Given the volatile trading range on S&P 500 index futures to start the week, investors should trade with care.

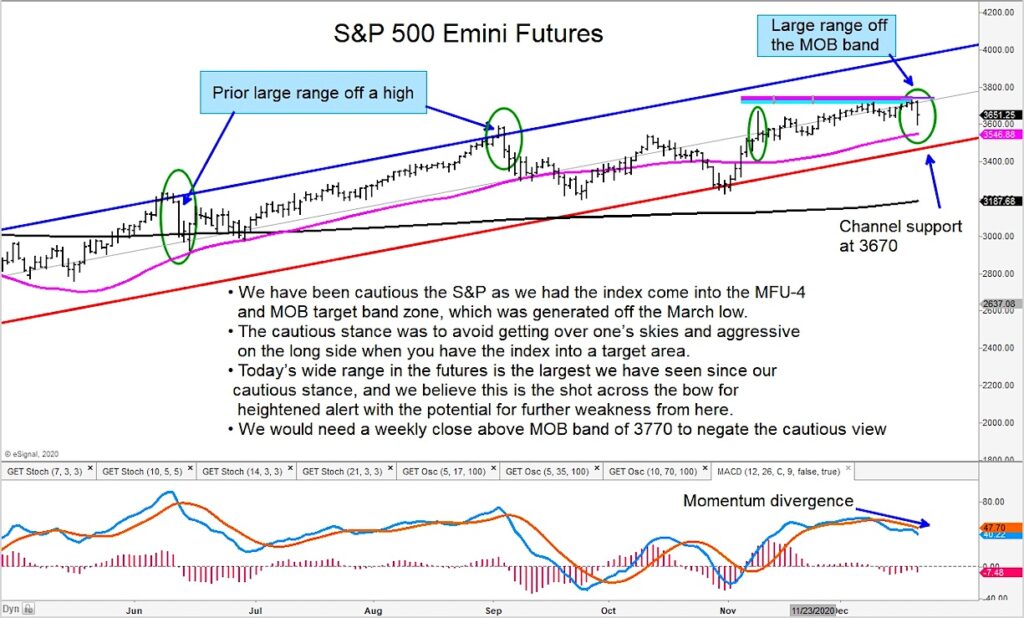

I have been cautious the S&P 500 index since it traded into its MFU-4 (money flow unit) price target zone.

This stance was to avoid getting caught too long in a stretched market. That’s the purpose of our MFU targets.

The wide trading range and up-tick in volatility could very well be a shot across the bow and heightened alert to investors of further weakness to come.

Only a weekly close above 3770 would negate my cautious view. Trade safe.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.