The Kraft Heinz Company has had a difficult few months with the stock dropping from $80 to $57 currently.

This company caught my eye when running a scan for oversold stocks priced over $40 with average daily volume over 1 million.

The stock is currently trading at 57.06 which is 39% below the high achieved in early 2017.

After showing some positive divergence on the chart in early May, KHC attempted to rally but found trouble at the declining 50 day moving average.

RSI was not able to get above 50 on the recent rally, if it can break above 50 on the next attempt, the rally could have some legs.

After such a prolonged downtrend, pessimism on the stock must surely be getting to an extreme.

A recent article on Seeking Alpha pointed out that:

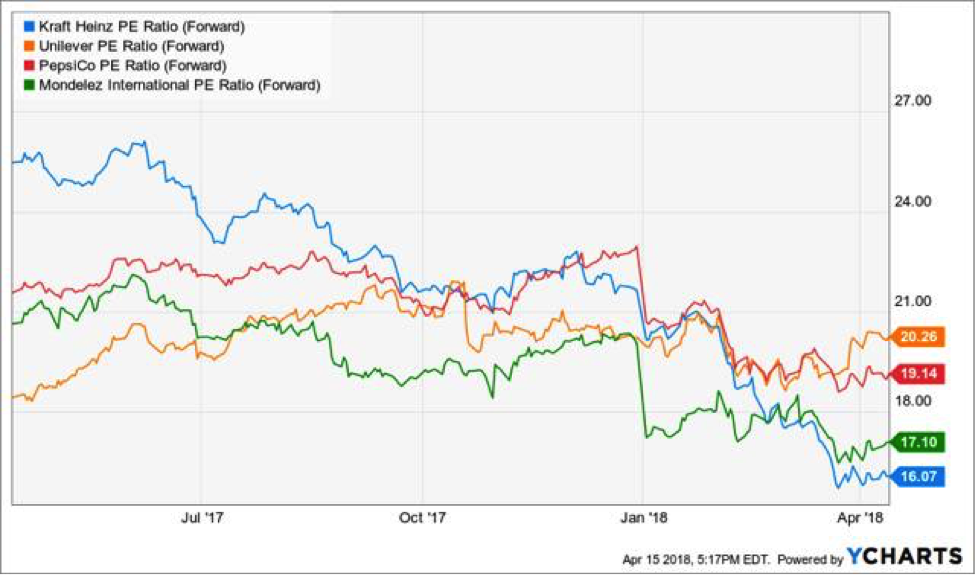

“…if measured by traditional valuation multiples …… it appears by most measures not only at its cheapest since the creation of the company, but is also trading at a discount to major competitors.”

For contrarian investors with a long-term view, this could be a good chance to get exposure to a high-quality company at a cheap price.

Another way to reduce the cost basis on KHC would be to sell a cash-secured put.

The idea behind a cash-secured put is that you sell an out-of-the-money put, while also setting aside enough cash in the event of assignment. This would occur if the stock falls below the strike price at expiry. The seller of the put would then be forced to buy 100 shares of the stock at the strike price.

Most traders sell short-term puts to take advantage of time decay. However, going out further in time can provide some benefits via increased premium received and more time for the trade to work out in the investors favor.

Selling an out-of-the-money put generates income while gaining a bullish exposure to the stock.

Looking at KHC, the July 20th, 2019 $5 puts are currently trading around $1.05.

A trader selling this put would receive $105 into their account which would be theirs to keep. If KHC falls below $5 by July 20th, they would be forced to buy the stock for $55. The effective net cost of the position would be $53.95 thanks to the option premium received.

That’s 5.45% below today’s price.

If the stock stays above $5 at expiry, the puts expire worthless leaving the trader with a healthy 12.68% return p.a. on capital at risk.

The main risk with the trade is similar to outright stock ownership. That is, if the stock falls precipitously, the trader will suffer a loss, but the loss will be partially offset by the premium they received for selling the put.

Thanks for reading and trade safe!

Twitter: @OptiontradinIQ

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.