CURRENCIES

US Dollar Index: The Dollar closed just under the 50-day moving average for three straight sessions before breaking out on Wednesday. The April 26-27 FOMC minutes came to the rescue, as the message was interpreted as hawkish. The US Dollar index jumped 0.7 percent in that session.

The sudden tilt toward hawkish message among several regional Fed presidents has helped the dollar index, as the yield curve has shifted up, with the two-year having risen from 0.72 percent on May 10th to 0.9 percent on May 18th and the 10-year from 1.71 percent on May 13th to 1.87 percent on May 18th.

In this regard, Ms. Yellen’s Friday speech will be crucial – see if she continues her hitherto dovish message or changes the tune.

Based on how they are positioned, non-commercials still look tentative – not yet convinced if the recent rally in the US Dollar index is for real.

Net longs are near two-year lows.

May 20 COT Report Data: Currently net long 10.4k, down 1.7k.

Euro: The Eurozone’s trade surplus widened in March to €22.3 billion from €20.6 billion m/m, due primarily to imports contracting more than exports. Exports fell 1.3 percent, while imports shrank 2.7 percent.

Everywhere we look, exports are weak. Competitive devaluation is rampant, but that is no panacea.

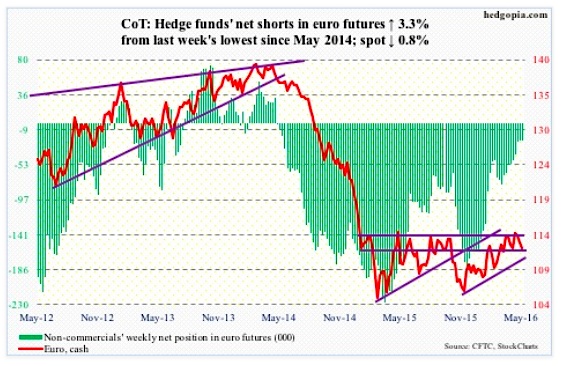

From the perspective of Eurozone exports, Mario Draghi, ECB president, must be a happy man in that the euro was not able to break out of 114-114.50. Turns out the breakout early this month was false. With a three-plus percent drop since, the Euro currency is at the lower bound of a six-month ascending channel. A breakdown here only ensures more weakness for the Euro.

May 20 COT Report Data: Currently net short 22.6k, up 715.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.