Key Takeaway: After 18 months of disappointing economic data and a lack of consistent positive economic news, the U.S. economy is surprising to the upside. With inflation drifting higher and labor market conditions remaining firm, this could put upward pressure on treasury bond yields. We continue to keep a close eye on wages for evidence of price stickiness.

Positive Economic News May Put Upward Pressure On Bond Yields

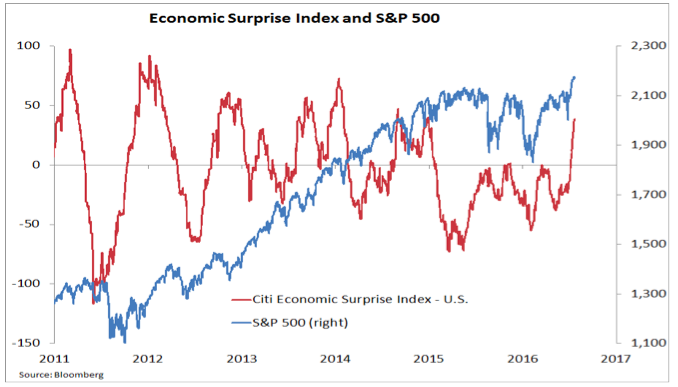

The curious thing about surprises is that they are, almost by definition, unexpected. While the economic surprise index does not make a distinction between economic data that is more positive than expected and that which is just less negative than expected, it is clear that the tone in the data overall relative to expectations had improved dramatically over the past few weeks. After spending virtually all of 2015 and the first half of 2016 in negative territory, the economic surprise index has surged to its highest level since December 2014. This has coincided with a rally in the S&P 500 Index (INDEXSP:.INX).

As it stands now, the most recent low in this index came as the market was digesting the news of the Brexit vote. It would seem to be a classic case of overreaction (from not only the financial markets, but also economic forecasters)… particularly if that low continues to hold.

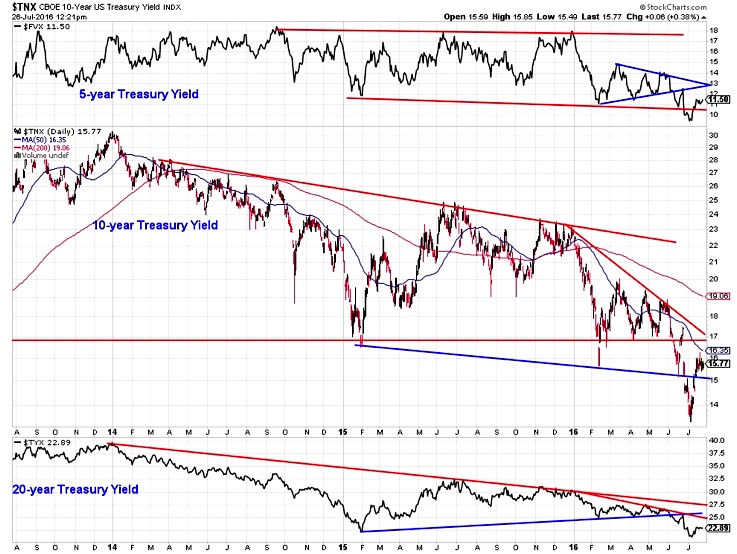

We have already seen stocks (in the United States at least) rebound from their post-Brexit reaction lows. Recognition that the economy has fared better than feared could make further upside economic surprises more difficult to achieve. That said, one area that has not returned to its pre-Brexit level is Treasury bond yields. More aggressive talk from the Federal Reserve on interest rate hikes, perhaps coming as early as this week, could change that.

Treasury yields across the curve moved lower in the initial reaction to the Brexit vote and have remained depressed in the month that has followed. This has been despite better-than-expected economic data and has helped support the breakout to new highs for stocks. And as yields have fallen, bond instruments have risen (NASDAQ:TLT).

