The S&P 500 Index and the Dow Jones Industrial Average continue to grind higher for the third week in a row.

The most recent trends in the stock market are showing some broadening out. Small cap stocks, which are the most responsive to economic trends, have begun to move up.

Leadership in the stock market is rotating away from the mega-cap tech stocks toward the cyclical sectors, like industrials and materials.

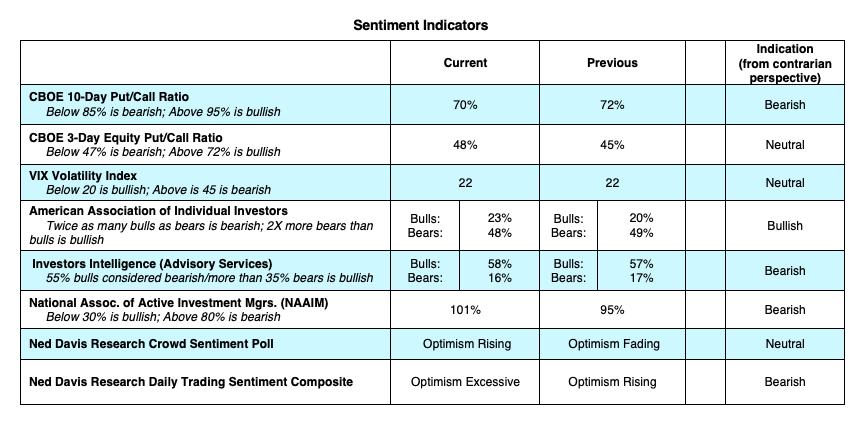

The sentiment indicators are flashing caution.

Excessive optimism can be found in the Chicago Board of Options Exchange data that shows the lowest put volume in decades.

Options traders have a history of being wrong at important junctures in the market. Last week’s survey from the National Association of Active Investment Managers shows their allocation to stocks ballooning to 101% versus 10% at the March lows.

Small trading platforms, like Robinhood, are exploding with new accounts by encouraging speculation via zero commission trades.

Excessive optimism can move the market in the short run but also makes the market susceptible to pullbacks on bad news.

Seasonal trends point to increased stock market volatility.

Historically, investors begin to focus more narrowly on the presidential election around the time of the political conventions. Typically, the race for the White House tightens in September and October resulting in a rising level of uncertainty for the financial markets. In the past, this has triggered an increase in stock market volatility.

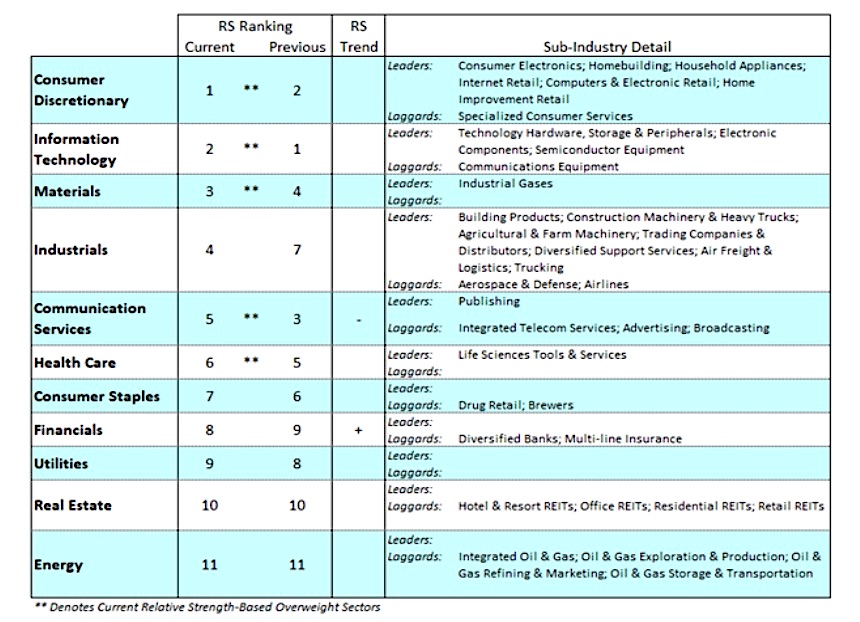

We are beginning to see signs of a trend away from growth and technology toward cyclical and value.

Evidence of this is found in the S&P sector relative strength rankings that show the materials and industrial sectors among the top five strongest areas of the market. Cyclical stocks tend to benefit from an improving economy. We do not expect the technology revolution to go away but the flattening out of prices in the tech area and the rise of the cyclicals promote a healthy bull market.

The strongest bull markets occur when most stocks, groups and sectors are in harmony with the primary trend.

Last week 62% of S&P 500 stocks were trading above their 200-day moving average. A move toward 70% would offer confirmation of improving market breadth.

The Bottom Line:

New cases in the COVID-19 virus are declining as are hospitalizations and the rate of increase in deaths. A slow improvement in the economy can be found in the most recently reported initial jobless claims which fell below one million for the first time since March. High frequency data such as TSA screenings and restaurant reservations also point to a moderate improvement.

The market positives are an improving economy, continuing Federal Reserve stimulus, improving market breadth, and the Fed’s pledge to keep rates at zero for the foreseeable future. Low interest rates encourage investors to move money into stocks as there is no other seemingly good alternative. Low rates also stimulate housing and capital spending. The trend for now is positive but we expect to see short-term bouts of increased volatility due to excessive market sentiment and seasonal trends.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.