Dow 36,000 Logic?

Remember James Glassman’s infamous “Dow 36K” book written right after the peak in 2000? The prevailing logic to explain the low ERP today is similar to Glassman’s – “there is no alternative (TINA)” equities carry little if any risk relative to bonds and that is the reason for the low equity risk premium. The reality is ERP is telling us there is little long term reward for risk in the broad U.S. market at current valuations. Since the last breakout in yields, we have been pointing out to clients that many are mischaracterizing the equity breakout as another ‘great rotation’ out of bonds and into stocks as we saw in the mid-80’s. But, as discussed, today we are in a Fed divergent rising rate environment punishing bonds and potentially compressing PE and equity markets.

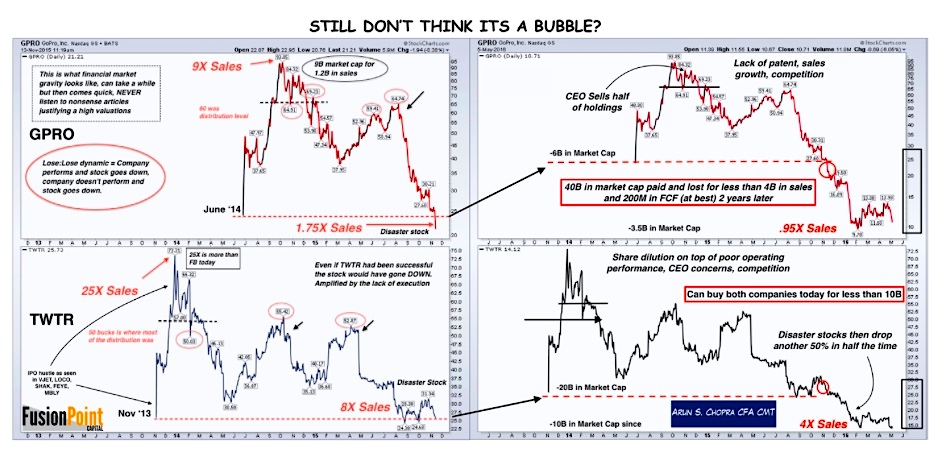

Getting micro, what does this really mean for individual stocks? Here’s another chart from Arun, this time looking at price to sales ratios. Extreme price to sales stocks (in this case GoPro and Twitter but examples abound) face a lose/lose investment scenario, eventually giving up and falling much further than most expect.

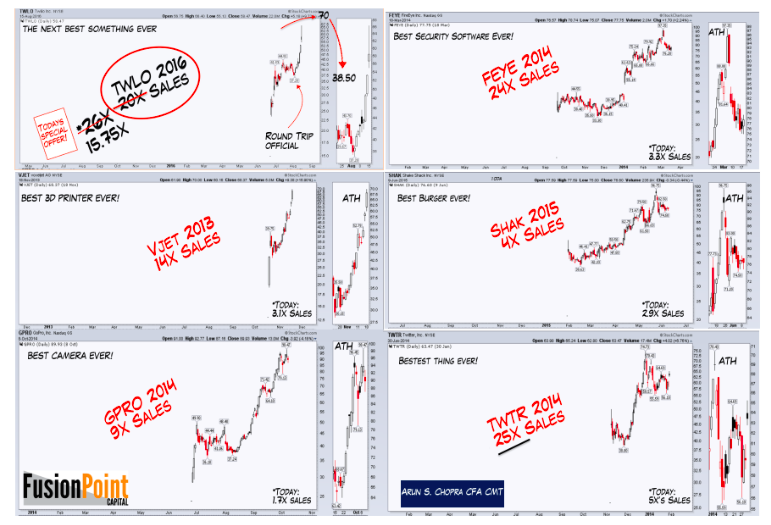

And here are some high margin digital businesses that the TV argued ‘deserved’ higher multiples. They are on sale now at “dirty” multiples one would assume…

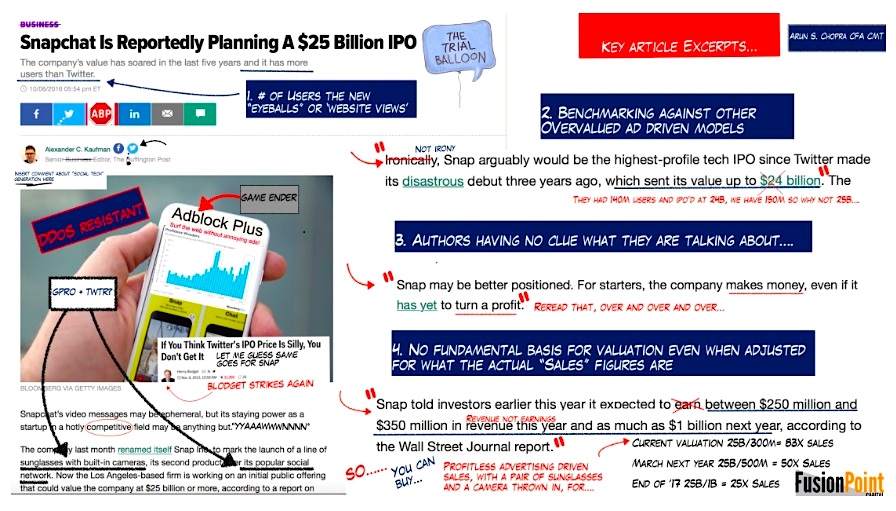

And now…we have SNAP on the way.

