I have heard much discussion of volume conditions in recent months, with the S&P 500 Index achieving all-time highs but accompanied by volume that is well below average levels.

Does this mean the recent breakout in stocks should be suspect?

Yes and no.

Conventional technical analysis wisdom says that a healthy uptrend should be accompanied by heavier volume. This would suggest an influx of buying power as investor demand increases.

But if we look at the S&P 500 over the last five years, we’ll see that the current volume predicament is actually quite normal.

My mentor Ralph Acampora always told me that “markets go up the escalator but down the elevator.”

To put another way, investors tend to accumulate positions over time as an up move in price increases their conviction in the trade. But when investors get fearful and decide to sell, they don’t tend to slowly and diligently wind down positions as the price drops. They panic and dump everything to close out the position.

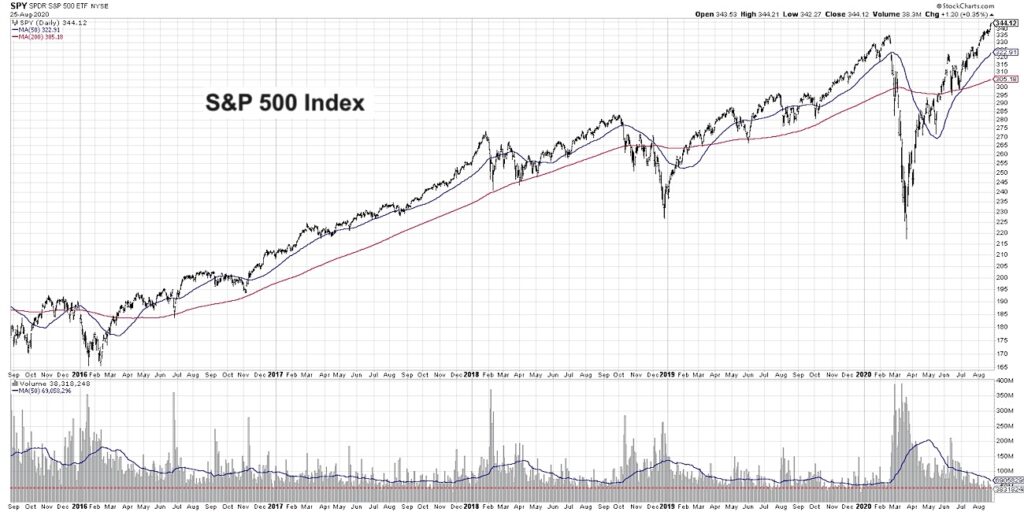

This chart shows the daily price and volume for the S&P 500 ETF (SPY) going back for five years. At the bottom, the daily volume bars are shown with a 50-day simple moving average in blue.

The highest volume spikes over the last five years occurred during major selloffs such as in February 2018 and February 2020. If you look at the volume trend immediately after these pullbacks, you’ll see that average volume indeed trends lower. Again, once the low is in, accumulation begins not immediately but instead builds over time.

The lighter volume conditions we’re seeing now may speak less to the uniqueness of current conditions, but more reflect the normal volume levels at a mature stage of a cyclical bull market move.

What about the absolute volume level?

I’ve also included a dotted red line which approximates this week’s volume so we can compare it to previous levels. You may notice that we have been at these quite low levels before, for example, in December 2016, October 2017, and August 2018. The problem is that in each of those instances, the market continued higher for the next 2-6 months!

So is volume just a meaningless metric? Not necessarily.

I would say that the lighter volume conditions are not due as much to an exhaustion of buyers as to the narrow leadership that we’ve seen. A smaller number of stocks in the Technology and Communication Services sectors (along with other sectors of course!) with a heavy weight in the index are making the S&P 500 look much stronger than equal-weighted versions of the index.

I’ve spoken often about the breadth conditions, particularly using the cumulative advance-decline lines for the major indices. As a matter of fact, I included this key measure of breadth in my Bull Market Top Checklist. In general, these are showing weakness in recent weeks, especially from mid-cap and small-cap stocks.

This brings me to my final point about the anecdotal evidence of lighter volume. I tend to think about broad market analysis in three parts: price, breadth and sentiment. These are in priority order, with price being the most important and breadth and sentiment focusing more on the conditions that accompany the price moves.

Weaker volume tells me that the bull market is most likely in the latter stages, and that I should begin looking for signs of a downtrend in price. But until the price goes lower, the trend is up by definition.

While lighter volume tends to be an interesting talking point and the idea of an absence of buyers can be a compelling narrative, I would argue that current volume readings speak more to the underlying conditions surrounding the markets at this point in time. The path of least resistance for stocks appears to be higher until proven otherwise.

To see this article in video format, check out my YouTube channel!

Twitter: @DKellerCMT

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.