Real estate is a key cog in our economy. And when it’s strong, it is supportive of the financial markets as a whole, including the stock market.

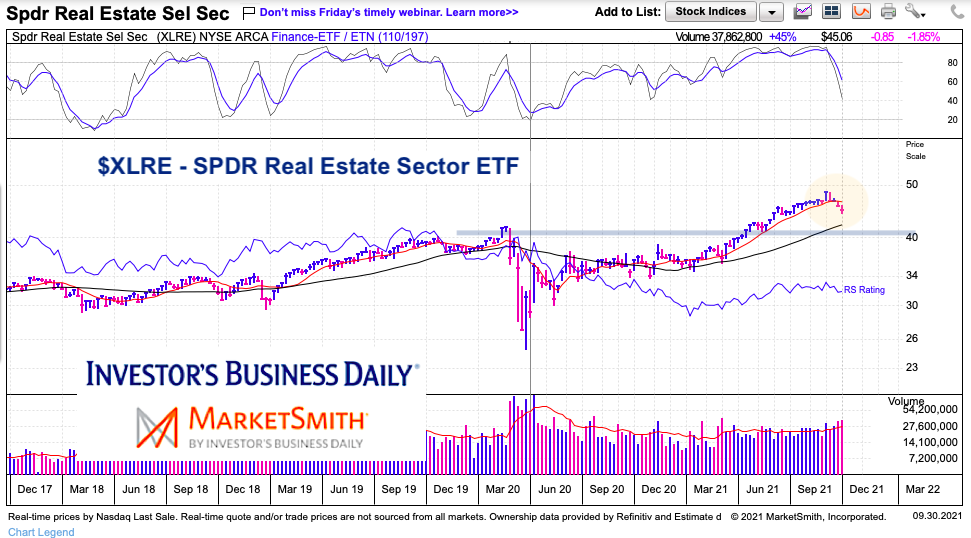

Heading into September, the SPDR Real Estate ETF (XLRE) was recording new highs and sporting a very bullish posture. Perhaps it was overheating…

The real estate ETF XLRE ended the month (September) on a down note trading near 3 month lows. The decline has been fairly persistent, lasting through most of the month.

So is this short-term decline nearing an end? Could it turn into something more? Below I share the “daily” and “weekly” charts, letting them mostly speak for themselves.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$XLRE SPDR Real Estate ETF “daily” Chart

The daily chart highlights a near-term concern with the sharp move lover in momentum and the 20-day moving average turning down through the 50-day moving average. This indicates that there is overhead supply (sellers) and it will take some time for this sector to turn higher. The 200-day moving average and up-trend line are around $41-$42.

$XLRE SPDR Real Estate ETF “weekly” Chart

The weekly chart allows us to zoom out. We can see that they breakout to new highs came in the $40-$42 area. If a retest is in order, then this chart may be confirming the target area around $41. The longer-term posture remains bullish and hints that this decline may serve as a correction rather than a bear market.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.