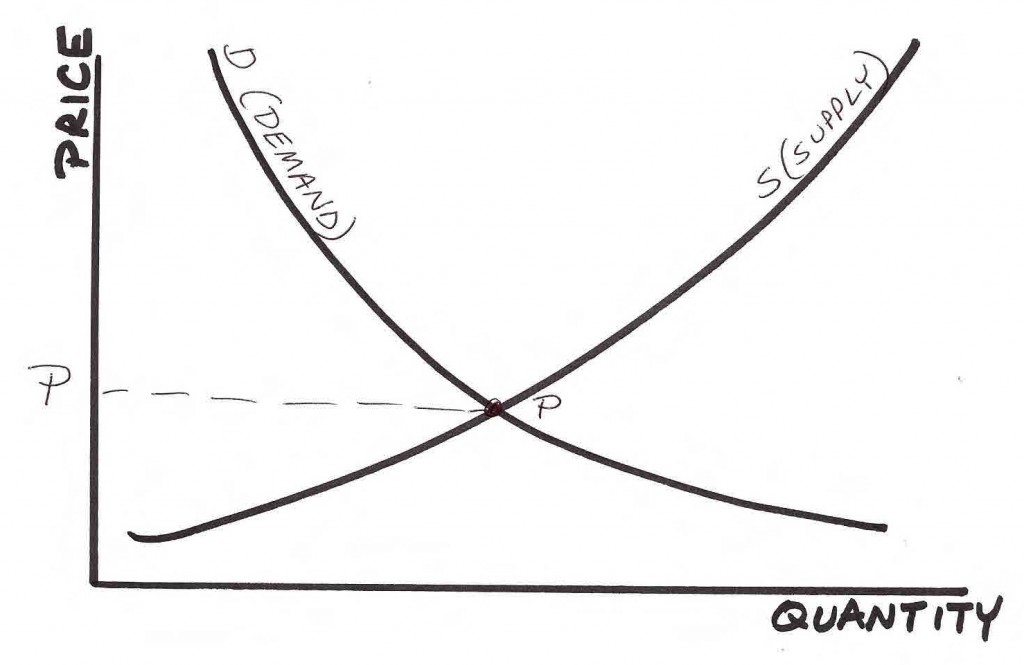

On the very first day of Economics 101, you will see the below chart. This simple illustration identifies (in theory) the optimal price of a product (P), where the supply curve of a good (S), intersects the curve representing the range of consumer demand (D). Basic yet essential.

On the very first day of Economics 101, you will see the below chart. This simple illustration identifies (in theory) the optimal price of a product (P), where the supply curve of a good (S), intersects the curve representing the range of consumer demand (D). Basic yet essential.

Over my past few posts I’ve highlighted a few trends to put on your radar screen through the remainder of 2013 – margin debt, Apple’s success, where’s the beef?, as well as housing’s coming split. I’ve really struggled with this last theme on consumer demand due to the strength of its underlying trends, for what its unwinding may signal for the overall economy, and also due to the fanaticism many individual stocks who fit this theme possess.

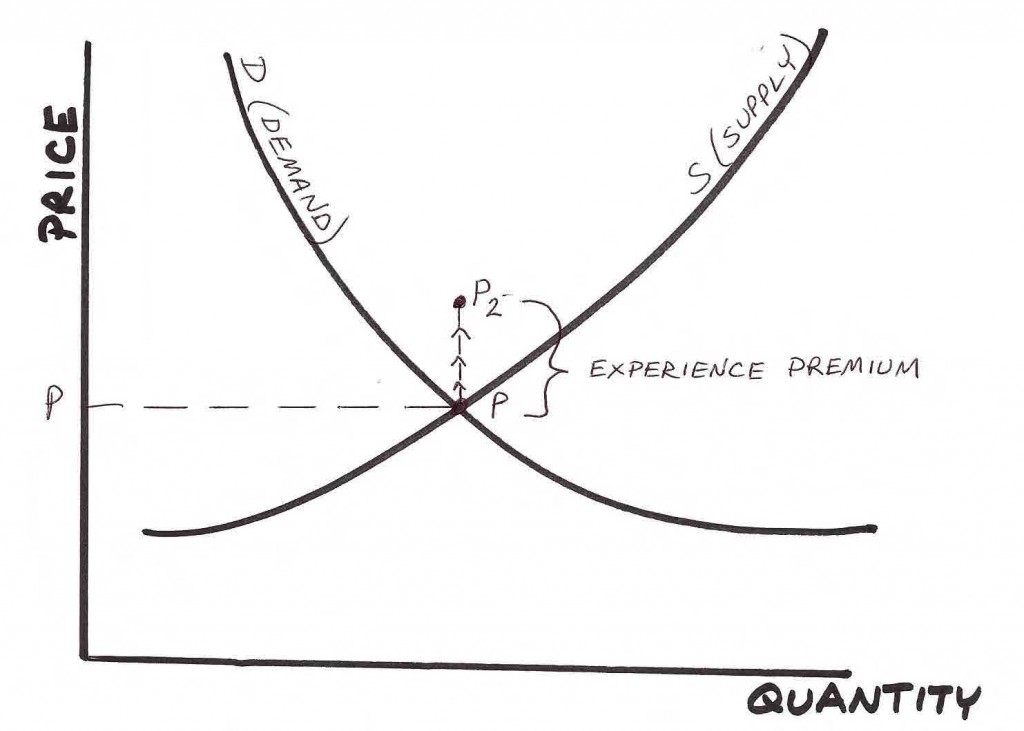

Recently, and in an increasing frequency, it appears many companies have hijacked the above referenced supply-demand curve and levitated the (P) by charging an artificial premium in exchange for the consumer receiving an “enhanced experience”, a “good feeling”, or a ‘look of approval” while sporting a new outfit or handbag. If your grandparents wonder why you dropped $60 for a new sweatshirt when a $20 one accomplishes the same function, you’re well aware of these companies.

This upward price shift isn’t a result of companies restricting supply in an effort to drive higher prices. To the contrary, they are flat-out selling as much as they can to as many as they can, creating a walking advertisement of consumer demand “premium.” Their strategy intentionally involves creating an aura that they are indeed the hipster pants, restaurant, beverage, handbag company, et al and if you are not on board, you are just not with it. Yes, this has always been the case, but the number of companies relying on it as corporate strategy, has likely never been higher.

It’s difficult to quantify when (and why) the consumer will start balking at paying these premiums to so many companies. Recently, retail companies (and thus many stocks) have started to see signs of a slowdown – Kohl’s Wal-Mart, and Macy’s have all reported frustrating results which appears to signal that at its core, consumption is waning. Trendy, hipster, cultish brands won’t likely see immediate pressures as consumers will put off tougher decisions where intense loyalties lie until they are at last forced to.

Why has this business strategy exploded in popularity? I’m no sociologist, but it seems the seeds of this new “industry” were planted over a decade ago when the tech bubble imploded, subsequently followed by 9/11. Perhaps companies started to tap into a consumer need of having to be reassured that they are ok, that their new workout gear or a lunch stop at a trendy chain restaurant is convincing enough that their financial lives have not been compromised.

If you then factor in a few years of quantitative easing to help finance this new retail and lifestyle phenomenon, and then add in a dash of social media playing the role of steroid-induced public relations and marketing (i.e. checking in at xyz on foursquare to get instant validation via Facebook), and you have a recipe for elevated consumer demand “premium.” And this has only helped to compound this new industry’s growth.

Questioning companies who are successfully employing these strategies prompts ire from their fanatical cheerleaders, so I’m intentionally refraining from highlighting specific companies. Many of these companies are extremely well known and if they’re looking beyond next quarter’s earnings, aspire to join a very short list of those who’ve executed the strategy long-term. Companies like Mercedes and Tiffany’s (TIF) come to mind, but the key is that their product quality has also passed the test of time. This new breed of company is attempting to accomplish premium pricing with an increasing number of basic consumer products and some of them are actually succeeding while distributing products of questionable quality.

When the economy experiences a turn of any sort, many of these companies will be hosed… with a capital “H.” Memories get shorter in bull markets, but it wasn’t just a few years back that Proctor and Gamble (PG) struggled because consumers turned to embrace store brands. P&G has recently embarked on a strategy to take their productive, workhorse tried-and-true brands to go after this premium-paying bunch. Getting you to pay more for laundry detergent because ‘you deserve it!’ is the bell ringing in my head that this artificial elevation in pricing has reached a climax. And eventually, when consumer demand takes a hit, strategies like this falter… and premium prices will not hold for many.

Not all companies who are employing this strategy will be affected, though – obviously, a handful will thrive but their numbers will likely be minimal. What are some signs of vulnerability? How long has the (P) been elevated? The longer its elevation, the more exposed the company will be to the “experience” waning. It’s a very short list of companies that have successfully turned duration into an asset ala Starbucks, whose success looks rather Warren Buffett moat-like.

Other risks? Higher prices come to mind. At the extreme high-end, companies may be immune from cross-currents, but for typical consumers, higher prices will only increase a company’s susceptibility to changing trends. Additionally, be on the lookout for how easily the product can be substituted by eager competitors.

Perhaps the greatest risk of all to these companies is how deeply connected a company’s future fortunes are to middle-class, middle-American consumers. Over the past decade, companies who’ve successfully implemented these business strategies have increasingly relied on the middle-class’ infatuation with these aspirational products. How much of a company’s gross margins are tied to this geographic and economic class? Analyst channel-checks in Paris or New York City won’t tell you the story that Sioux Falls and Topeka will until the horse has left the barn.

When this trend subsides, I’m guessing it won’t show up immediately in share prices. It’ll likely start to evolve in companies blaming suppliers, weather factors, an earlier Easter – you get the picture. Over time, the momentum of previously unbreakable trends will subside and income statements will start disclosing stalling revenue growth. When these ‘turns’ take place is always questionable but if history is any guide, they always seem to come well after bears expect them.

Perhaps I am wrong about this trend and am underestimating economic strength and the risks to the ever expanding list of “experience”-touting companies. Maybe our intensely connected future is to be dominated by brands where “coolness” will be the over-riding factor. Maybe a person like me who still wears his 1996 NFC Championship sweatshirt is the wrong person to evaluate coolness. But make no mistake – the “right” logo on those sweatshirts will most definitely change, because innovation dictates they must.

Heart Capital does not offer investment advice via this medium. Under no circumstance whatsoever do these postings, opinions, charts, or any other information represent a recommendation or personalized investment, tax, or financial planning advice.

Twitter: @heartcapital and @seeitmarket

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.