The global economy, even the U.S. or Canadian economies for that matter, are rather complex.

You have millions of people (billions for the global economy) making decisions every day that are largely meaningless in themselves. But add them all together and even a small net change in attitudes towards spending or saving, or in confidence can have a dramatic impact on the overall economy.

There are also millions of companies that make countless decisions: whether to greenlight an expansion plan or cut back on travel to reduce expenses, hire or not hire.

The result? Any money spent (aka expenses) by an individual or a company – even for something as insignificant as coffee pods – represent another person’s or company’s revenue. A single person or company won’t move the needle but, collectively, the domino effect of one’s decision on the next amounts to the economy.

The cascade or domino effect in the economy is important at the moment.

For the most part, there was little concern when developing economies started to show slower economic growth a few years ago, but this gradually spread to impact developed economies that are more trade sensitive, such as Europe and Asia.

Now the fallout of this slower growth has spread, slowly, to the U.S. This has lead to a slowdown in global manufacturing, perhaps even a ‘manufacturing recession’ as some coin it. Trade uncertainty has exacerbated this slowing and sapped corporate confidence. So here we are today:

• Global growth continues to slow, most evidently in the more cyclical manufacturing industries.

• Trade uncertainty and corporate confidence continues to fall, leading to more conservatism.

• Companies have been dialing back corporate spending (remember, one company’s spending is another’s income).

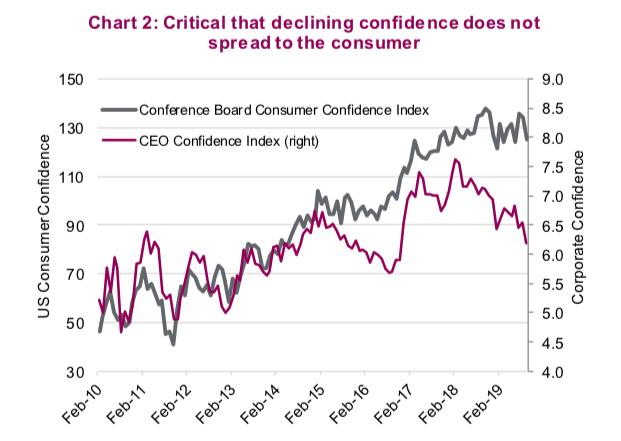

BUT, the dominos have not reached the consumer and that is the crux (Chart 2 compares corporate & consumer confidence). We have gone through manufacturing/corporate spending slowdowns before and if they persist long enough or become deep enough, companies begin firing instead of hiring, which then impacts the consumer. Companies will cut all sorts of expenses before they begin laying people off as it is expensive to re-hire and because company’s have hearts too.

So far the consumer sector has not been impacted and remains healthy, especially in the U.S., which makes up a substantial portion of the global economy. In the next section we will share further analysis and our thoughts on the consumer, but for now this is the saving grace. There are other positives as well.

Remember, while manufacturing is more cyclical than other industries, it is a smaller and smaller part of the economy. Money and credit trends are now very supportive with just about every central bank becoming more accomodative. Lower bond yields have helped. While we believe the efficacy of monetary policy on the economy has fallen over the years, we are not denying it still impacts some industries. U.S. housing has seen a revival of activity which is positive.

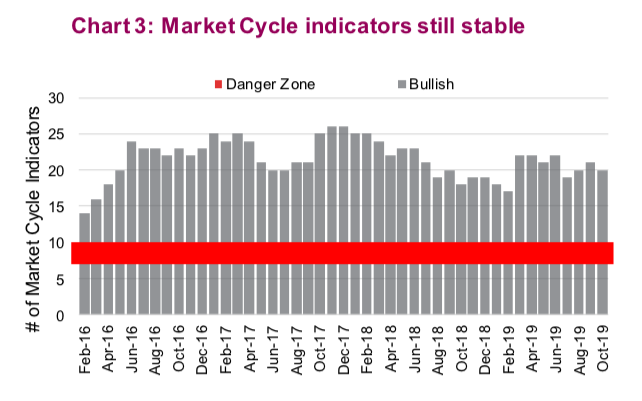

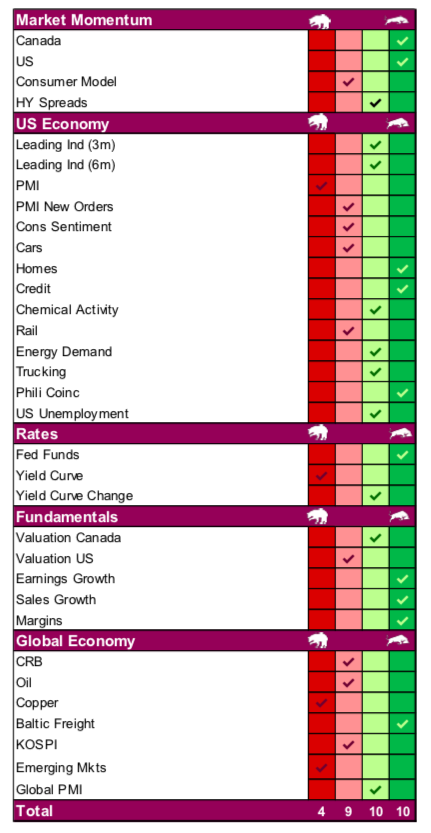

Data often conflicts with some pointing to positive trends and other to negative developments. This is why we use our Market Cycle framework, comprising key data: economic, technical, sentiment, fundamentals and rates. There is no one model or signal that will work consistently for predicting the markets or economy, so we use a cross-section that have each shown some efficacy historically. The good news is that while there has been some weakness or loss of momentum, the Market Cycle indicators have remained relatively stable.

While we rely upon the aggregate number of market cycle indicators that are bullish or bearish in our assessment of the health of the current economic cycle, the devil is often in the details. Comparing the current data with three months ago, we see some interesting changes.

The most notable is that the global economy has continued to lose momentum relative to the start of last quarter, but has improved over the past month. U.S. economic indicators have also seen some declines, not surprisingly, centred around manufacturing. Housing has returned as a bullish contributor. Finally, rates have become more positive. The Fed has cut rates and while the yield curve is still inverted, it has steepened somewhat (i.e. it is less inverted).

This has us in a more cautious stance regarding the overall market with extra emphasis or focus on whether or not slowing growth will spread to the consumer. At this point, that spells the difference between a continuation of the current aging bull or the rise of a bear market. If you want to help, you can always go out and buy something!

Note that this is a section from Richardson GMP’s weekly investor insights.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.