In July of 2015 we penned an article entitled “Finding Value in the Ninth Inning of the Great Bond Rally”. At the time, bond yields surged higher in response to an all-too-familiar growth and inflation scare. In that article, we noted that while the bond market rally of over 30 years was aging, the fundamentals were still supportive of lower yields.

Accordingly, we made specific investment recommendations for those in agreement with our forecast that bond yields were close to peaking and would soon head lower again.

In January of 2016, following a 75 basis point reversal lower in the ten-year Treasury bond yield (INDEXCBOE:TNX), we wrote a follow up article, “Payoff Pitch”, in which we suggested taking profits on the original recommendations. Anyone following our advice posted double digit returns over the six-month period.

The recent bond yield surge in interest rates is creating a similar opportunity. Since July, ten-year Treasury bond yields have risen over 60 basis points, comparable to the increase that led us to make our 2015 recommendation. Investors again appear overly-concerned that the 30-year bond bull market has finally run its course and interest rates will continue rising. This fear is creating opportunity with a reasonable risk/reward backdrop in the fixed income sector.

When we penned “Finding Value in the Ninth Inning of the Great Bond Rally” we stated there were economic headwinds and deflationary forces that would keep bond yields low despite the recent uptick. We maintain a similar belief today, but the markets have a different opinion. The market is concerned that Donald Trump’s victory will usher in massive fiscal expansion, driving interest rates and inflation higher. While those fears could persist and result in even higher interest rates in the short run, that outcome likely causes significant economic trouble, ultimately resulting in lower interest rates.

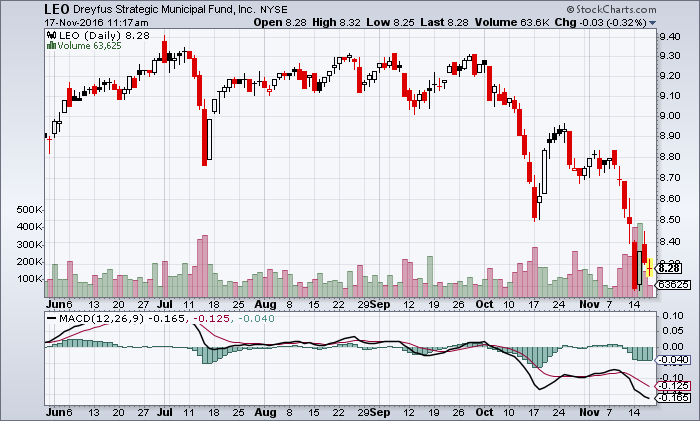

Here’s an example of the ongoing carnage in muni bonds – a well-known fund from Dreyfus (NYSE:LEO):

We re-examined the Closed End Municipal Bond Fund sector in light of the recent sell-off and believe there are opportunities to invest in certain funds. While we certainly cannot guarantee returns similar to those from the prior recommendation, we are confident that an investment opportunity is presenting itself.

As part of our shift in the coming months to a subscription service, we are not freely releasing the full details of this recommendation. However, if you are interested in a subscription to the “The Unseen”, contact us at mplebow@720global.com and get access to this recommendation and more.

Twitter: @michaellebowitz

The author or his clients hold positions in the mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.