One of the problems with applying DeMark to futures is that when the contract rolls over all the counts get screwed up. The alternative is to use the continuous contract but from what I remember, DeMark is pretty strongly against that.

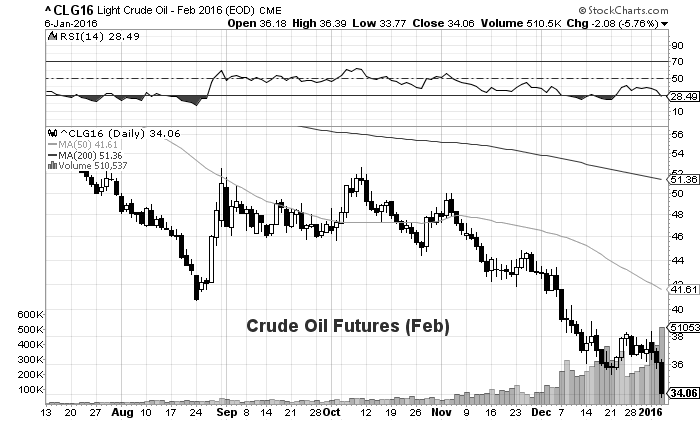

That said, I thought it would be a good time to provide a quick update on what I’m seeing in the Crude Oil futures market. In my last update, I warned that there would be more downside coming. Well, that downside erupted over the past week in the Crude Oil futures market.

On a daily basis the active Crude Oil futures contract (CLG6) printed a new Sequential 13 Buy signal yesterday, with the Risk Level at $34.60. With yesterday’s close that risk level has already been broken but on a non-qualified basis for now.

On a weekly basis CLG6 printed a DeMark Setup Buy last week and is printing Bar 8 of the active Countdown Buy this week. As you may know, Bar 8 of Countdowns tend to be the pause/retracement level before a final washout to complete the 13 (bar 13 MUST be above/below Bar 8 to complete the Countdown).

So between the DeMark Setup Buy and the Bar 8 of the Countdown one would think Crude Oil futures will stabilize/bounce some in the days ahead.

Even so, I continue to subscribe to the view that the crude oil collapse is a function of the unwind of many trillions of energy related derivatives, a dynamic that doesn’t really pay attention to “exhaustion” since it’s more in the nature of forced-selling than “normal” buying and selling. In that context, based on some data I saw from Brian Reynolds over the last month, the unwind seems to be about 60-70% over. That would argue that the teens are not out of the question before this disaster is over (perhaps not today’s business).

Twitter: @FZucchi

Author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.