I spend a lot of my time writing about the common mistakes made by investors because I operate under the assumption that cutting down on unforced errors could drastically improve portfolio performance for a majority of investors.

I spend a lot of my time writing about the common mistakes made by investors because I operate under the assumption that cutting down on unforced errors could drastically improve portfolio performance for a majority of investors.

The behavior gap between reported fund returns and actual investor returns that results from poorly timed purchases and sales is probably the most pervasive problem facing investors today. Well-known funds such as the Fairholme Fund and MainStay Marketfield have both had impressive runs in the past decade but most of the investors in these funds didn’t get to come along for the ride. Most of the money poured in after periods of outperformance and left after the ensuing underperformance. And this caused ever widening behavior gaps.

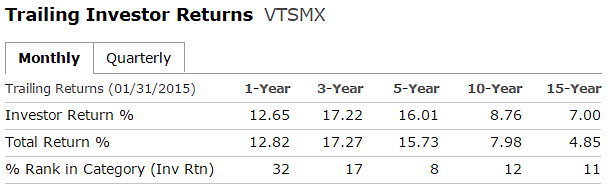

But not all investors make repeated mistakes and not all behavior gaps are created equal. Case in point is the Vanguard Total Stock Market Index Fund (VTSMX). This is a simple, low-cost fund that is designed to track the entire U.S. stock market. There’s nothing fancy about it. Take a look at the historical return numbers through the end of January:

Over the past 15 years investors in the fund, as measured by dollar-weighted returns, have actually outperformed the reported fund returns by more than 2% per year. This means investors in an index fund have outperformed the stock market for a decade and a half by more than 200 basis points, something most professional investors could only dream of. The 5, 10 and 15 year investor returns all rank near the top decile in performance numbers when measured against the fund’s peers. These are the kinds of returns the fund management firms should be shooting for — successful results from actual investors in their funds.

Why have the investors in this fund been so successful? It’s hard to say for sure, but here are my thoughts:

- It’s an extremely simple fund strategy. There are no real surprises and investors know exactly what they are getting — low-cost beta exposure to the U.S. stock market. More exotic strategies tend to lead to worse behavior gaps.

- This fund is probably a core holding for many. Some investors go for the core-and-explore approach by keep a large portion of their portfolio in a core holding – in this case a total market fund – and using the remaining allocations to take more risk or search for other opportunities.

- A migration from active funds to index funds. Index investing has seen substantial growth over this time frame. You have to assume many of the flows into this fund are because of this change in investor allocations and the growth of Vanguard in the fund industry.

- Investors have learned their lesson and have cut down on performance chasing?

I put a question mark on the last bullet point because I’m not so sure about that one. Indexing doesn’t solve all of your problems as an investor. I have a feeling that many of the investors that have jumped on the passive investing bandwagon recently are going to find this out the hard way in the coming years. It doesn’t matter what kind of funds or strategy you rely on if you can’t implement it over a variety of market cycles.

But I do find it encouraging to see positive investor results, no matter how the funds are allocated. Hopefully this is a trend that continues. Thanks for reading.

This originally appeared on A Wealth Of Common Sense. Follow Ben on Twitter: @awealthofcs

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.