This article was written with Craig Basinger.

This week we wrestled with what to focus on given the many big moves we have seen in the markets including bond yields, the Canadian dollar (C$) and crude oil.

Our problem stemmed from the fact that these three topics were covered in the previous three weeks (you can see what we said on these topics over the past few weeks HERE). We don’t want to write a ‘re-run’, but given the number of inquiries that we have received on these three topics, a revisit seems prudent. So here goes.

Crude Oil

Oil prices have retreated back down to below $45/barrel. What makes this more troubling is this has occurred with record demand which continues to grow at a decent pace thanks to broadening global economic growth. Clearly the issue is on the supply side with some faltering within OPEC on production cuts and rising U.S. production. In May, according to IEA, the world consumed 96.9mbpd, and yet produced 98.1mbpd. This is the highest surplus, 1.2mbpd, since before the announced OPEC production cuts. China oil imports were 15% higher in May of this year compared to a year ago. U.S. consumption is 4.2% higher. So clearly it is not a demand issue, which is a good thing.

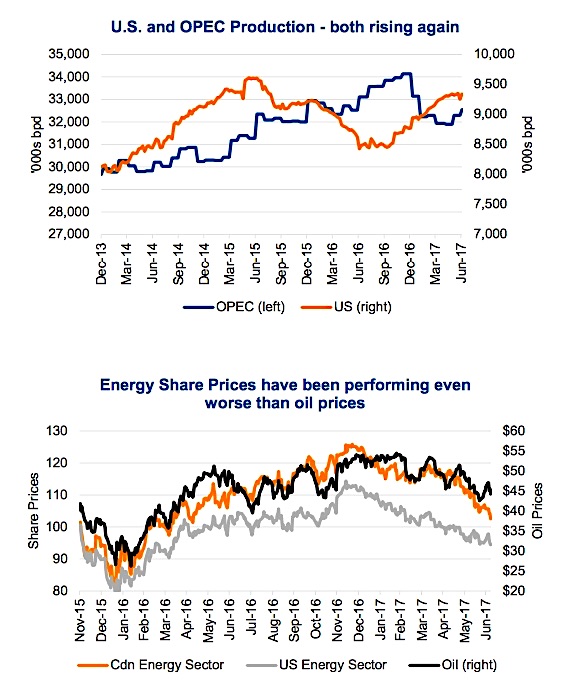

Supply remains the issue. OPEC, after a number of months of contracting supply thanks largely to seasonality and cuts, has started to raise it again (blue line chart 1). At the same time U.S. production continues to climb, nearing its pace from when oil was much higher (orange line chart 1). Not a good combination for the commodity price. The number of drilling rigs in the U.S. has been rising for a year and is at two-year highs. DUCs are also back (DUCs = Drilled but uncompleted wells), 5,000 in the four major shale zones is a record high.

Even more troubling than just the commodity price is the underlying stock prices (see 2nd chart above). During recent periods of commodity strength the sector just hasn’t risen as much as the commodity. And since 2017 started, the energy sector is the worst performing sector for both the S&P 500 and TSX.

We remain significantly underweight energy and more defensively focused mainly on integrateds and some pipes. This stance has not changed but with oil now below $45 and prices starting to look more attractive, we are nearing a phase at which we would consider adding. But not yet. One aspect that is starting to make oil perhaps nearing oversold levels is the rapidly declining number of net non-commercial futures contracts. If these tick much lower when the data is released on Tuesday and the stocks continue to slide, we may switch our fundamental hat for a contrarian hat and do some buying.

Canadian Dollar

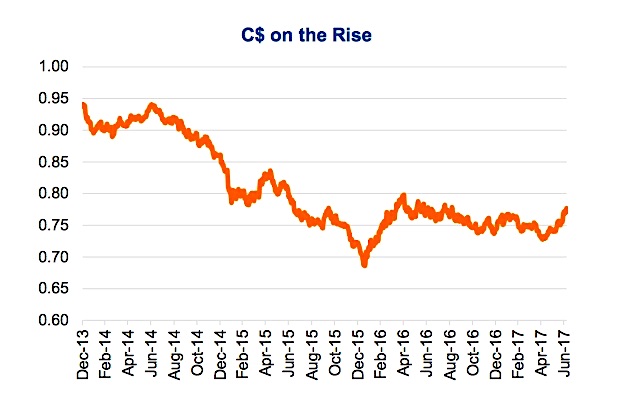

The loonie is soaring like an eagle, back to levels not seen since last summer. Given oil’s decline, this move is even more impressive as it appears totally built on improving economic data, which has the market now pricing in a 93% probability of a rate hike this week. To put this into perspective, the probability was almost 0% one month ago.

