By Jeff Wilson

In the previous post I talked about supplementing stock positions with options as part of a hedging strategy. In this article, I will talk about utilizing options exclusively into a binary event as a way to take advantage of high IV (implied volatility).

Lock and Replace

Let’s assume you bought 100 shares of International Business Machines (IBM) at an average of $200/share. It’s trading at $207.80/share. You are faced with the question of not knowing what to do with your profitable position into earnings. One option (no pun intended) is to lock in profits of $7.80/share and use the profits to buy calls or call spread into earnings.

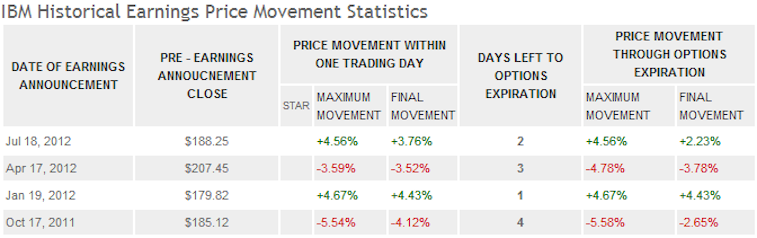

But let’s say you think it can trade 3% higher or up to about $214/share after earnings (see table below for historical IBM price movement through options expiration).

You can look to buy OTM weekly or if you think it may take a few days for IBM to get going, October (or even November) monthly 210 strike call for about 2.54. Since IBM is reporting during the week of options expiration, no weekly options will be available. Before I proceed, it’s vital to note that buying weekly calls, while “cheap” on a total cash outlay basis, it is also that which has the highest IV (e.g. the most “expensive” on a time decay or per day basis). For the purpose of this article, let’s assume you decide to look at the October monthly calls. If you lock up your stock position you net $780 in total gains. You can turn around and use a portion of that profit and buy one(1) 210 strike call for $254. What you’re effectively doing is clearly defining your risk since you cannot lose more than what you had laid out by buying the call. Let’s examine what happens given the following scenario:

a) IBM stock closes at $215 which is $5 over the strike price you bought. You have the option to either sell the call or exercise the call and take assignment of 100 shares of stock at $210. A few minutes before expiration, that $210 strike call should be valued close to 100% intrinsic meaning if IBM is trading at $214.50, that call should be worth very close to $4.50

b) IBM stock closes below $210. Your call will expire worthless and you lose 100% of the position.

As you can see there is the risk that the stock doesn’t move or doesn’t move enough where you can still lose 100% of your position. This is what you give up in exchange for not having to worry about carrying your stock position and risk a possible gap down at the open.

Lock and Get Paid to get Back In

Assuming you are faced with same scenario in the previous example concerning IBM stock. Maybe this time, you are not as confident that IBM will have better than expected numbers which can serve as the impetus for buying pressure on the shares. However, you being the proactive value investor that isn’t too concerned with the technicals is willing to buy 100 shares of IBM stock again if it dipped 3.5% from here at roughly $200/share. Without knowing if the stock will be sold off, you can opt to take advantage of higher IV and sell one (1) $200 strike put for $1.24. By selling a naked put, you are basically telling the buyer of that put that you don’t care if IBM is trading below that strike price, you are willing own it if it gets back down at the $200 price level. If IBM doesn’t move below the strike price you sold puts when the contracts expire, you keep all the premium you collected (Similarly, you can sell the November contract and take in more premium but obviously the time aspect and management of that position is different). So sideways, up or down (but not too far down) moves on the stock and you collect 100% of the premium should you elect to hold onto the position until expiration. Basically, 2.5 (1/2 being down but not too far down) out of 3 ways you can profit. How about risk? There are a couple here: a) Downside risk is that if IBM’s numbers come in far below expectations and stock gets sold off, you are responsible for having to take the other side of the trade which the put buyer can exercise what is your responsibility of buying 100 shares of IBM for $200 regardless of how much lower the stock is trading below the strike price. Hence, it is imperative that one understand the risk involved with selling puts and not sell more puts than how much stock one is willing to own on a worst case scenario. b) Max gain is the premium you took in. In other words, whether IBM is UNCH or shoots up 10%, all you get is the premium you collected.

This example isn’t too popular with a lot of traders since selling naked puts can present some nerve rattling experiences. While traders like to look for ideal support levels to hold before going long, selling naked puts removes that part of the equation. Fundamental analysis based investors will argue that this stock is cheap at this level and I’m willing to buy it down here. However, one can argue that the fundamentals of the company may change based on the numbers they present. It’s beyond the scope of this post to argue the merits of technical vs. fundamental analysis, though, so we’ll leave that to the readers.

Combination

In the last example, you can see how you don’t get to participate in any up move. You can opt to play it both ways–buy call(s) and sell put(s). If both the OTM calls and puts both have the same maturity, this structure is also referred to as the risk reversal. Be aware of the leverage involved in this strategy as you are long calls as well as being short puts (both are delta positive positions). This strategy allows you to profit on a big directional move upwards(via the calls) as well as the loss in value of the puts one sold. Obviously, since this strategy involves buying calls as well as selling puts, one will not want a narrow sideways price action if this structure was put on for a debit.

There are a host of other strategies one can employ into binary events such as earnings, FDA announcements, etc but I wanted to focus on more simple ways to use options in conjunction stock positions. I hope I made it simple and succinct enough to understand after one run through. Good luck trading into the coming earnings season.

All stock and options prices are as of close Friday, October 12, 2012.

The information provided above is for educational purposes only and does not constitute investment advice. Please consult with your financial advisor before taking any action.

I do not have any position in IBM but may initiate one within prior to earnings or within 48 hours after earnings are reported.

———————————————————

Twitter: @cerebraltrades and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.