It’s dangerous for traders and investors to get caught up in the feeling that you ‘have to’ nail your next trade. Lacking patience, with the fear of missing out in the back of your mind. It’s a recipe for disaster.

You have to ignore those thoughts. They are simply a hallmark of the battle of a trader vs themselves. In reality, the next great trade opportunity is generally only a few weeks or months away.

Let’s take a look around the world and see how much opportunity there is.

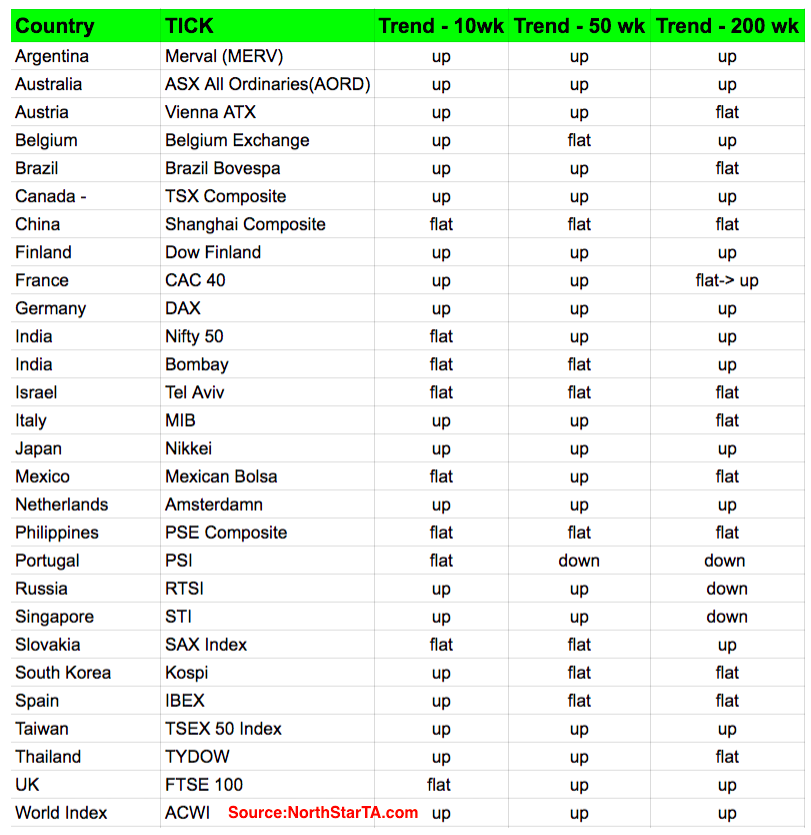

First off, there just aren’t that many downtrends in major stock markets across the globe. Here’s a look at current trends across several major stock markets around the world (through January 30):

It’s pretty impressive when you think about it. That said, what else can you expect in a world of global currency war. The name of the game is to keep your currency weak and your stock markets up.

As an American, I usually just follow the Country specific ETFs. In a list of 50 or so markets, you’re going to find quite a few technical patterns. Here’s a look at some of the best patterns around the globe. They either are or will be great trading opportunities at some point.

Norway ETF (NYSEARCA:NORW) broke a head and shoulders bottom in late 2016 and measures a move to 13.80. Expect the 200 week moving average nearby to provide a challenge near term.

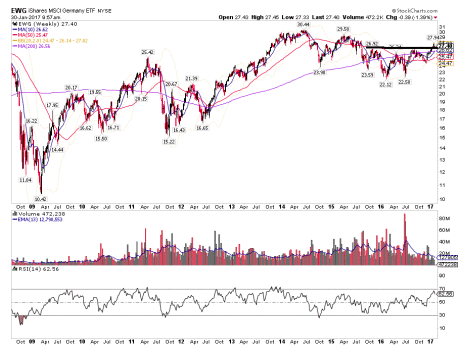

Germany ETF (NYSEARCA:EWG) has just started to break out of this bottoming base. There is potential for a move to new highs targeting 32.

Austria ETF (NYSEARCA:EWO) has traded within a compressing range for 6 years. If it breaks higher here, a measured move would target ~25.

Philippines ETF (NYSEARCA:EPHE) has traded in a large range since early 2013. When it breaks, it’ll likely determine the next multi year trend targeting 15 or 55.

Turkey ETF (NYSEARCA:TUR) is trading within a long time falling wedge. While it’s not your classic, buy for a quick pop short term setup, it’s an interesting formation none the less.

Brazil’s major index (Bovespa) has compressed in this range for nearly 9 years. Can it break higher now? If so it could see a move to 110,000.

There are always opportunities in the markets. Why? Because things are always happening underneath the surface, out of the public eye.

Never get discouraged when your trading is struggling, because if you keep working, your next big opportunity is right around the corner.

You can read more on my blog. Thanks for reading and trade ’em well!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.