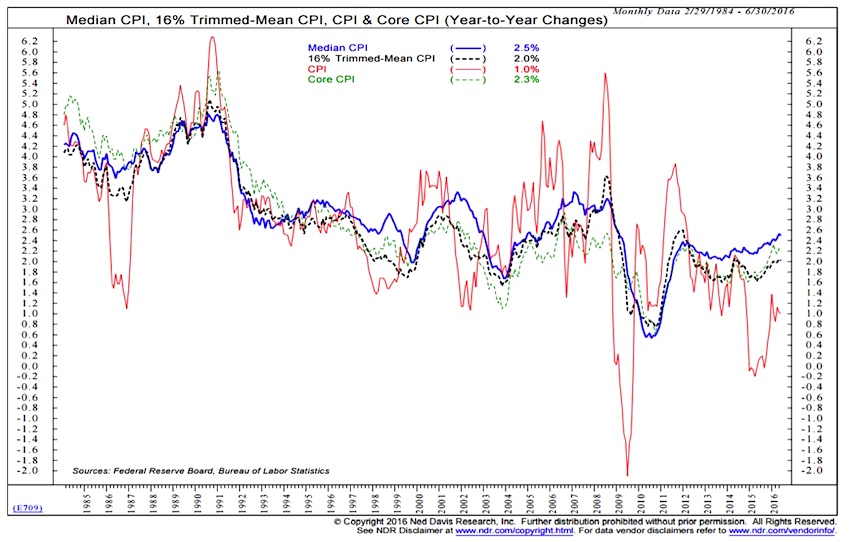

While bond yields in the U.S. are influenced by overseas yields, domestic inflation also has an impact. It is becoming difficult to argue that inflation trends have not turned higher. Wide swings in the price of oil are contributing to the usual level of noise in the overall CPI, but more stable measures of inflation are trending higher. We particularly like the methodology behind the median CPI measure, and this shows inflation at its highest level since 2008.

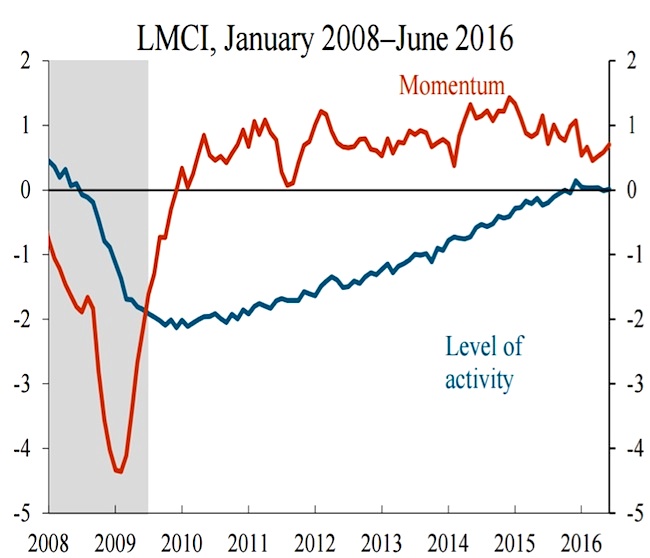

Inflation trends are drifting higher at a time when labor market trends look to regain some of the momentum lost over the course of 2015. While the Fed’s Labor Market Conditions Index has gotten attention for showing continued labor market softness, the more robustly supported Labor Market Conditions Indicator from the KC Fed shows that labor market indicators have stabilized and momentum is again expanding.

Tying labor market conditions directly to inflation, the Atlanta Fed’s wage growth tracker continues to move higher, with overall wages rising 3.5% over the past year. Perhaps even more surprising (and more robust evidence of labor market strength) the wage growth tracker for those switching jobs is up 4.3% over the past year, the highest level since 2007.

For the first time in months, it feels like the U.S. economy may be setting up of some positive economic surprises (news). Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.