That most of this will be noise adds to the likelihood of increased volatility. More likely than not, the second 10% or more correction in as many years will be experienced in 2016. This is not so much a forecast, as it is a description of the historical norm.

Broad Market (the “Tape”): This is the epitome of focusing on what is happening, not what could or should happen. The faltering in the broad market even as the S&P 500 remained range-bound in the first half of 2015 gave early evidence that all was not well beneath the surface, and the improvements in the broad market seen during the fall correction provided hopeful signals that the lows for the year were in place.

While the recovery in breadth in the fourth quarter of 2015 has been overall unimpressive, we have not seen important divergences emerge. Rather, the S&P 500, fueled by gains in a handful of stocks, has recovered ahead of most of our breadth indicators. Market breadth has recovered at a slower pace than the popular averages but it would be premature to suggest they are heading in opposite directions. One factor clouding the discussion is that the overall gain in the S&P 500 has been relatively muted in 2015 – this makes it easier to hand-pick a few winning stocks that are “providing the all of the gains for the index this year.” That would be a much more powerful warning if the S&P 500 were up 10% or more for the year, rather than up just a percent or two.

Two things in particular bear watching from a market breadth perspective as we move into 2016: The relative lack of individual stocks making new highs and the wide dispersion in sector-level returns. The best markets are those in which all areas are participating. It might be easy to dismiss weakness in the Energy sector as not significant for the overall market, but history suggests stocks overall struggle when one (or more) sector is lagging significantly. That certainly seemed to play out in 2015.

On the issue of new highs – even when the S&P 500 and the Russell 2000 were making new highs in the first half of 2015, relatively few individual stocks joined in that celebration. The lack of issues making new highs weighs on the indexes and speaks to a lack of broadly based momentum that can sustain a rally even if a few leaders start to stall.

Investing Themes and Considerations for 2016

Diversification for the sake of itself can lead to more risk, as can needlessly complex solutions. Investors should follow relative strength when able – using trends to their advantage rather than trying to pick inflection points and/or reversals. Successful investing is hard enough; we do not need to make it more complex than necessary.

With 2016 likely to be another (and perhaps increasingly) volatile year and overall upside restrained by a fully invested public and elevated valuations, holding higher-than-normal levels of cash could provide the scarcest of all resources: liquidity in periods of stress. By cash we mean cash or something so similar it is indistinguishable – we do not mean financial products that promise liquidity, attractive returns and little downside risk.

Know your investing biases and work to counter them – be a little bit skeptical if you find exactly what you were looking for.

Small-caps vs Large-caps: Small-cap stocks enjoy a seasonal tailwind into the first quarter of 2016 and that could help overall breadth continue to improve. If this leadership fails to emerge and/or small-caps fail to make a new high relative to large-caps it could provide strong evidence that we have seen a secular peak in small-cap strength.

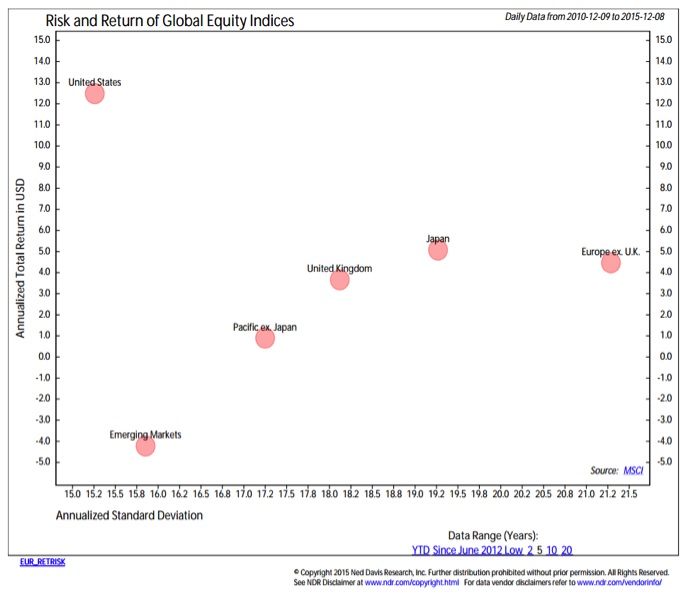

United States vs. Rest of World: The US continues to trend higher versus the rest of the world, and from a risk/return perspective (in dollars) there is little comparison between the U.S. and the other regions. While we would continue to focus domestically, the 2016 stock market outlook could see the rest of the word start to play catch-up and opportunities may emerge. Central bank easing in Europe could provide a tailwind for stocks there, but political risks remain a potential obstacle.

Commodities: Long-term commodity super-cycle trends suggest it would be awfully early to start looking for a significant low. While history suggests that most of the price damage (around 75%) to commodities may be in place, we are only one-quarter to one-third of the way through the cycle in term of time. The next stage of the cycle is typified by fading correlations and increased investor apathy. Selective rally opportunities may emerge, but the long-term trend is still flat to down. This could also continue to weigh on commodity stocks, and relative strength there remains challenging.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.