Behavioral finance is often the most important input in our process (both micro and macro). In Aww Snap, Arun noted four important behavioral fallacies that slip past the mainstream lines (showing the type of market we are currently in).

- New user metrics such as number of eyeballs.

- Benchmarking against other overvalued models.

- Authors with limited experience in the field (increasingly the case with old and numerous new outlets etc. – something we saw consistently with GPRO etc.).

- Challenging to justify absolute valuations.

Are the pundits on the TV, never mind the over the wall analysts, institutions, financial journalists and retail even aware of the 1990s metrics (eyeballs) they are using and accounting fallacies in Aww Snap, or are they just willfully blind?

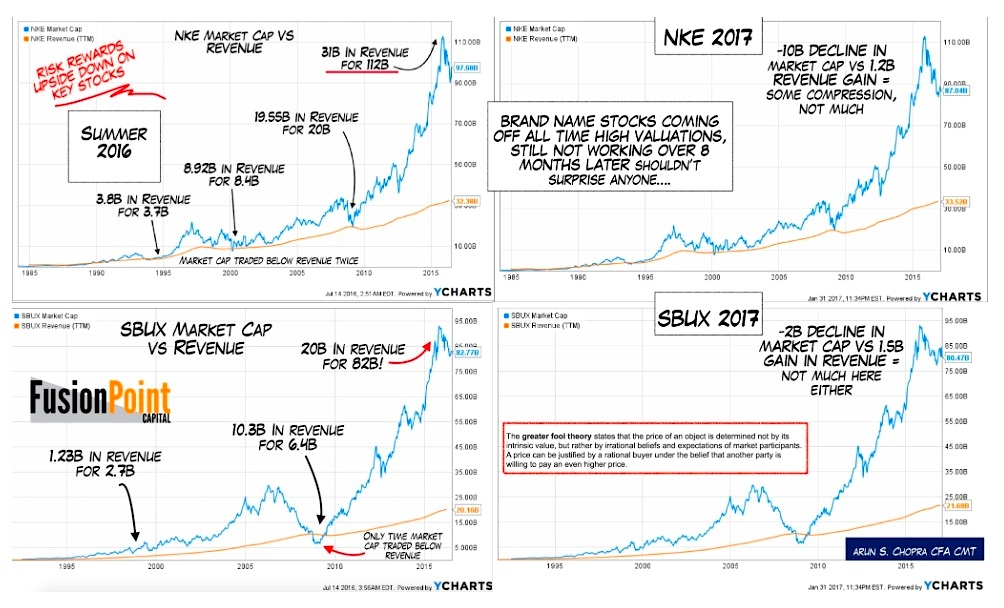

Lastly, and to the larger point of this writing, the Aww Snap valuation rationalization is not relegated to extreme price to sales valuation new new thing stocks. Here are two household names everyone is crowded into creating a similar limited upside max downside capture scenario. Just 9 months ago, valuations didn’t matter either on these digital era stalwarts, which are underperforming the S&P by 15% and 13%, respectively since (when they traded at 3x-4x times sales…very high ratios for them). When valuations reach extremes, despite what the masses say, even greater fools run out.

The TV, research analysts, and conferences say the Trump trade is on, the 18x forward multiple is just right porridge (ignoring the dubious history of forward earnings estimate accuracy, bowl size and porridge thermodynamics that would dictate otherwise), that it’s just sector rotation, and financials, industrials, materials, energy, and discretionary are going to rip as stimulus and tax money comes pouring in. And, of course this time is different because margins are digitally dirty…err…different.

Yet, we have increasing uncertainty around Policy Trumpacho, the same operating margin level as 10 and 50 years ago with a 20% premium paid, PE10 at its third highest level ever, a rising rate environment, ERP indicating there’s just 1% of excess return over Treasuries, and numerous recent examples that fundamentals, in the end have a way of rearing up and bucking bad hombres off when they get too heady.

But, that’s not how this works. That’s not how any of this works. It’s digital…

Thanks for reading.

Twitter: @JBL73

Charts by Arun Chopra, CFA CMT – @FusionPointCapital

The authors may have positions in mentioned securities by the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.