It is clearly very trendy to talk about the price of milk, gasoline, used cars or how the core CPI is the highest since the early 1990s. While there are ongoing price gyrations driven by supply issues, robust return of aggregate demand and changing spending patterns, these will sort themselves out.

After all, while it is profitable for companies to solve supply bottlenecks, spending patterns are unlikely to continue to change in the same direction (they are actually starting to reverse) and the best solution for high prices, is high prices.

This price spike does negatively impact the real value of your portfolio and other assets but given how markets and asset prices have risen over the past year, don’t expect too much sympathy. The big question is what happens next?

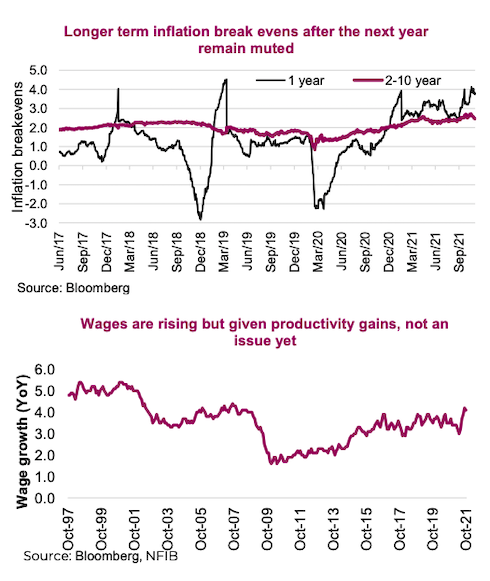

The short-term price gyrations will continue well into 2022, certainly making this a recurring topic. From a market perspective, we should care more about the longer-term inflation expectations, as it is these long-term inflation expectations that underpin bond yields, valuations and discount rates on the price of just about anything. If these move, it has a big impact, much more so than paying an extra 75 cents for milk.

The good news so far is longer-term inflation expectations have only marginally ticked higher. The chart on the left is the inflation break-evens being priced into the bond market. True, the one-year reading is elevated at nearly 4% but the implied inflation after the next year out to 2031 (2-10 year) remains muted. This is the market telling us that much of the rise in prices is a short-term issue. This number matters more for asset prices, from stocks to bonds to real estate.

So, what happens after the short-term price spike? There are some very long-term forces on both sides. The amount of debt in the world remains a deflationary force, and wow is there a lot of debt now! Demographics, the gradual aging of the world population especially in developed nations, remains a strong deflationary force. But some deflationary forces are diminishing.

Globalization, essentially the relocation of manufacturing to lower labour jurisdictions, has been slowing and could slow even faster as companies/governments are rethinking their supply chains. Company mindsets around logistics and inventory appears to be changing from ‘just in time’ to ‘just in case’. This may pass as the pandemic fades, but if this is a new trend it is inflationary (or at least a deflationary force that is softening).

While we expect the CPI inflation impulse to fade in 2022, given its longevity it is starting to drag longer-term expectations higher. And the policy impact has likely not flowed through the system as it too hit bottlenecks, from higher savings, to lack of goods, to buying, to inability to spend on some activities during this pandemic. This situation does support higher inflation expectations going forward, and is starting to translate into higher wages.

This isn’t the 1970s (higher prices with falling productivity) nor is it the late 1940s (higher prices driven by rebuilding the world). But the inflationary trend is to the upside and this has implication from financial plans, corporate behaviour on debt and buybacks, value vs growth, yields and valuations. We believe investors should have an inflation protection tilt to their portfolios, and consider the impacts of gradually rising longer-term inflation on all investments.

Sources: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.