- With 74% of S&P 500 companies reporting thus far, EPS growth for Q4 2025 currently stands at 13.2%

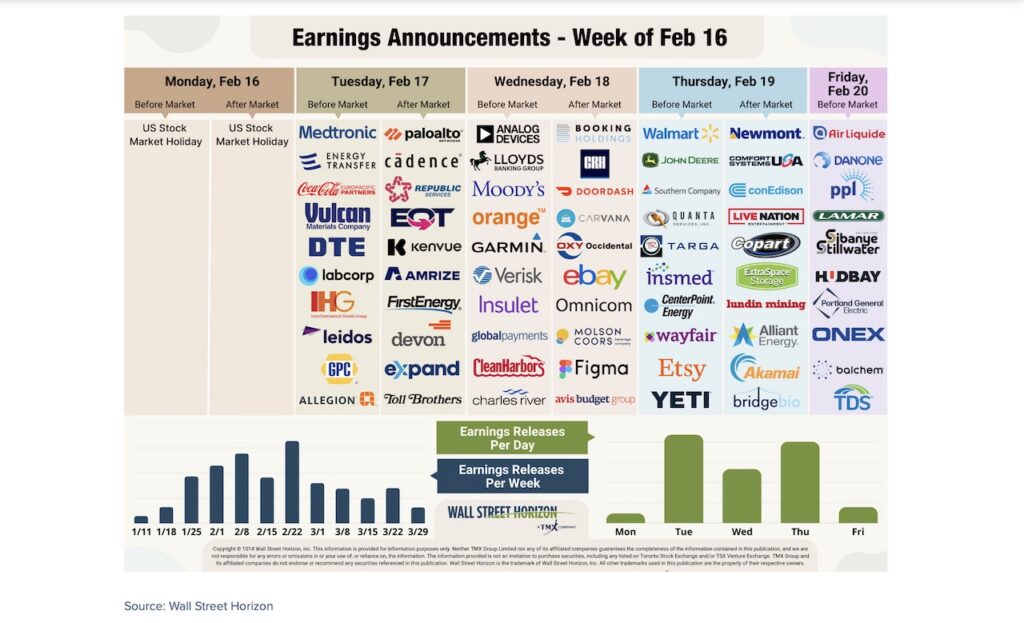

- This week, 1,033 companies are expected to report, including results from WalMart, Palo Alto Networks, Wayfair and more

- Potential earnings surprises this week: Booking Holdings, Global Payments, Insulet Corp and more

Macro Resilience, Tech Resistance as Rotation into Cyclicals Continues

Volatility was once again the theme in US markets last week as a profound alpha rotation reshapes Wall Street. Investors continued to flee mega-cap tech, software stocks, and anything considered an AI loser, in favor of more cyclical sectors such as energy, materials and industrials.

The list of impacted industries expanded across certain real estate, trucking and financial services names.

This exodus from software stocks over the last couple of weeks was triggered by advancements in agentic AI, specifically the launch of Anthropic’s Claude Code and Claude Cowork. These tools have shifted the narrative from “AI helps software” to “AI replaces software,” leading to fears that the traditional per-seat licensing model, the bedrock of companies like Salesforce and Adobe, is becoming obsolete.

As companies realize that a handful of AI agents can do the work of dozens of human employees, the demand for traditional software seats will continue to decline, unless these names can prove they are beneficiaries of AI and show core revenue improvements.

Against this backdrop of tech turbulence, the delayed January Jobs Report provided a confusing but ultimately stabilizing signal for the broader economy. The report showed 130,000 jobs were added in January, more than double the 55,000 expectation by economists surveyed by Dow Jones. The unemployment rate edged down to 4.3% from 4.4%.1 Strength was once again seen in health care, social assistance and construction. Economists are calling this a “low-hire, low-fire” environment. While the labor market isn’t exactly thawing, it seems to have found a floor that is preventing a broader economic collapse even as tech workers face a fresh wave of AI-driven layoffs.

