As the markets have pulled off their respective all-time highs, I believe there is something more important to be on watch for out there: the iShares Micro Cap ETF (NYSEARCA:IWC).

While the S&P 500, Dow Industrial, NASDAQ, Mid Cap 400, Russell 2000 and 3000 are all well above 2015 highs, the Russell Micro Cap index is not.

In fact, we are struggling with these exact levels. Looking back a little further, we are not far from the 2014 highs either.

iShares Micro Cap ETF (IWC) – Weekly Chart

It is important to note the haunting negative divergences and that we just barely reached overbought momentum back in December. For a market that has been so strong, we lose a bullish factor when the Micro Caps are struggling to participate.

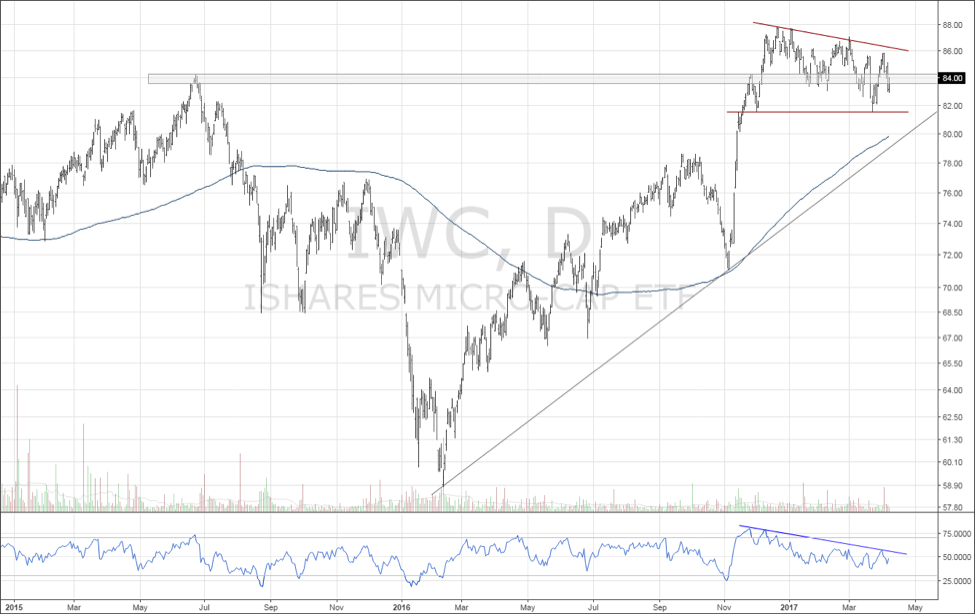

Zooming in on the daily chart, we can further see this weakness. Caution is warranted in the near term.

iShares Micro Cap ETF (IWC) – Daily Chart

What happens in this index may be an indicator of where we head Q2. Thanks for reading.

ALSO READ: Should Bulls Be Concerned Here?

StockTwits: @Alpha_Eye

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.