The treasury bond market has been playing ping pong with investors for the past several months.

Back in October, I provided an update to the chart for the 20 Year Treasury Bond ETF (TLT), looking for lower prices. Though prices have moved lower, it’s been an uneven ride.

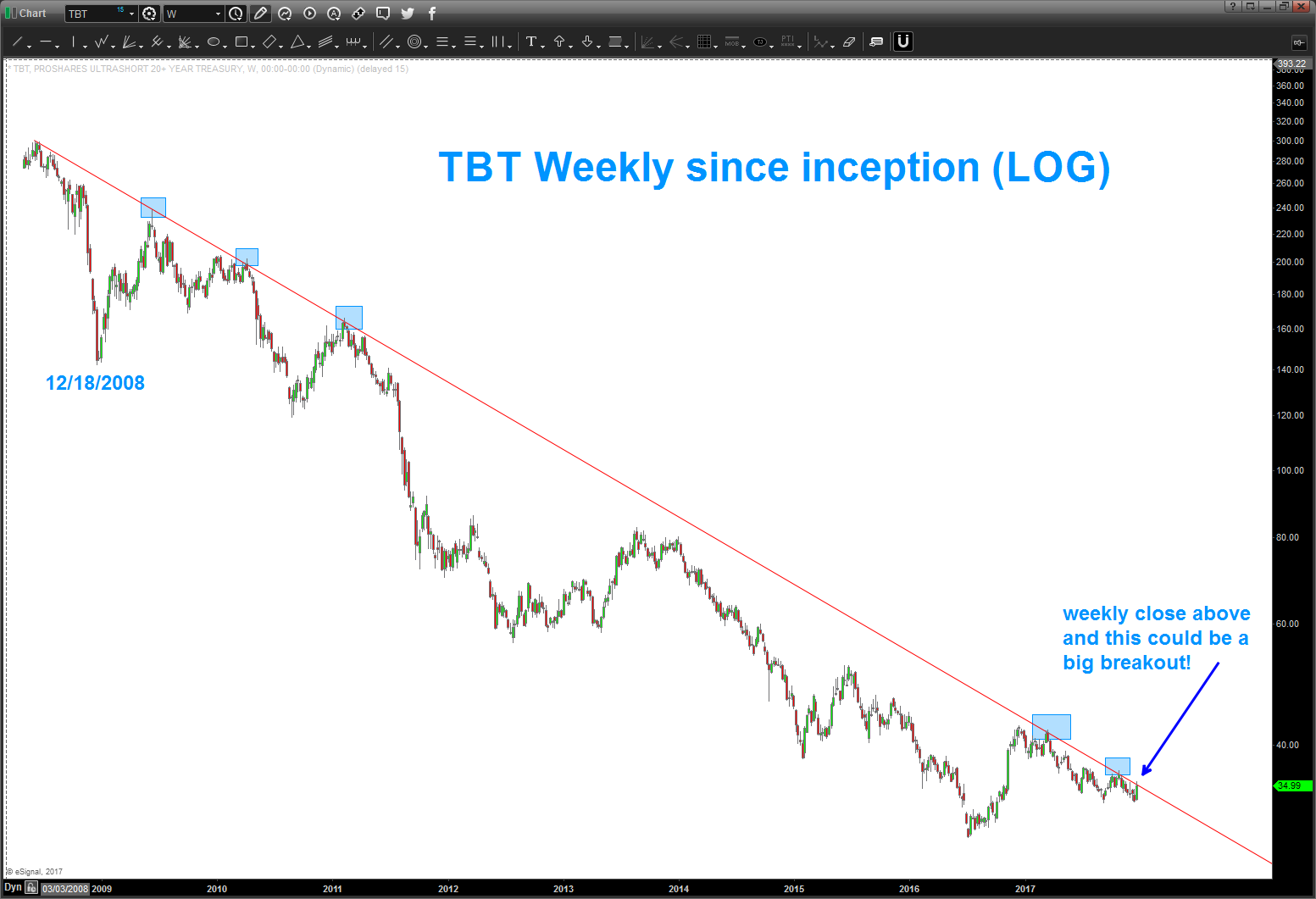

This week, I want to call attention to the other side of the treasury market – the UltraShort Treasury Bond ETF (TBT). This “short” long-term treasury bonds ETF could be a big time winner if/when it breaks out of its long-term downtrend channel.

As you can see in the chart below, TBT is testing the long term “log” downtrend line. Investors should keep an eye on this. With TBT, you are betting that interest rates are going to rise. So if this breaks out above the down trend line, it could start move higher.

Depending on our risk appetite a weekly or monthly close above this long standing trend line could be your signal that this is getting ready to run higher.

Investors can also use this as an indicator / cue that rates are ready to rise and adjust your portfolio accordingly.

ALSO READ: Treasury Bonds Continue Bumpy Ride For Investors

Thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.