Known for their flamboyant spokeswoman Flo and innovative features such as “Snapshot”, Progressive Insurance has transformed into one of the largest car insurers in the United States over the last eight decades.

On January 27th, the Progressive Corp (PGR) topped fourth quarter earnings estimates by $0.06 per share. Net premiums written came in shy of the Wall Street consensus, but were up 4.9% to $4.84B. For FY15 revenue jumped nearly 8% to $20.8B on solid investment gains and an uptick in premiums written. One notable negative from the report was the 110 basis point spike in the combined ratio to 92% (percentage of premiums taken in vs claims and expenses paid out).

All in all, I believe Progressive Insurance stock (PGR) is in a prime position considering strong U.S. auto sales (17.5M in 2015) and a diversified product offering. The could make for a PGR bullish trading setup (more below).

PGR trades at a P/E ratio of 15.25x (2016 estimates), price to sales ratio of 0.85x, and a price to book ratio of 2.44x. On a historical basis, shares are trading near the lower end of the 15-17x range (in terms of EPS). Progressive Insurance Corp revenue is projected to 7-8% annually, topping $22B this year. This allows management to sustain a hefty 2.9% dividend yield and possibly payout $1.00+ per year very soon.

On July 15th, 10,000 Feb 2016 PGR $30 calls were bought for $1.45. Call activity was 19x the average daily volume. Also, there remains 4,500+ Feb 2016 $31 calls in open interest.

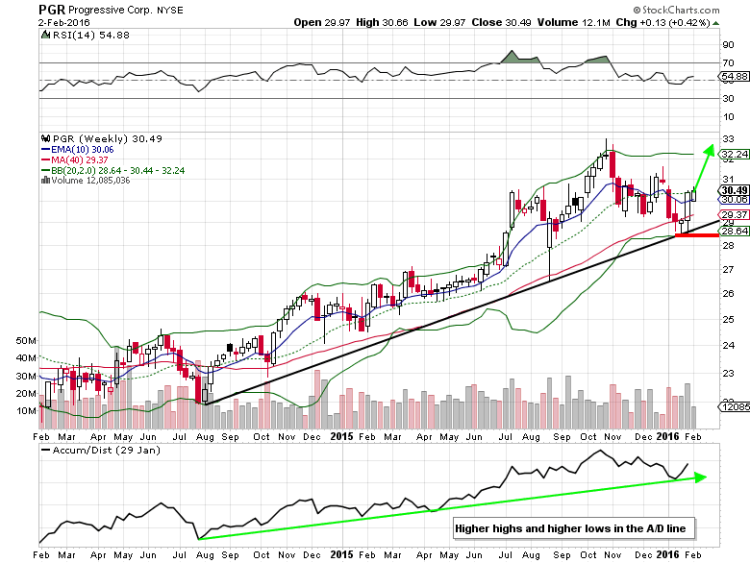

Viewing the 2-year weekly chart above, we can see that the stock corrected more than 10 percent from the 2015 highs and PGR is now seeing buyers step in once again at the 40-week simple moving average and the uptrend line. Entries near the key price support levels have proven to be profitable times to buy shares or call options. In order to stay disciplined, consider placing a stop loss under $28.50 (just below the January 2016 lows), while looking for upside toward the $33-$35 in the longer-term. Below is an options trading idea for a potential PGR bullish trading setup.

Progressive Insurance ($PGR) Options Trade Idea

A trader could buy the Feb 2016 $30 call for $1.00 or better. Below gives an idea of how I would manage that options position (it’s currently on my trading radar).

Stop loss- $0.50

1st upside target- $1.50

2nd upside target- $2.00

Thanks for reading.

Twitter: @MitchellKWarren

The author does not hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.