It is with a heavy heart that we acknowledge the delisting of Long Blockchain (LBCC), a stock that quickly became the poster child for Blockchain Bubblemania.

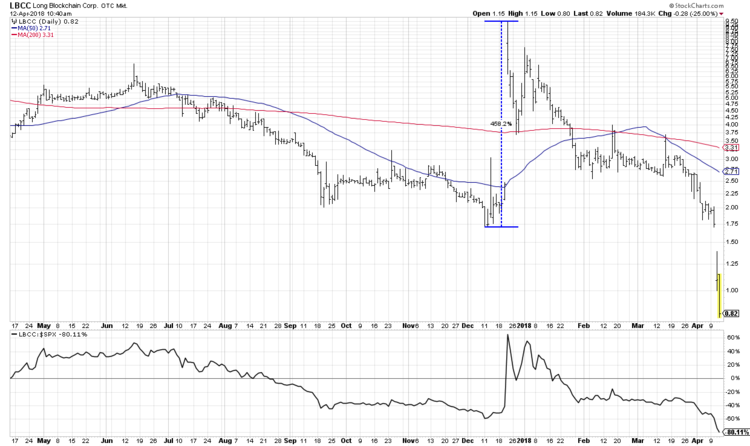

As a reminder, this is an iced tea company based in New York whose stock jumped 450% over a two-week period when they announced they were pivoting their business to focus on blockchain. And iced tea, apparently.

A look at the Long Blockchain Delisting…

Here’s a price chart of Long Blockchain through the morning of April 12:

Similar to the dot coms in the 1990s and the electronics names in the 1960s, there were a number of companies that changed their names to take advantage of the euphoria around the latest fad.

What’s fascinating is that in the case of Long Blockchain Corp., the company’s name change actually called the top in Bitcoin.

In the almost four months since the company’s prescient announcement, The NYSE Bitcoin Index is down about 65% to its current level around 7000.

As a technical analyst, I can see that Bitcoin has been recently oversold, suggesting a short-term upswing in value. I also notice that the RSI is in a bearish configuration, staying in the 30-60 range.

Compare that to the bullish configuration in the chart above, where the RSI stayed in the 40-90 range. This technical “regime change” suggests a short-term bounce in Bitcoin within the context of a larger downtrend.

However, as a market behaviorist, I see a beautiful visual representation of the euphoria of bubble periods, as well as the often uncanny timing of people making a decision such as a company name change.

Followed by the Long Blockchain delisting…

Books like Robert Shiller’s Irrational Exuberance do a fantastic job of explaining the reasons behind bubbles and the characteristics of a bubble period. In this case, a picture is worth a thousand words!

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.