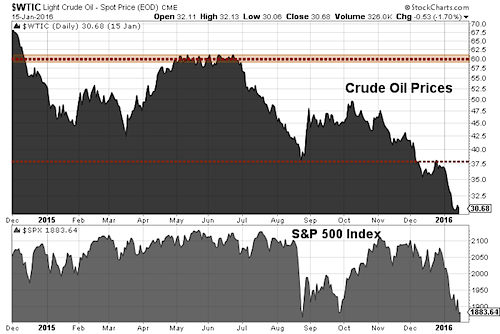

The financial markets are a hot topic in early 2016 as volatility and uncertainty once again are in the spotlight. Energy related commodities (i.e. crude oil) have taken the brunt of the damage, with stocks also off to a terrible start in 2016. As many of you know, my style is to focus on the credit markets (and what they may be implying about equities markets) and DeMark indicators (for both).

And since there’s a lot going on out there, I thought it would be a good idea to share some random thoughts with you on the current state of the credit and equities markets.

Two Key Thoughts:

- By many DeMark indicators, the current stock market decline may end up being the worst one yet since ’09. Looking at the S&P 500 (SPX), 1850 is nearby and very important (weekly TDST Level Down). If that breaks on a qualified basis, the next weekly TD Rel Retracement at 1771 is squarely in play. So keep 1850 on your S&P 500 radar.

- But in my opinion, all the key credit components supporting the primary bull market that began in ‘09 remain in place.

Other notables for credit and equities markets:

- Relative to its 2007-’15 range, the IG CDX at 110bps is now squarely in the band consistent with the current correction in equities, and levels that could push stocks into a cyclical bear market. The threshold that could portend a serious financial mishap remains about 50-60bps away. The HY CDX is roughly in the same shape;

- IG spreads lost 10bps last week, but in its defense there was also $60B+ plus of new bonds sold. In the days when supply and demand of new bonds were balanced, a 10bps widening during a $60B+ issuance week was perfectly normal. For whatever reason, it is now fashionable to view that as a disaster. For reference sake, the 2011 IG spread wide was 231bps vs. 170bps right now;

- Credit’s red-headed stepchild is the HY spread. At 755bps it’s nearing the 825bps 2011 wides. So it’s no shocker that the Russell 2000 Index is already in a bear market (amongst the major U.S. equities markets);

- Speaking of bear markets, energy credit is now ABOVE the 2008 wides. I have been saying for quite some time that the energy space remains untouchable. The big debate is whether energy credit is to the financial system what mortgages were in ’07-’08. For reasons I’ve tweeted about ad nauseam, the answer remains no. Energy credit will spoil the earnings of a bunch of banks, and many energy bondholders (let alone stockholders) are toast, but it likely won’t turn into a systemic issue. I am confident that If I am wrong tweeps will remind me of it for a long long time;

- It is weird and, yes, complacent, that the 3-month curve of the Volatility Index has not made it below -5 during the year-to-date stock pasting. By comparison, it reached -19 in August of last year;

- If China is the root cause of the current tantrum for stocks (I think it’s the catalyst, not the cause), my index of China sensitive CDS doesn’t show it. It’s above the 2015 wides, but still below the 2013 and 2011 highs. It’s below the latter by A LOT;

- Similarly, if banks are about to be run over by bad energy loans, you would not be able to tell by my index of CDS on large US financials. It’s at 474 compared to 2000+bps at the 2011 highs;

- Finally, and most importantly, $95.5B of new bonds were sold so far in the January “surge”, way above last year’s MTD tally. Are these buyers scared? Misguided? Well, if they are the same group that did the buying during the September “surge”, they are likely to be giddy: not only they are getting much better yields, but the average price of 29 of the largest bonds sold in September is currently $100.42, with only 7 trading below par, and the weakest trading at $91. No margin calls on this kind of portfolio.

Thanks for reading and good luck out there!

Continued reading from Fil Zucchi: “Crude Oil Futures Decline Again: A DeMark Update“

Twitter: @FZucchi

Author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.