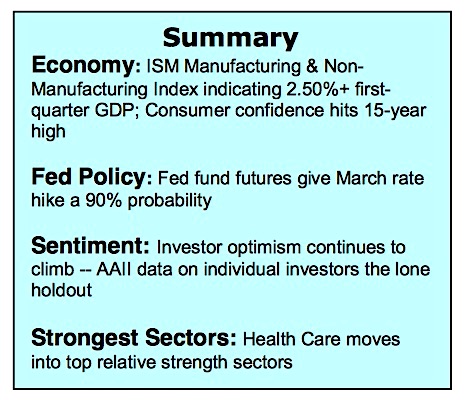

The S&P 500 Index (INDEXSP:.INX) rallied for the sixth week in a row and the Dow Industrials crossed the 21000 level for the first time last week. Stronger-than-anticipated economic data and a 15-year high in consumer confidence helped spark the gains in the blue-chip averages. The fact that the economy is improving in front of tax and regulatory reform has boosted estimates for corporate earnings growth for 2017.

Fed Signals March Rate Increase

The potential for stronger economic growth and new highs by the stock market have not gone unnoticed by the Federal Reserve governors. Fed Chief Janet Yellen and other board members have signaled that a 25-basis-point increase in the level of fed funds is likely on March 15.

This is not expected to create any serious problems for the stock market. Interest rates are very low historically and a boost in interest rates is widely anticipated as seen in the fed funds futures market giving the event a 90% probability. Furthermore, long-term rates remain locked in a trading range with the yield on the benchmark 10-year T-note at 2.50%. We would anticipate interest rates not becoming an important headwind for stocks until the fed funds level moved above 1.25% and/or the 10-year T-note climbed above 3.00%. This week, the markets will be focused on the February Employment Report due on Friday. Consensus estimates are that the economy generated 185,000 new jobs and the unemployment rate fell to 4.7%.

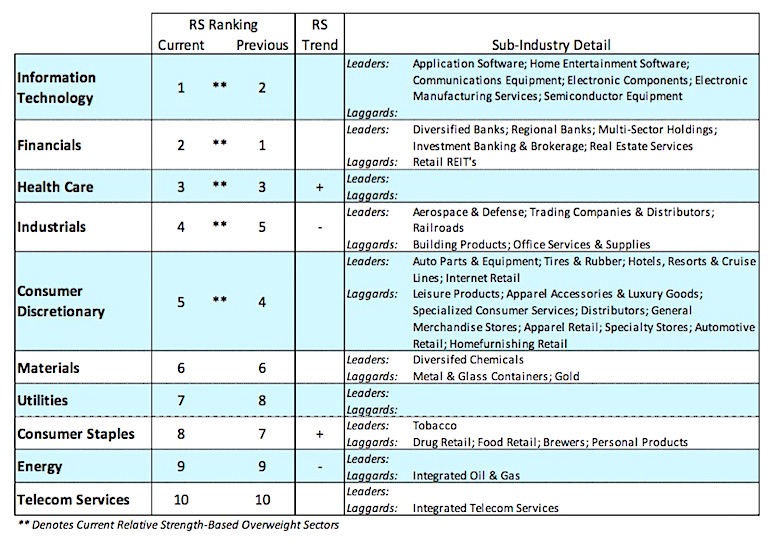

Most of the technical indicators argue that the path of least resistance remains to the upside for the stock market. Trend and momentum continue to strengthen with the NYSE advance/decline line hitting new record highs matching the strength in the popular averages. The percentage of NYSE stocks trading above their 50- and 200-day moving averages continues to rise but short of readings that would suggest stocks are overbought. Last week’s new high by the S&P 500 Index was accompanied by a rise in stocks within the index to 30%. Additionally, six of the S&P 500 sectors also reached new high ground last week. In a healthy bull market, most areas are in harmony with the primary trend, which is true in the present example. Historically, the broad market peaks three to six months in front of the averages suggesting that any weakness that develops near term will likely be followed by a retest of the highs.

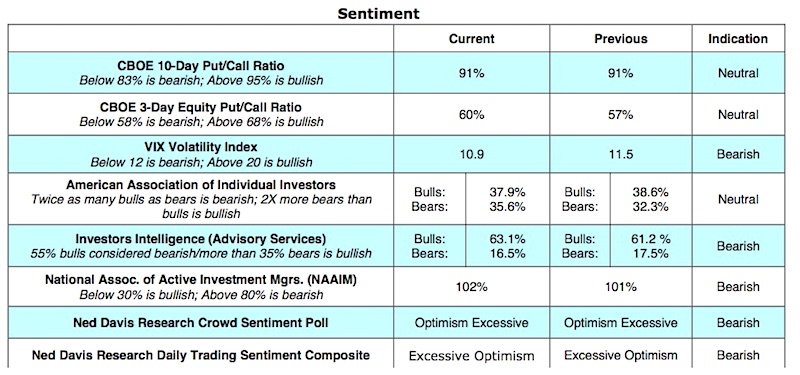

Indicators of investor psychology remain a concern. The most recent data from Investors Intelligence (II) showed an increase in bulls to 63% last week, a 30-year high. The optimism found in the II data is confirmed by a report from the National Association of Active Investment Managers that shows an allocation to stocks of 102%, the second highest on record. The survey from the American Association of Individual Investors (AAII) shows less than half of those surveyed outright bullish. Should the AAII data eventually match the enthusiasm for stocks found in the II and NAAIM statistics, our concern for a near- term pullback would increase.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.