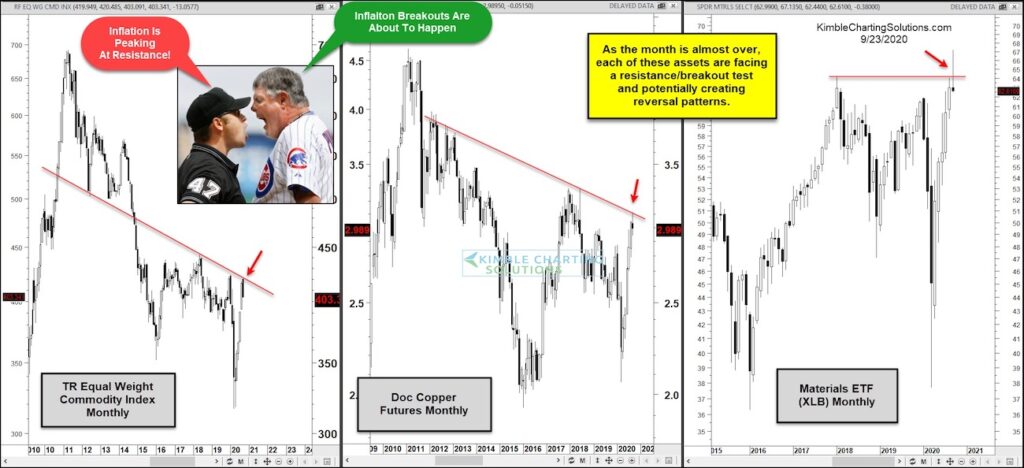

Commodity Index vs Copper Futures vs Materials Sector “Monthly” Charts

Inflation has long been a word that the Federal Reserve uses but the general markets have forgotten about.

Why? Well because it’s been virtually non-existent for years. Key indicators like commodities (i.e. copper) have been in a down-trends and the Materials Sector (XLB) has lagged… until this year.

In today’s chart 3-pack, we take a look at the Equal Weight Commodity Index, Copper Futures, and the Materials Sector to highlight why inflation could come back to the forefront once again!

As you can see, commodities have been making a comeback this year and are testing an important down-trend line. Copper futures have also rallied and are testing its own down-trend line. And Materials have risen to make new highs but have yet to close above it prior highs (so also testing important resistance).

Taken together, this is a big test to see if inflation is peaking or about to end long-term bearish trends. Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.