Regional banks failures (Signature Bank and Silicon Valley Bank) and ongoing jitters with First Republic Bank have investors on edge. This has ushered in a wave of volatility and weighed heavy on the stock market indices.

One winner in all this, however, has been precious metals.

When market participants lose faith in banks or government, they often turn to gold. And this is showing up on the charts in the form of attempted breakouts. Today we highlight a couple of bullish breakouts on charts of the Gold ETF (GLD) and Gold Miners ETF (GDX).

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$GLD Gold ETF Chart

As usual, we let the charts speak for themselves. Here you can see that Gold ended this week with a major breakout. I’ll be watching over the coming days for follow on buying.

Gold is getting a lift by the recent banking uncertainties, coupled with rising tensions in the war abroad.

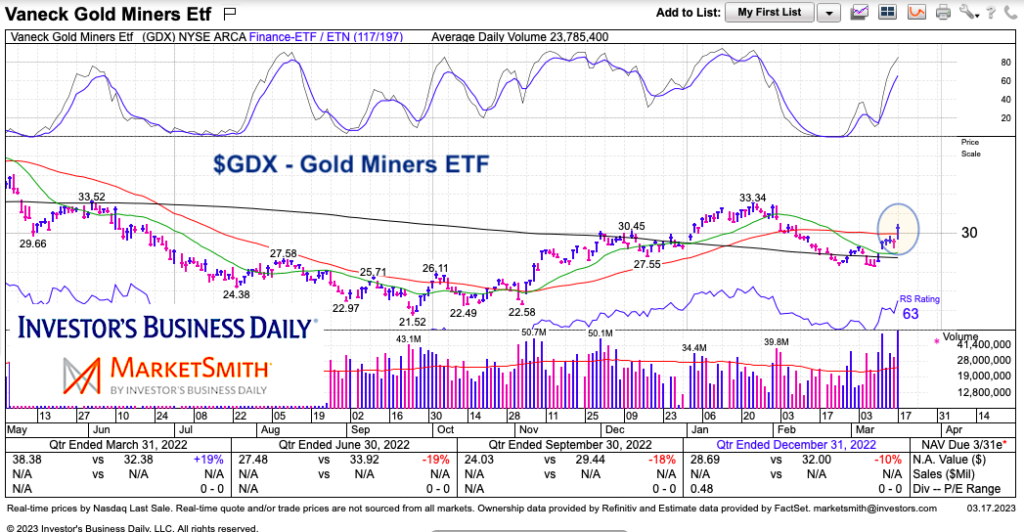

$GDX Gold Miners ETF Chart

Rising gold prices have also been good for mining stocks. Here we see the Gold Miners ETF (GDX) attempting a trading breakout. Another bullish sign for the gold complex.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.