More positive macro news came on Friday when the latest Consumer Price Index (CPI) reading was released. The headline annual inflation rate dropped to 2.4% in January (down from 2.7% in December), undershooting the 2.5% forecast and marking its slowest pace since May 2025.2

Q4 2025 Earnings Scorecard – Heading into the Final Peak Weeks

Corporate earnings continued to do their part to support the current economy. With 74% of S&P 500 companies now reporting for Q4 2025, YoY EPS growth stands at 13.2% and revenue growth at 9.0%.3 Consumer-facing names such as McDonald’s, Coca-Cola and Marriott gave us an early peek at the health of American shoppers ahead of the retail earnings parade which is scheduled to begin next week when WalMart reports results. The results from those names were mixed, and pointed to a theme we saw throughout 2025 in which higher-income consumers continue to do the heavy lifting while lower and middle-income shoppers remain more cautious.

Retail sales results for December also came in flat last week.4 One upcoming tailwind for US consumers? A roughly $100B tax refund windfall is expected in the first half of the year due to permanent individual, estate and business tax extensions in the One Big Beautiful Bill Act (OBBBA). Consumers tend to treat tax refunds as windfall and will most likely spend those discretionary funds.

- Positive Surprises: 74% of companies have beaten EPS estimates, below the 5-year and 10-year averages. Meanwhile 73% have beaten on the top line, above both the 5- and 10-year averages.

- Sector Leaders: Information Technology, Communication Services are leading the charge in top and bottom-line growth.

- The Laggards: Meanwhile, Consumer Discretionary is expected to post a YoY decline in EPS, while Energy is estimated to show YoY declines on both the top and bottom-line.5

On Deck This Week

This week, the market’s focus will shift from AI and software stocks to the Main Street health of the American consumer. U.S. markets were closed yesterday, Monday, February 16, for Presidents’ Day, setting the stage for a shortened but high-stakes four-day trading week dominated by the world’s largest retailer. While Walmart is the headliner, several other names will provide clarity on the sector rotation we’ve been seeing.

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.6

This week we get results from a number of large companies on major indexes that have pushed their Q4 2025 earnings dates outside of their historical norms. Six companies within the S&P 500 confirmed outlier earnings dates for this week, five of which are earlier than usual and therefore have positive DateBreaks Factors*. Those names are: Expand Energy Corp. (EXE), Edison International (EIX), Insulet Corp (PODD), Booking Holdings (BKING), and Evergy (EVRG). Only Global Payments (GPN) has a negative DateBreaks Factor this week.

Q4 2025 Earnings Wave

In this shortened trading week, 1,033 companies are expected to release results (out of our universe of 11,000+ global names). Currently, February 26 is predicted to be the most active day with 831 companies anticipated to report. Thus far, 75% of companies have confirmed their earnings date and 41% have reported. The remaining dates are estimated based on historical reporting data.

The Bottom Line

Heading into this shortened trading week, all eyes will turn to the state of the US consumer when WalMart releases Q4 results on Thursday and University of Michigan’s February Consumer Sentiment reading hits the tape on Friday. While the shift toward cyclicals suggests a defensive posture, the combination of a stabilizing labor floor and positive earnings outliers provides a compelling case for optimism. Ultimately, the next four days will reveal whether the current rotation is a temporary retreat or the beginning of a fundamental rebalancing of the 2026 market.

Sources:

1 The Employment Situation — January 2026, U.S. Department of Labor, Bureau of Labor Statistics, February 11, 2026, https://www.bls.gov

2 Consumer Price Index Summary, January 2026, Bureau of Labor Statistics, February 13, 2026, https://www.bls.gov

3 FactSet Earnings Insight, John Butters, February 13, 2026, https://advantage.factset.com

4 Advance Monthly Sales for Retail and Food Services, December 2025, US Census Bureau, February 10, 2026, https://www.census.gov/retail/sales.html

5 FactSet Earnings Insight, John Butters, February 13, 2026, https://advantage.factset.com

6 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.