Stocks opened the week with some nice follow through, giving investors some relief against the backdrop of recent emerging markets news.

Let’s review key price levels on the major stock market index ETFs, along with today’s market theme.

S&P 500 (NYSEARCA: SPY) 285 was resistance, now support. And a good pivotal number to use if the market sells off.

Russell 2000 (NYSEARCA: IWM) 169.76 is what we are looking for to clear. Otherwise, this was a rally to resistance with 167.50 support to hold

Dow Jones Industrials (NYSEARCA: DIA) 256.75 now pivotal support with same sentiment as SPY

Nasdaq (NASDAQ: QQQ) 182.65 the resistance we watched to clear before we left, never cleared. Now, 177.50 then the 50 DMA support to hold

First off, thank you Geoff Bysshe for filling in with your excellent and helpful insights on the market!

As I was away for 2 weeks, a review of the Modern Family (Semiconductors, Biotechnology, Regional Banks, Russell 2000, Retail and Transportation), is a good jumping off point.

Before we left, and what Geoff wrote a lot about is not only how those sectors and one index are doing, but also how the rotation has offered big gains.

For example, Retail (our Granny $XRT), on August 3rdI wrote,

“XRT over 50.00, should send it to 51.00. From there, we are in new high territory. After a gorgeous double bottom at 38, and a golden cross on the weekly chart, a breakout over the previous all-time high could send XRT up into the 60’s.”

Geoff picked up on this rotation in the last two weeks, writing about the move out of Semi’s and into Retail, Transportation and Regional Banks.

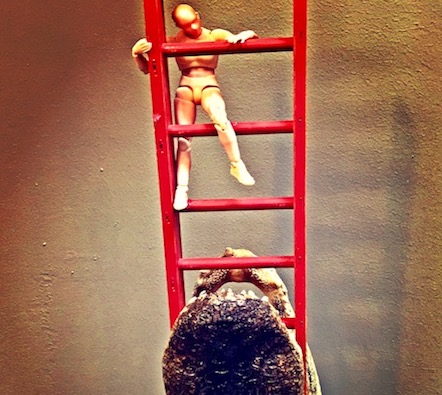

That makes our Modern Family a huge part of the reason the market remains a few rungs above the alligator’s open mouth.

Beginning with Granddad Russell 2000, IWM the ETF, in a wide trading range, has all-time highs nearby at 170.20.

More importantly, the chart was indicating lower highs since that all-time peak on June 20th.

While we would like to see IWM clear the ATHs, that pattern of lower highs will negate once this clears 169.76. Today’s high 169.18.

Granny Retail (XRT), I believe, is the main catalyst for the current strength.

Now that XRT is on new ATHs, uncharted territory brings me to the target of somewhere over 60.00.

Transportation, IYT, looked scary a few weeks ago. However, it held the 50-week moving average to the tick and now, is one push away from making new ATHs over 206.73.

We never argue with Tran.

Our Prodigal Son, Regional Banks, is a sleeper. It may be our best opportunity right now. With KRE is huge consolidation and in a bullish phase, a close over 63.60 should get it going.

Big Brother Biotechnology IBB, could be the icing on the cake. As long as it holds the 50 DMA at 114.86, a move over 117 could spark some new spec interest and will help everything.

Finally, Sister Semiconductors has done her job beginning in 2012. While SMH made new highs in 2018 and has since retreated, I would go there to short if the market rolls over.

Nonetheless, as SMH failed the 50-week moving average for the first time since November 2016, it did not close the week below it (102.85). That’s KEY!

Henceforth, we have the players in the race between the alligator’s mouth and the market hanging on a few rungs above.

Note that you can get daily trading ideas and market insights over on Market Gauge. Thanks for reading.

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.