The popular stock market averages enjoyed the best start in 14 years with the S&P 500 and Dow Jones Industrials gaining 2.6% and 2.3%, respectively, last week. And the stock market rally has continued into this week (thus far).

The rally triggered a buy signal from the widely followed January barometer, which claims that as January goes, so goes the year. Since 1950, when the S&P 500 Index has recorded strong gains in the first week of the New Year, the period from February to December has shown gains averaging 12%.

The weight of the technical evidence supports the argument that the path of least resistance is to the upside.

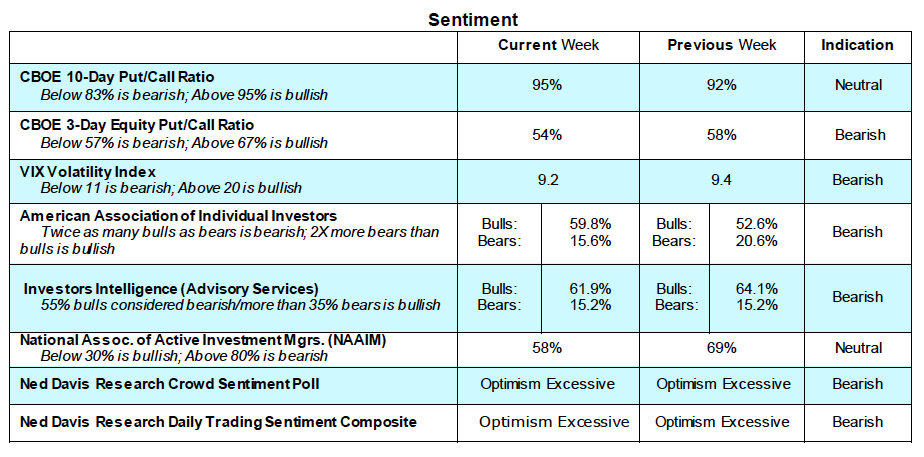

The current rally remains broad based with 80% of the S&P 500 stocks trading above their 50- and 200-day moving averages. Additionally, more than 80% of the industry groups within the S&P 500 are in decided uptrends and small-cap and mid-cap joined the large-cap indices in recording record highs last week. Stocks will also enjoy a seasonal tailwind that stretches into April. Our largest near-term concern is that investor optimism has reached levels that historically represent a headwind for stocks. The latest survey by the American Association of Individual Investors (AAII) shows nearly 60% bulls, which is the highest reading since 2010. The bears in the survey plunged to 15%, the lowest since 2014. In recent years, the AAII data has consistently shown the public fighting the bull market. Although the sentiment numbers are disconcerting the fact that the broad market is strong along with positive economic fundamentals to support earnings suggests that pullbacks will be limited in time and price.

The strongest sectors in terms of relative strength include the financials that are expected to benefit from wider spreads and increased loan demand, materials which are benefiting from rising commodity prices, and consumer discretionary that is benefiting from lower corporate taxes and expanding discretionary income among their clients.

Global Economy

One of the bullish surprises in 2017 was the synchronized strength of the global economy. This is important long term because bull markets are historically global in nature. Since 2009, the U.S. economy has outpaced the world economy. This abruptly changed in 2017 with confidence spreading from the U.S. to most of the important economic centers around the world. Prior to 2016, the U.S. was the only economic engine outside of China generating more than 2.00% GDP growth. Markets around the world have followed the economic reports that have surprised on the upside since mid-2016.

Most important, is that growth overseas is broad based with 90% of the world economies in expansion modes. Europe witnessed expanding activity for the eighth straight month in December, the longest winning streak in 15 years with emerging markets showing the best growth since 2012. Most forward-looking indicators suggest that the global economic expansion will continue in 2018. We think some equity exposure to the strongest growth areas including Europe and emerging markets is smart.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.