Euro: Euro-area consumer prices rose an annual 0.4 percent in January, after rising 0.2 percent last month. This was the biggest increase since October 2014.

That said, the five-year, five-year forward inflation-swap rate is at its lowest since January last year. In the meantime, in Germany the Ifo Institute’s business-climate index fell for a second month in January.

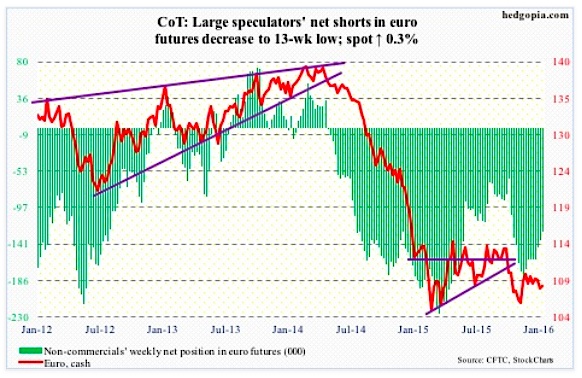

Mixed signals, and the Euro reflects that.

On December 3rd, the Euro rallied 3.1 percent, rising intra-day to 109.80. Markets decided Mario Draghi, ECB president, failed to live up to expectations of dovish action/message. Since then, that high, besides a brief breach, has held the Euro back. The BoJ move was no help on Friday, with the currency losing one percent.

Non-commercials continue to cut back net shorts – now at a 13-week low.

January 29 Commitment of Traders Report: Currently net short 127.2k, down 9.8k.

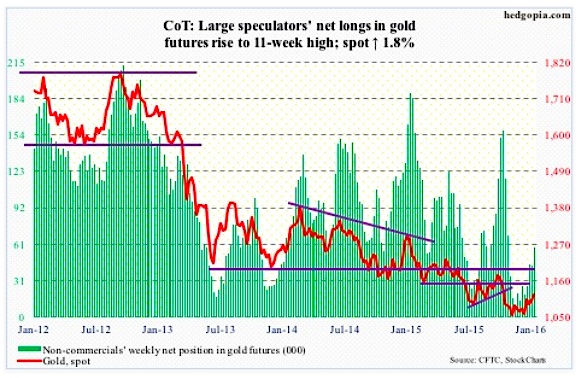

Gold: The metal finally saw some bidding – up 1.8 percent for the week.

The rally off of the 50-day moving average since the middle of the month brought spot gold prices to the upper Bollinger Band, as well as to just under the 200-day moving average. Daily conditions for gold are overbought. This could be a perfect spot for gold to digest the recent gains.

On the way down, 1,080 is a must-hold… which, by the way, also approximates the 50-DMA, which is now curling up.

January 29 Commitment of Traders Report: Currently net long 59k, up 15.3k.

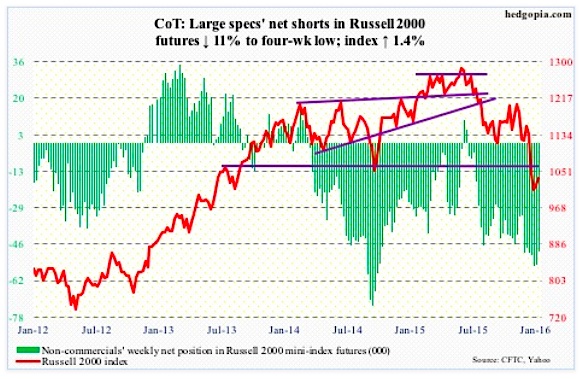

Russell 2000 mini-Index: In the week ended Thursday, $1.4 billion moved into the iShares Russell 2000 ETF (IWM) – courtesy of ETF.com.

As is the case with the Nasdaq 100, damage repair is in progress. As things stand, the best stock bulls can hope for is a move toward 1080.

Two weeks ago, non-commercials had the highest net longs since October 2014. Per the January Commitment of Traders report, hey have since cut those down by 11 percent now. If bulls can get their act together, there is room for squeeze in small caps stocks.

January 29 Commitment of Traders Report: Currently net short 48.7k, down 6.1k.

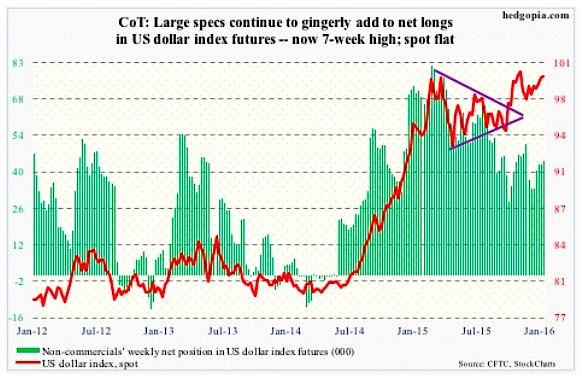

US Dollar Index: In March and November last year, the US dollar Index rallied just north of 100, only to retreat. This level is now important technically.

Prior to the BoJ action, the index looked to be wanting to go lower, with the 50-day moving average pointing lower and weekly momentum indicators weakening.

Friday, on the coattails of the BoJ action, the dollar index rallied one percent, but still not enough to push the US Dollar Index past the afore-mentioned resistance.

Once again, judging by non-commercials’ holdings, no breakout is imminent. They have been grudgingly adding to net longs the past five weeks… holdings pale in comparison to what they had leading to the March high last year.

January 29 Commitment of Traders Report: Currently net long 44.2k, up 1.5k.

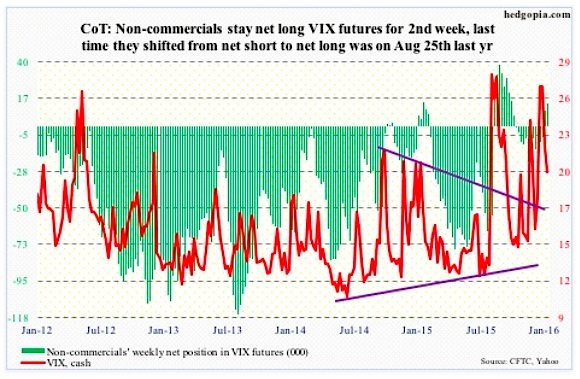

VIX Volatility Index: Non-commercials went net long last week for the first time since August 25th. This week, they added.

If past is prelude, non-commercials shifting from net short to net long coincides with a peak in the spot Volatility Index. So far, this is precisely how things have unfolded.

If there is a spot for volatility bulls to put their foot down, this is it. The spot (20.20) is sitting at support, which also approximates its 50-day moving average.

January 29 Commitment of Traders Report: Currently net long 14.2k, up 4.7k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.