The Michigan Consumer Sentiment Index was just released by none other than the University of Michigan. The reading continues to give us a good gauge into the psychology of the consumer. This remains an important factor as the consumer makes up nearly three quarters of the United States gross domestic product (GDP).

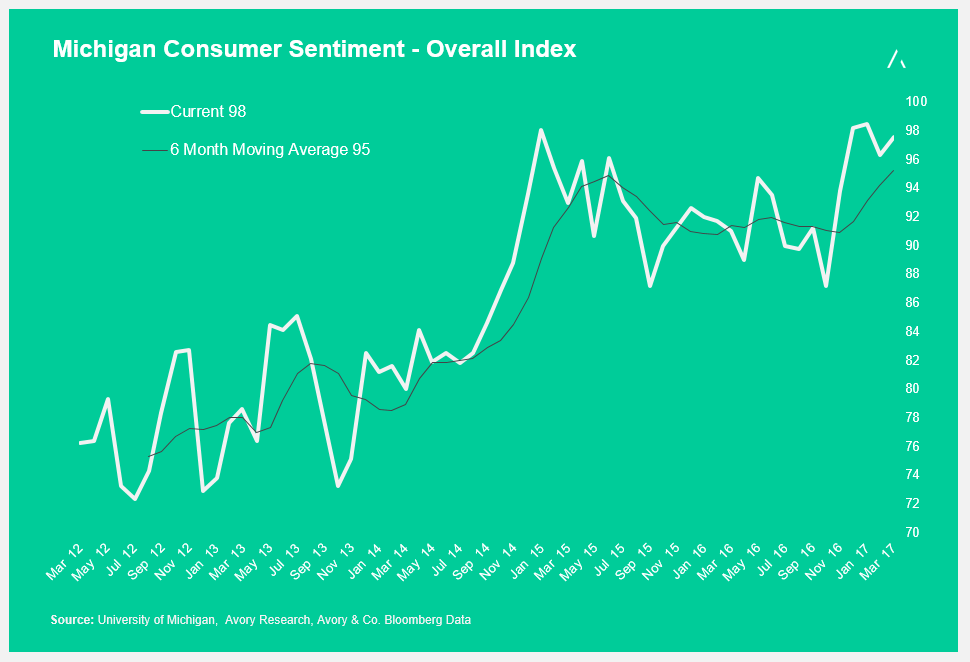

Here is the overall index reading:

As you can clearly notice, following the elections the sentiment reading shot higher. We have seen back to back readings which have come down, which in retrospect is warranted given the strength in the prior move.

How does this relate to the stock market? It does in numerous ways. A healthy consumer leads to a higher probability of increased consumer spend, which in theory helps companies (some more than others).

The Michigan Consumer Sentiment reading has numerous components to it. Some focusing on current conditions, and others focusing on more forward outlooks. I like to understand current conditions, but what is most important is what will happen tomorrow as today is already gone.

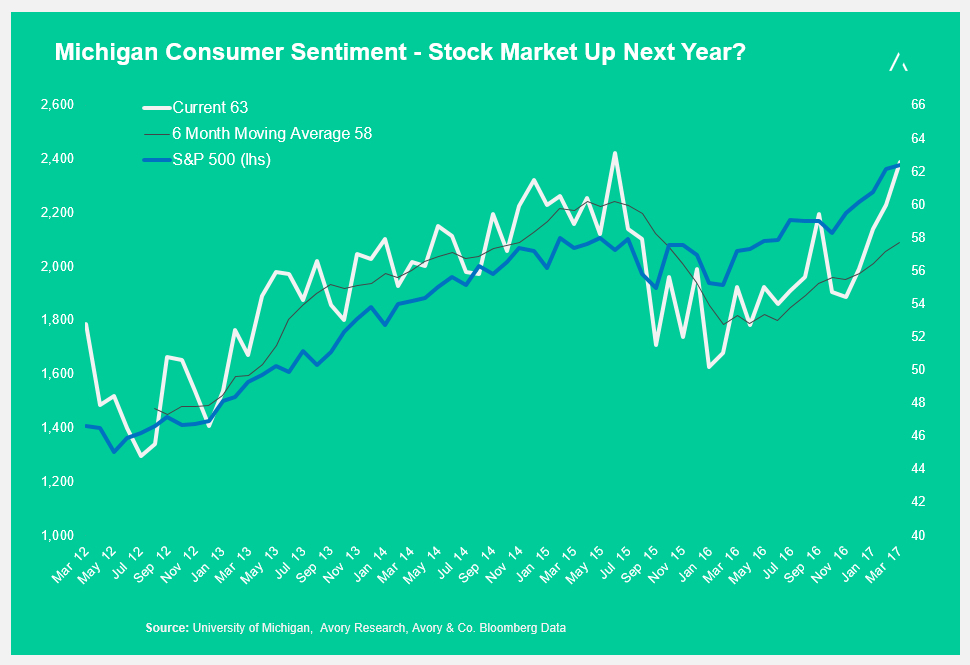

Let me be more specific. The chart below highlights one of the various sub-readings which pertains directly to the stock market. Observers are asked about their opinion of the stock market on a go forward basis. What we can see is that the reading is now back to the June 2015 highs. Some may think this is a good thing, however markets tend to over and under shoot as the pendulum of psychology swings back and forth between positive and negative. I quickly overlayed the S&P 500 to monitor the price behavior relative to the consumer index.

What I notice is that the market actually saw a short term peak only 1 month following the peak in the sentiment index. Being a contrarian, I think a short term side-ways to lower market from here may make sense if recent behavior patterns repeat, and as optimism subsides. As you may know, we own and focus on specific companies, however it is always good to have a sense of the direction and psychology of the broader market.

Thanks for reading and have a great weekend.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.