For weeks now, we have waited for the Russell 2000 Index INDEXRUSSELL: RUT to show signs of strength.

With the S&P 500, NASDAQ 100 and the Dow Industrials making yet another new all-time high, the Russell 2000 Index just looks so tired.

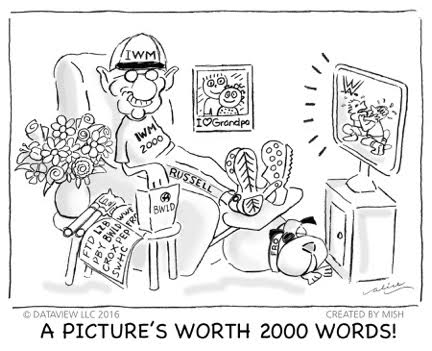

Today, the Russell 2000 ETF (IWM) picked up a bit and outperformed the other index ETFs percentage-wise.

Perhaps IWM found inspiration from the Biotechnology Sector ETF (IBB) one of his kin, as IBB rose 2%.

Nevertheless, IWM has yet to clear last week’s high at 159.88.

Then, the 11/08 high 160.46 looms over that level as resistance.

Given the weakness in Gramps’ partner, the brick and mortar Retail Sector ETF (XRT), can we get the Russell 2000 out of his Laz-Y-Boy chair?

By the end of the session, IWM gave up a lot of its earlier gains.

At the same time, the Transportation Sector ETF (IYT), did not do very much of anything. However, IYT seems to love the 195 level these days.

XRT got smacked from the impact of poor retail earnings. Yet, XRT remains in a bullish phase.

With Black Friday nearly here, I believe that measure of consumer sentiment will be extremely telling.

Yesterday, I wrote about junk bonds as one indicator to measure investors’ appetite for risk. Today, JNK closed in the red, but not below the support at 107.00.

So, game still on for now.

S&P 500 (SPY) 309.60 support. All-time high 312.698.

Russell 2000 (IWM) 155-156 Key support. 157.75 Pivotal. 160.46 resistance.

Dow Jones Industrials (DIA) A new all-time high at 280.84. 278.00 now nearest support.

Nasdaq (QQQ) All-time highs at 203.84. 201.65 support.

KRE (Regional Banks) A move under 55.40 should bring in more selling. 57.52 next resistance to clear.

SMH (Semiconductors) 135.26 all-time high. Breakaway gap intact if holds 130. Interim support at 133.25

IYT (Transportation) 195 pivotal 194 some support and must clear 200.42

IBB (Biotechnology) 108.75 support. 115 major resistance.

XRT (Retail) 42.95-43.05 key support.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.