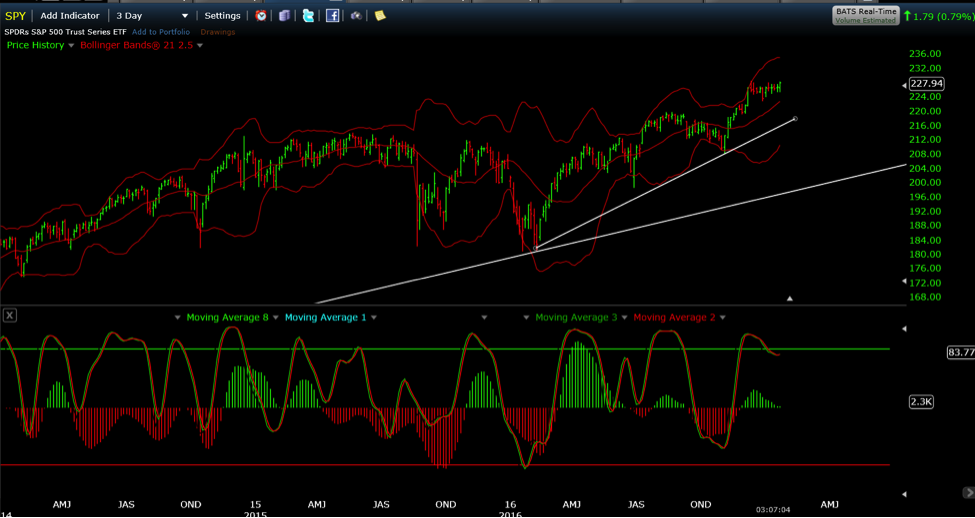

Will this sideways consolidation of the so called Trump rally lead to another leg higher or will it fail and take S&P 500 (NYSEARCA:SPY) and the broader markets materially lower?

That is the question of the day and maybe of the year. The market seems to have taken a wait and see attitude at the current levels waiting to see the pace and tenor of the Trump administration’s rollback of regulations and Obama era executive orders.

As I look at quantitative readings, there has been a material slow down in money flow to the market as far back as mid November 2016. The contradiction of weakening internals and climbing index levels is a tough concept for young traders to grasp. So as fewer and fewer stocks continue to propel the broad indices, the market becomes much more vulnerable to sharper pull backs.

Of course, this vulnerability doesn’t always materialize into pullbacks, sharp or otherwise, but as traders, our number one job is to manage risk and managing risk goes beyond positional risk but to portfolio risk in general. In short, I consider this a generally “risky” broad market environment. Again, that opinion is supported by quantitative readings as stocks are being sold more aggressively into highs than they have been bought into lows.

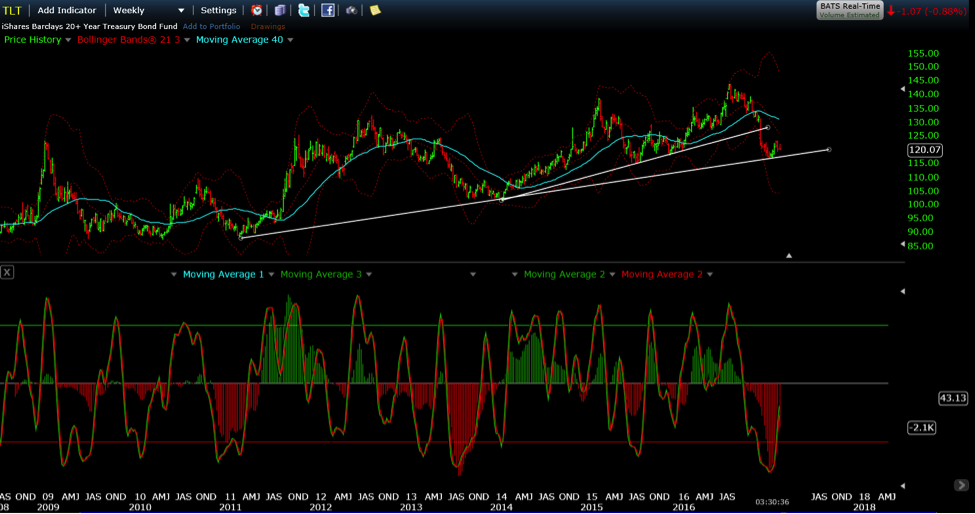

The result of this type of market action is cumulative and tends to reach a point where rotation runs its course and market participants run out of attractive sectors where to put capital to work. Defensive sectors and Treasuries (NASDAQ:TLT) begin to outperform as the broad equity market corrects. We seem to be nearing such point now.

S&P 500 Chart

20+Year Treasury Bonds Chart

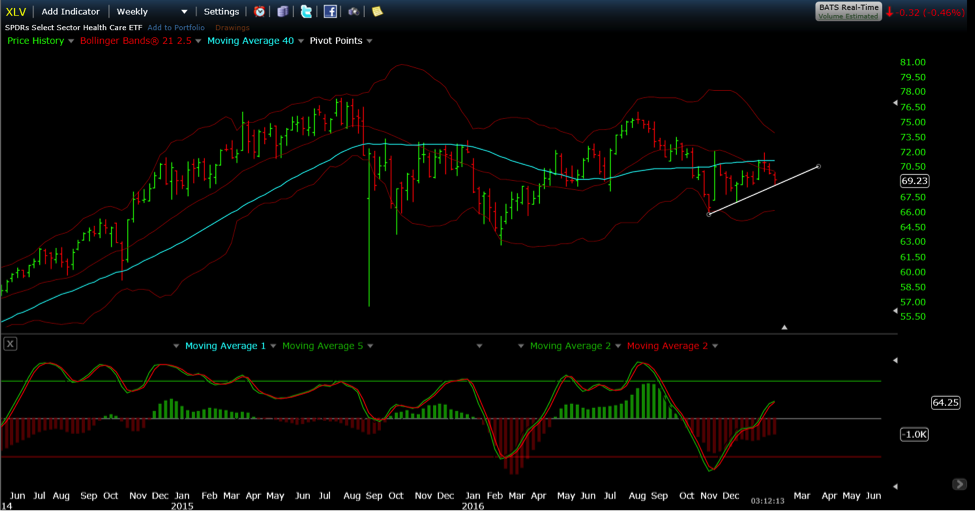

How much and how far remains to be seen. I believe this pullback, if indeed one materializes shortly, will be a buying opportunity in select sectors that I feel are going to outperform this year such as Big Cap Healthcare (NYSEARCA:XLV) and Pharma.

Health Care Sector ETF (XLV)

Thanks for reading.

Twitter: @CJMendes

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.