Euro Stoxx 50

The surge in European stocks earlier this year may have peaked just as investors were noticing it.

In the wake of the April peak, European stocks initially held support even as momentum was waning. The second test of support (near 3300) did not hold as momentum then was expanding to the downside.

3300 is again resistance, while support is now near 3000.

Despite so many investors looking for opportunity and excitement in overseas markets, the price trend is strongly favoring U.S. leadership. While the trend got ahead of itself in the second half of 2014, the ratio held support and is now challenging its highs. Just because exposure can be gained relatively easily or is packaged in a fancy wrapper does not mean it merits inclusion in a portfolio.

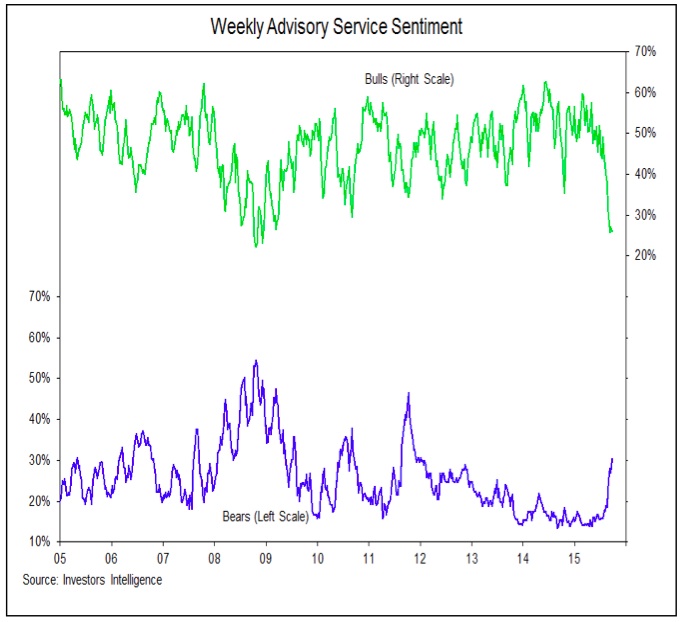

The Investors Intelligence data suggest that the lack of bulls is sufficient for stocks to make a good low, but the number of bears remains relatively subdued (although encouragingly it has begun to expand). At the 2011 lows, bears on this survey were above 40%. Right now they are 30%. Capitulation is getting closer, but it does not look like we are there just yet.

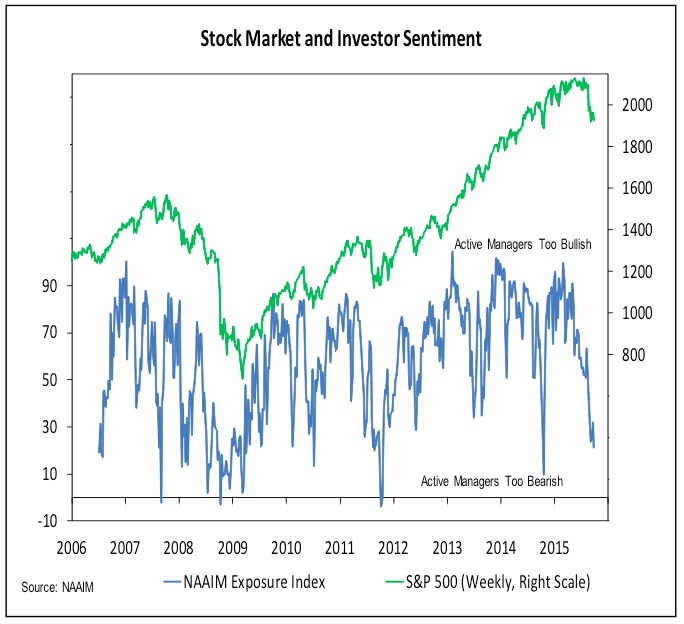

We see a similar story from the NAAIM Exposure index. Stock allocations among active investment managers dropped from 32% last week to 21% this week. At the October 2014 low it was below 10%. In 2011, it was negative. We may not need to get back to the 2011 lows, but a single-digit reading would seem consistent with managers throwing in the towel.

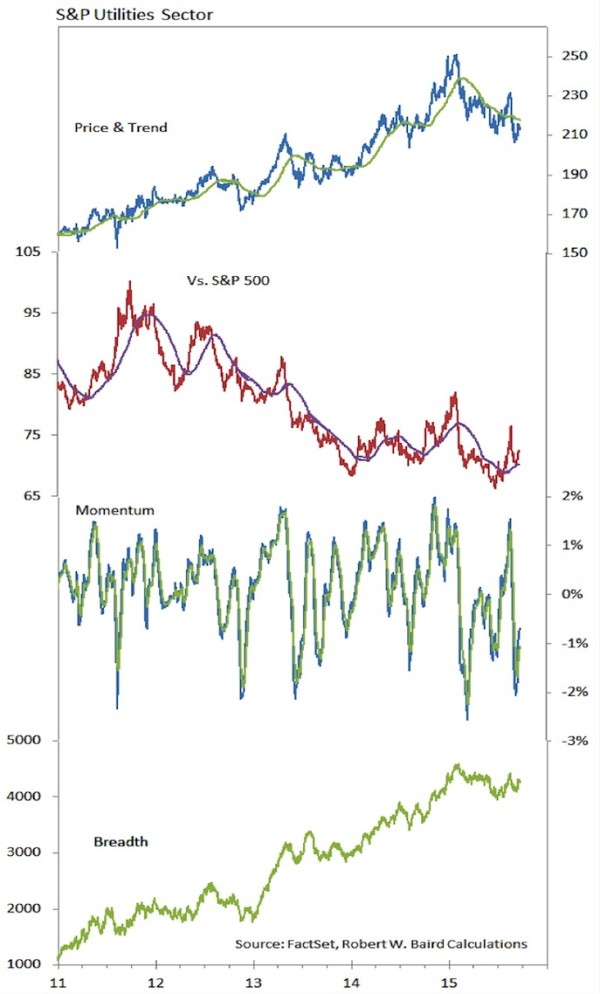

Utilities have risen into the leadership group on a relative strength ranking basis. While the absolute price line shows a lower low being made, both the relative price line and the breadth line show higher lows being made – postive divergences that could help produce sustained strenght in the sector.

Thanks for reading this week’s market outlook. Have a great weekend.

Robert W. Baird & Co. Disclaimers

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

Foreign and emerging market securities may be exposed to additional risks including currency fluctuation, political instability, foreign taxes and regulations and the potential for illiquid markets. Historically, small and mid-cap stocks have carried greater risk and have been more volatile than stocks of larger, more established companies.

Copyright 2015 Robert W. Baird & Co. Incorporated.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.