“Let me be clear, what I said was, it’s not the beginningof a long series of rate cuts.”- Fed Chairman Jerome Powell -7/31/2019

“What the Market wanted to hear from Jay Powell and the Federal Reserve was that this was the beginningof a lengthy and aggressive rate-cutting cycle which would keep pace with China, The European Union and other countries around the world….”– President Donald Trump – Twitter 7/31/2019

With the July 31, 2019, Fed meeting in the books, President Trump is up in arms that the Fed is not on a “lengthy and aggressive rate-cutting” path.

Given his disappointment, I need to ask what else the President can do to stimulate economic growth and keep stock investors happy. History conveys that is the winning combination to win a reelection bid.

Traditionally, a President’s most effective tool to spur economic activity and boost stock prices is fiscal policy. With a hotly contested election in a little more than a year and the House firmly in Democratic control, the odds of meaningful fiscal stimulus before the election is low.

Without fiscal support, a weak dollar policy might be where Donald Trump goes next. A weaker dollar could stimulate export growth as goods and services produced in the U.S. become cheaper abroad. Further, a weaker dollar makes imports more expensive, which would increase prices and in turn push nominal GDP higher, giving the appearance, albeit false, of stronger economic growth.

In this article, I explore a few different ways that President Trump may try to weaken the dollar.

Weaker Dollar Policy

The impetus to write this article came from the following Wall Street Journal article: Trump Rejected Proposal to Weaken Dollar through Market Intervention.In particular, the following two paragraphs contradict one another and lead us to believe that a weaker dollar policy is a possibility.

On Friday, Mr. Kudlow said Mr. Trump “ruled out any currency intervention” after meeting with his economic team earlier this week. The comments led the dollar to rise slightly against other currencies, the WSJ Dollar index showed.

But on Friday afternoon, Mr. Trump held out the possibility that he could take action in the future by saying he hadn’t ruled anything out. “I could do that in two seconds if I wanted to,” he said when asked about a proposal to intervene. “I didn’t say I’m not going to do something.”

Based on the article, Trump’s advisers are against manipulating the dollar lower as they don’t believe they can succeed. That said, on numerous occasions, Trump has shared his anger over other countries that are “using exchange rates to seek short-term advantages.”

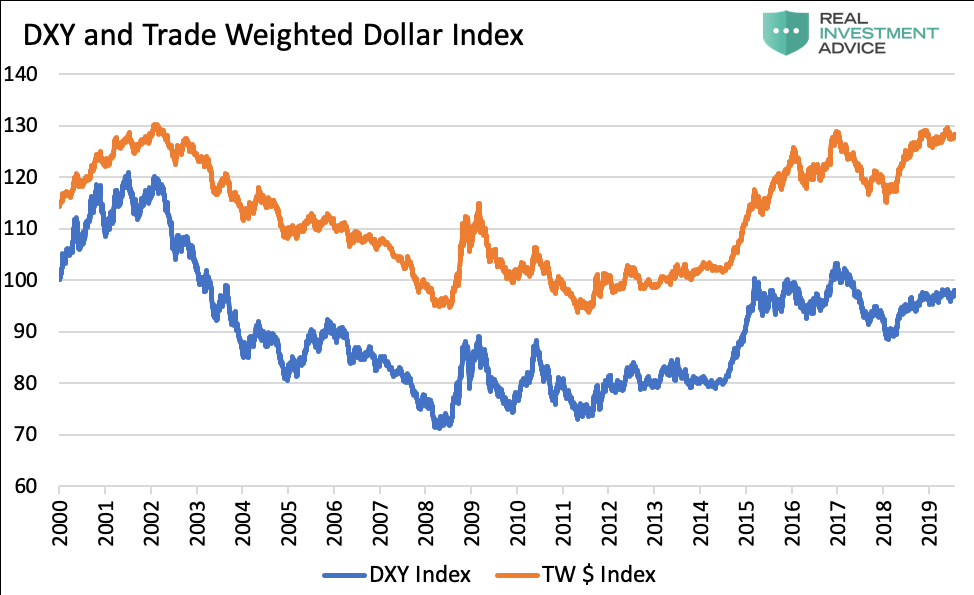

As shown below, two measures of the U.S. dollar highlight the substance of frustrations being expressed by Trump. The DXY dollar index has appreciated considerably from the early 2018 lows but is still well below levels at the beginning of the century.

This index is inordinately influenced by the euro and therefore not 100% representative of the true effect that the dollar has on trade. The Trade-weighted dollar which is weighted by the amount of trade that actually takes place between the U.S. and other countries. That index has also bounced from early 2018 lows and, unlike DXY, has reached the highs of 2002.

Data Courtesy Bloomberg

Trump’s Dollar War Chest

The following section provides details on how the President can weaken the dollar and how effective such actions might be.

Currency Market Intervention-

Intervening in the currency markets by actively selling US dollars would likely push the dollar lower. The problem, as Trump’s advisers note, is that any weakness achieved via direct intervention is likely to be short-lived.

continue reading on the next page…