We can see 14.4% annual domestic subscriber growth and just 3.6% quarter-over-quarter. That means growth is going to have to come from the upcoming international expansion, and that has enormous risk.

RISK

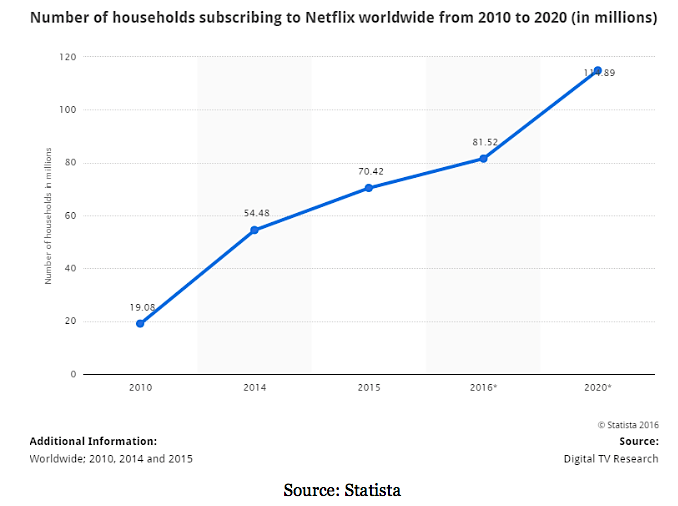

We will see great growth internationally for the next few quarters, but make no mistake, Netflix may be going through the largest pivot any large cap tech firm has gone through in a decade and the implications are huge for the company and Netflix stock price. First, here are the forecasts for total Netflix subscribers (worldwide).

The jump from 70 million in 2015 to 115 million by 2020 is coming almost exclusively from international expansion.

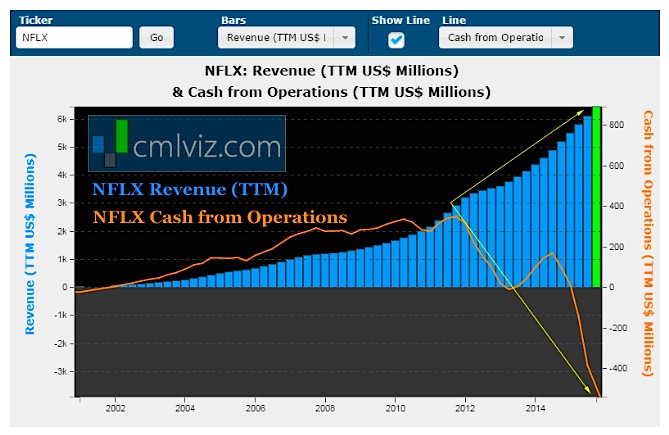

The company is going to need a billion dollars a year for the next couple of years to reach its expansion goals internationally. Netflix is betting the house on this expansion. Look what happens to that revenue chart when we add cash from operations in the orange line:

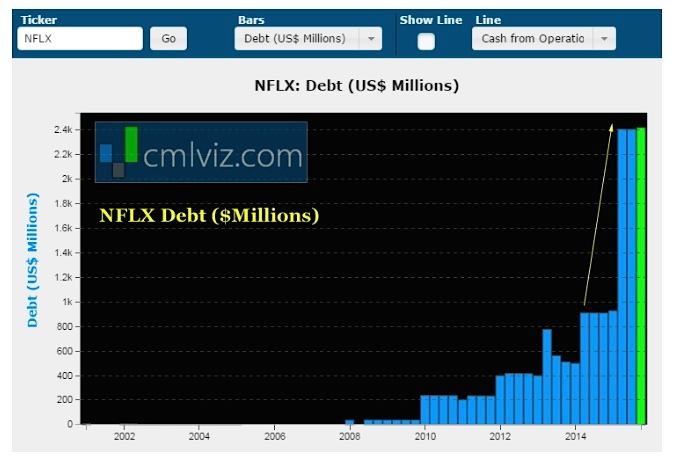

The incredible divergence between revenue and cash from operations means Netflix is going to have to go to the market for some more debt. Here’s how that trend looks as of today, and CEO Hastings clearly said that Netflix may have to go out and borrow more.

Debt now sits over $2.4 billion and should rise well over $3.5 billion in the near-term.

THE STAKES

Netflix is attempting to be the only global all-in-one content provider this planet has ever seen, and whether valuations feel stretched or not, a $35 billion market cap pales in comparison to what this company would be worth if successful. Yes, I’m saying that Netflix stock price today is low if Netflix is successful.

But, that is a big “if.”

All of the focus should be on the success of this incredible expansion and ambitious endeavor. The revenue streams Netflix will produce from higher subscribers will be substantially expanded with revenue from original content licensing and syndication. And this could benefit Netflix stock.

If you enjoy understanding what’s really going on in a company beyond the headline noise, sign up for CMLViz email updates?

WHY THIS MATTERS

If any of the information we just uncovered feels like a surprise, in many ways it is. These charts, data and trends are known by analysts that represent the wealthiest 1% but they have no interest in sharing.

Back to the original question: Is Now Time to Buy Netflix? We answer that question specifically in CML Pro as well for the other ‘Top Picks’ that are breaking down the doors of artificial intelligence, the Internet of Things, Cyber Security, driverless-car technology and many more themes. Thanks for reading

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

Author has a position in NFLX. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.