvious market patterns.

A diversified and systematic approach to managing risk, trades, and portfolio strategies is essential, which is why we continue to monitor all members of the Modern Family daily.

No matter what happens in the stock market on any given day, there will always be stocks and sectors that zig – when others zag.

Sister semis is a valuable gauge for any trader, investor, or financial professional evaluating the tech sector.

Sister Semiconductors (SMH) is attempting to regain her 200-day moving average. SMH briefly crossed the 200-day moving average before finding support near the 50-day moving average.

If SMH regains its 200-day moving average in the coming weeks and holds – this could signal a significant market shift.

Yet, the continued uncertainty in global markets has caused many investors to avoid the semiconductor industry.

Weak sales have weighed heavily on chipmakers, including Intel, Qualcomm, Texas Instruments, AMD, Micron, and Nvidia, to name a few.

While some investors are rightly concerned, there is also an opportunity for savvy investors with market timing and trading knowledge to invest in sister semiconductor companies’ price recovery.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 380 support and 390 resistance

Russell 2000 (IWM) 170 pivotal support and 180 resistance

Dow (DIA) 330 support and 337 resistance.

Nasdaq (QQQ) 269 support and 278 resistance

Regional banks (KRE) 53 support and resistance 61.

Semiconductors (SMH) Support is 205 and 217 resistance.

Transportation (IYT) 211 pivotal support and 222 is now resistance.

Biotechnology (IBB) 130 is pivotal support and 139 overhead resistance.

Retail (XRT) 57 pivotal support and 63 is now resistance. Regained 60.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.