Coming back from a week-long vacation has its advantages. I was lucky enough to be able to unplug from the day-to-day operations of the business and markets, which allowed me to return with fresh eyes and outlook. I recommend that anyone who spends their day’s head down in their profession take the time to do this every now and then to gain some perspective on work, life, and family.

As I think back over the last six months of this journey through the markets, the following are some of my top of mind observations:

Investor Sentiment

The number one dynamic of this market that you simply can’t predict in advance is how sentiment affects your decision making process. I can’t tell you how many articles I read in February forecasting the certainty of a bear market and/or recession. Fast forward just four months and we are now back within spitting distance of all-time highs.

It’s not only stocks that are surging here. Commodities and bonds are hitting new year-to-date highs as well. Check out the performance chart below of the SPDR S&P 500 ETF (SPY), iShares Core U.S. Bond ETF (AGG), and iPath Barclays Commodity Total Return ETN (DJP) so far in 2016.

DJP and SPY have seen a big recovery over the last several months that now has everyone feeling giddy about the prospects for a breakout. Investor sentiment has followed suit. Bonds have simply continued the path of least resistance as interest rates stair-step lower and continue to bring global buyers to the table. When the majority of the world is staring at negative interest rates, suddenly that 1.7% 10-Year U.S. Treasury bond looks pretty attractive.

In my opinion, we are going to see a break in one of these asset classes over the next few months. I don’t know if we can escape the typically hostile summer months without some ramp up in volatility. That may come as a result of the Federal Reserve hiking rates again, a hiccup in oil prices, or simply just a mild-mannered 5-7% dip as a result of the market needing a breather.

Fund Flows

Fund flows have been an interesting story and confirmation of the bearish investor sentiment patterns in stocks. Investors have been exiting stock-focused ETFs and mutual funds at a big clip as the market gets closer and closer to its prior highs. Check out this table of the last five weeks of combined fund flows from ICI. The numbers say it all – investors are exiting stocks and buying bonds at a pretty consistent clip.

There are very few times in history when you can count on investors exiting stocks perfectly near a market top. Usually we see this level of outflows closer to a bottom rather than at a potential peak. However, these statistics aren’t necessarily something you can trade, they are simply food for thought.

Strategy

It’s tough to fault investors for becoming excited about the next six to twelve months in stocks considering the building base of momentum and technical signals. However, I would be cautious about adding new money to the market in large position sizes if you have been stoically sitting on the sidelines for some time. I would rather see you implement a multi-step trading plan to add positions over time or look to buy on some level of weakness.

In my opinion, the greater mistake this year was getting overly bearish at the lows rather than getting overly bullish at the highs. Investor sentiment tends to rise and peak with price. I have spoken with so many investors who were scared out of the market on all of the extreme negativity, only to regret the mistake just a few months later. Their problem is that they were overly aggressive from the outset and couldn’t handle a 10-15% drop in stocks.

My advice: Don’t take an outsized level of risk to begin with!

Keep your stock allocation as such that you are comfortable riding out a similar correction in the future or take swifter action to preserve capital with a tighter risk management plan. There is nothing worse than getting shaken out near the lows and having to play catch up as the global markets rip higher. Then you’ve experienced the double sin of lost money AND lost opportunity.

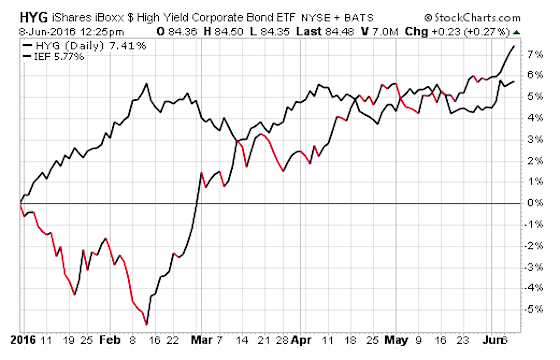

Similarly, I am also watchful about the price action in bonds. Both credit (high yield, emerging market) and safety (treasury, investment grade, mortgages) have rallied in a big way over the last several months and are likely due for a short-term breather.

Something is going to eventually give. I would prefer to have a little cash on the sidelines to take advantage of a dislocation in the fixed-income markets rather than gobbling up debt at these levels. Remember that bonds will ebb and flow just like stocks. There is a similar psychological pattern of fear and greed that takes place in this market as well.

The Bottom Line

If you have been enjoying the ride higher over the last few months, then continue to do what has been working for you. However, if you have been sweating nervously in cash and are thinking about just throwing caution to the wind up here, I would be a little more careful. The market loves to make fools out of us and being patient will likely serve you better than trying to play catch up in a hurry.

This is a long ride and there will be plenty of opportunity for those with a disciplined mindset.

Thanks for reading.

Twitter: @fabiancapital

Gather more insights from David’s investment blog.

The author of his clients may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.