Macro View

While stocks may benefit in the near term from the perceived alleviation of geo-political uncertainties, this may yield to a more pronounced focus on the ability of companies to deliver on elevated earnings expectations.

Consensus expectations have earnings rising 18% on reported basis in the first quarter (23% on an operating basis). This represents a high bar for stocks to get over and pattern of the past 20 years is that stocks have tended to struggle when upside earnings surprises have slowed.

Elevated earnings expectations are coming with stock market valuations stretched and Central Bank provided liquidity poised to ebb.

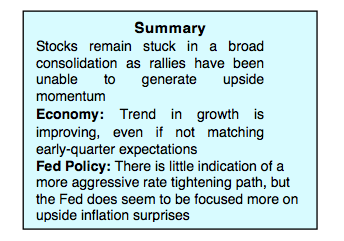

Macro Market Summary:

Market Thoughts

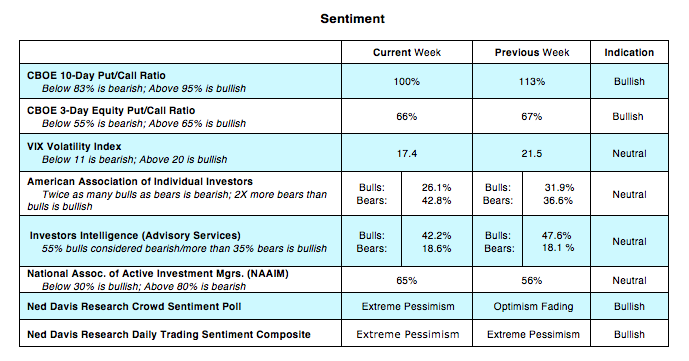

Stock market volatility (the S&P 500 has experienced 28 1% daily moves already in 2018) has helped lead to a pronounced reduction in investor optimism since the extreme readings seen early this year.

As discussed in our most recent Weight of the Evidence update, this shift toward a more favorable sentiment backdrop has been offset by a more challenging seasonal backdrop (brought in focus this past week by the Speaker Ryan’s announcement that he would not be running for re-election. The emergence of excessive pessimism could help stocks attempt to continue to bounce off of their recent lows. To gain conviction that any such moves will have meaningful staying power, we continue to look for evidence of upside momentum reemerging in the broad market (specifically two or more days with upside volume outpacing downside volume by better than 9-to-1). Absent the emergence of a breadth thrust, near-term swings and news-related rallies and sell-offs may mean a continuation of the ongoing consolidation phase.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.