We’re hitting the ground running in 2026. The first weekend of the new year was chock-full of geopolitical intrigue, which has (so far) been bullish for domestic Energy-sector stocks.

But don’t turn your back on the AI mega-trend. Major gains have been seen in tech, particularly outside the U.S. It hits on a central price-action theme from 2025: outperformance among international equities. Does that trend keep up this year? Investors will surely get plenty of opinions at conferences in the weeks ahead.

Tech Took Center Stage at CES

Indeed, it’s a jam-packed slate of Q1 corporate gatherings. This week’s headliner was CES (formerly the Consumer Electronics Show), held in Las Vegas. NVIDIA (NVDA) CEO Jensen Huang gave the keynote on Monday afternoon, after what has been a lackluster few months for NVDA shares.

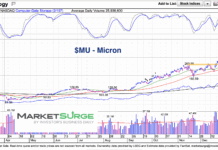

Competition is the word of the moment within the semiconductor space. Alphabet’s (GOOGL) in-house chips and rising demand for Broadcom’s (AVGO) custom GPUs and TPUs have put the heat on the world’s most valuable company. Key clues about the future of AI and the risks that could emerge for the broader Information Technology sector could be revealed at upcoming conferences.

Health Care in the Spotlight

And then there’s Health Care. Next week, JPMorgan (JPM) hosts its Annual Health Care Conference—among the most highly anticipated events of the year. Large-cap pharma continues to deal with a volatile, changing regulatory environment, while biotech stocks have been on a heater since the middle of 2025. Insurance providers, meanwhile, appear to be in the Trump administration’s crosshairs. It is a midterm election year, mind you.

Banks: Quiet Winners, Global Reach

Speaking of JPM, the big banks were quiet winners last year. Uptrending stock and bond markets, a solid year for IPOs, and booming M&A activity were catalysts. Citigroup (C) led, up almost 70% in 2025, while Wells Fargo (WFC) and JPM returned about 35%, dividends included. Financial institutions around the world stood out, too.

We don’t talk about them much, but HSBC, Allianz, Banco Santander, UBS, BBVA, BNP Paribas, and Barclays collectively tallied massive annual returns. So, we’ll mention a handful of overseas Financial Services conferences in today’s Q1 outlook.

Metals & Mining Ride Strong Tailwinds

Maybe the most upbeat conference ballrooms will be those occupied by CEOs and CFOs from the Metals & Mining industry. Gold and silver posted their best years since 1979, with incredible upside price action from August through mid-December. A year-end stumble has already been partly reversed in the first handful of 2026 sessions.

Record-high spot metal prices, low energy costs, and steady labor expenses appear to be the ideal recipe for the miners.

Asset Allocation Questions Grow Louder

Zooming out, investors will have their ears out for tidbits regarding asset allocation in light of recent trends:

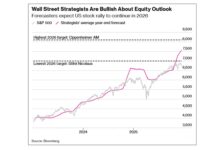

- The equity bull market is now more than three years old.

- U.S. bonds boasted a 7% total return in 2025.

- Emerging markets are finally within earshot of all-time highs (from five years ago).

- The dollar dropped in the first half of 2025, then steadied.

Indeed, investment-specific conferences will be particularly eye-opening in the months ahead.

Macro Forces Shape the Narrative

Finally, the macro pot is sufficiently stirred. A changing Fed makeup, resilient U.S. GDP growth, cooling inflation (hopefully), and the K-shaped consumer backdrop are bullet points that will surely litter conference slide decks—we’ll opine on those issues this year, too, of course. And we hate to say it, but another government shutdown can’t be ruled out.

Lots to unpack. Here are the major Q1 investor conferences to mark on your calendar:

Information Technology & Communication Services

January 5-7: CES

January 8: Needham 28th Annual Technology and Growth Conference

February 26: Susquehanna 15th Annual Technology Conference

March 2: Morgan Stanley Technology, Media, and Telecom (TMT) Conference

March 10: Citi TMT Conference

Health Care

January 11: Sachs 9th Annual Neuroscience Innovation Forum

January 12: JP Morgan 44th Annual Healthcare Conference

March 2: TD Cowen 46th Annual Healthcare Conference

March 10: Barclays 28th Annual Global Healthcare Conference

March 10: Jefferies Biotech on the Bay Summit

March 11: DNB Carnegie Healthcare Conference

March 24: BNP Paribas Healthcare Conference

Consumer Discretionary & Consumer Staples

January 11: NRF Retail’s Big Show

January 12: ICR 28th Annual Conference

January 14: Evercore ISI Retail Summit

February 17: Consumer Analyst Group of New York (CAGNY) Conference

March 11: UBS Annual Global Consumer and Retail Conference

Financials & Real Estate

January 28: 3rd Annual DealFlow Discovery Conference

February 6: World Outlook Financial Conference

February 10: Bank of America US Financial Services Conference

February 12: Keefe, Bruyette & Woods (KBW) Winter Financial Services Conference

March 10: RBC Capital Markets Global Financial Institutions Conference

Industrials

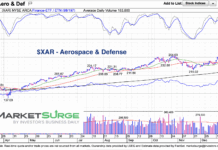

January 5-7: Bank of America Defense Outlook and Commercial Aerospace Forum

February 17: Citi Global Industrial Tech and Mobility Conference

February 18: Barclays 43rd Annual Industrial Select Conference

March 17: Bank of America Global Industrials Conference

March 17: JP Morgan Industrials Conference

March 25: Bank of America Infrastructure Conference London

Energy & Utilities

January 8: Evercore Power Conference

January 12: UBS Global Energy & Utilities Winter Conference

March 2: JEF Flagship Power, Utilities, Clean Energy & Energy Flagship Conference

March 4: Jefferies Power, Utilities and Clean Energy Conference

March 16: Piper Sandler 26th Annual Energy Conference

March 23: CERA Week

Materials

January 20: Red Cloud Virtual Institutional Precious Metals Producer Day

January 23: Metals Investor Forum Vancouver

January 27: TD Cowen 17th Annual Global Mining Conference

February 22: BMO Capital Markets 35th Global Metals, Mining & Critical Minerals Conference

February 27: Metals Investor Forum Toronto

Regional

January 12: UBS Greater China Conference

February 24: Goldman Sachs European Technology Conference

March 2: Morgan Stanley European Healthcare Conference

March 3: UBS European Healthcare Conference

March 4: Berenberg EU Opportunities Conference

March 11: JPMorgan Taiwan CEO-CFO Conference

March 17: Morgan Stanley European Financials Conference

March 18: Bank of America Securities Asia Tech Conference

Investor-Specific & Multi-Sector

January 14: Bank of America SMID C-Suite Conference

January 19: World Economic Forum Week

January 21: Sidoti January Micro-Cap Conference

February 4: Oppenheimer 11th Annual Emerging Growth Conference

March 2: JP Morgan Global High Yield & Leveraged Finance Conference

March 9: Loop Capital Markets 7th Annual Investor Conference

March 22: ROTH Capital Partners 38th Annual Investment Growth Stock Conference

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.