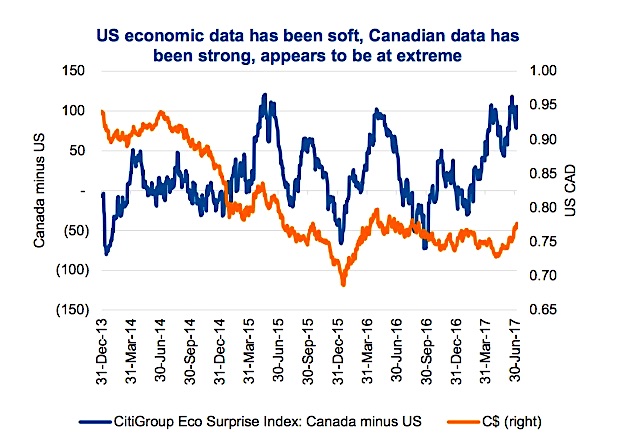

The data has been much better in Canada than the U.S. based on both absolute levels and also relative to consensus economic forecasts for each country. The Citigroup Economic Surprise indices measures a country’s economic data relative to consensus expectations and provides a rolling score (positive is good). In the next chart below we track Canada’s score minus the U.S. score, which is now about 100. This has been an extreme level over the past few years. Now to be fair, the U.S. data has not been all that soft, but simply the expectations were very high as well. In Canada, up until recently expectations had been very low. In the investing world, it is all about the relative change.

Next week’s Bank of Canada rate decision will be interesting. The market has almost priced in a rate hike. So if it happens, the impact on currency may be limited. If it doesn’t (unlikely) there could be a big reversal.

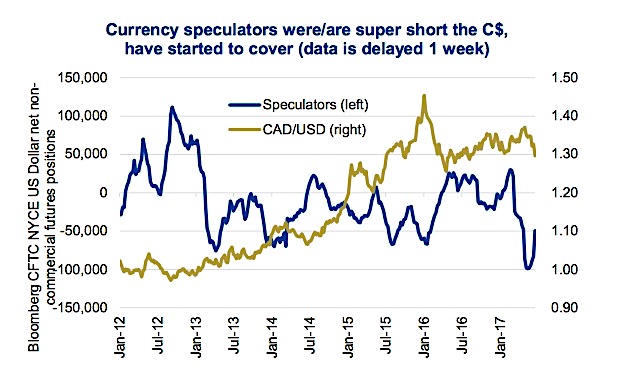

Accelerating the move in the loonie has been the amount of speculators shorting the currency. (chart below) This was at a record level at the end of May and we have seen roughly half those bets covered/closed as of the end of June. On Tuesday, we will see data from last week and it is a fairly safe bet more of the shorts will have covered. This has been contributing to the speed of the move.

From our June 19th report – “At 75.5 cents, we are pretty neutral, adding a little on the U.S. side. While not our expectation, if the C$ continued to rally closer to 80 cents we would consider closing out our hedge (In our Core Income Fund we had hedged about 1⁄4 of the currency risk a few months ago). Our base case is this rally in the C$ will fade and we will see a lower exchange rate in the coming months that will offer an attractive point to add to our hedge or trim U.S. exposure.” This view hasn’t changed at 77.5 cents today.

Yields

It has only been a week since we discussed rising yields and questioned whether the reflation trade from the 2nd half of 2016 was back on, so will keep it brief. Bond yields globally have continued to move higher, helped by improving economic data, notably the good employment reports out on Friday. If this trend continues, we believe it could trigger another iteration of the Taper Tantrum we experienced in 2013. More central banks are hinting or outright stating they are changing the direction of monetary policy. Albeit gradually, this could result in bond yields moving faster than many would expect given the economic data. This would weigh the most on the interest rate sensitives, which have been weak over the past few weeks.

Our conclusion is pretty much the same: Strategies to mitigate this risk include reducing bonds or at least reducing duration. Term premiums are historically low so you are not giving up too much from a yield perspective. You can also reduce exposure to the more interest rate sensitive sectors and reallocate to more cyclical yield sectors.

Financials including regional banks, money centers and lifecos all stand to benefit from rising yields. We are already starting to see early signs of a loss in momentum in Telcos, Utilities, Consumer Staples and Real Estate sectors.

Charts sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity