The stock market climbed well off its lows last week after Washington passed a massive government relief package for individuals, small and mid-size companies, distressed industries, health care entities as well as state and local governments.

The Federal Reserve promised a “whatever it takes” initiative with unlimited intervention to keep credit flowing with assurances that they have other tools and will be ready if more is needed.

There was also talk of re-opening segments of the U.S. economy where, based on scientific data, the spread of the coronavirus is low.

The Defense Production Act was invoked over the weekend to expand our industrial base to make sure the components we need to make medical equipment are available.

Companies such as General Electric, Ford and General Motors have been mandated to make health care equipment like masks and ventilators as well as hand sanitizer to fight the coronavirus. The whole of government as well as private and public companies (large and small) and American citizens are going all-in to beat this virus.

An economic rebound and stock market recovery hinge on the health care industry’s efforts to contain the spread of the coronavirus and on the economic policy response.

Our Baird Biotech Senior Analyst Brian Skorney is looking at Italy as a leading indicator which suggests to him that the worst for us is probably two to four weeks away in terms of deaths over a 24-hour period. However, he is watching the situation in Florida and in New Orleans to see if the outbreaks can be contained. If these regions explode, then that would extend the peak increases into early to mid-May.

The good news is that social distancing and the massive testing (to help identify those with the disease and separate them from healthy populations) appears to be working. Our government is studying successful strategies from S. Korea, Taiwan and Singapore where they use outside videos, GPS from cars and phones and credit card history to track the virus. Those countries never had to shut down their economies. There is also a lot of optimism in terms of the hundreds of clinical trials and antiviral drugs that are being studied to help combat this virus.

If the growth of this virus slows in the April/May time frame, then along with the massive amount of fiscal and monetary stimulus being injected into the system, we can expect the economy will begin to stabilize by late in the third quarter and start to gradually grow.

U.S. Treasury Secretary Mnuchin continues to expect to see GDP rebound in the fourth quarter of this year or the first quarter of 2021. The virus does not have to be fully eradicated for the economy to get back on track. Once the virus cases have peaked, investors will begin to feel more confident and economic activity can resume.

If it takes longer to lessen the spread of this virus, then we are looking at a more challenging economic environment.

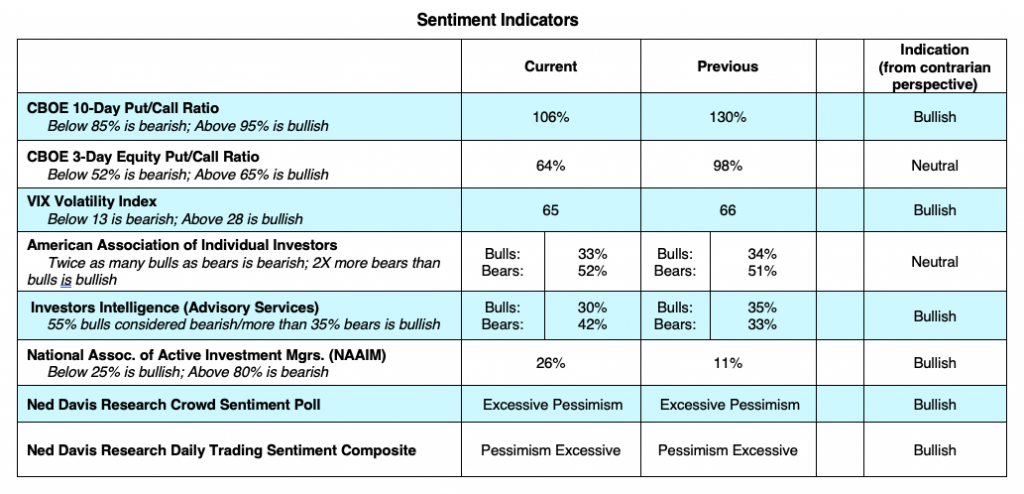

Technically, there are signs of a bottoming process in the markets with a reduction of stocks making new 52-week lows and evidence of building pessimism (a contrarian indicator). But overall, the technical indicators remain bearish. The major stock market averages are still trading below their moving averages.

Last Wednesday the stock market saw upside volume exceed downside volume by a ratio of more than 10 to 1. We will need to see a couple more days of this kind of upside volume confirmed by 90% of S&P stocks trading above their 50-day moving average to say that the decline has run its course and an upward trend has been established. A broad market upswing is not yet evident.

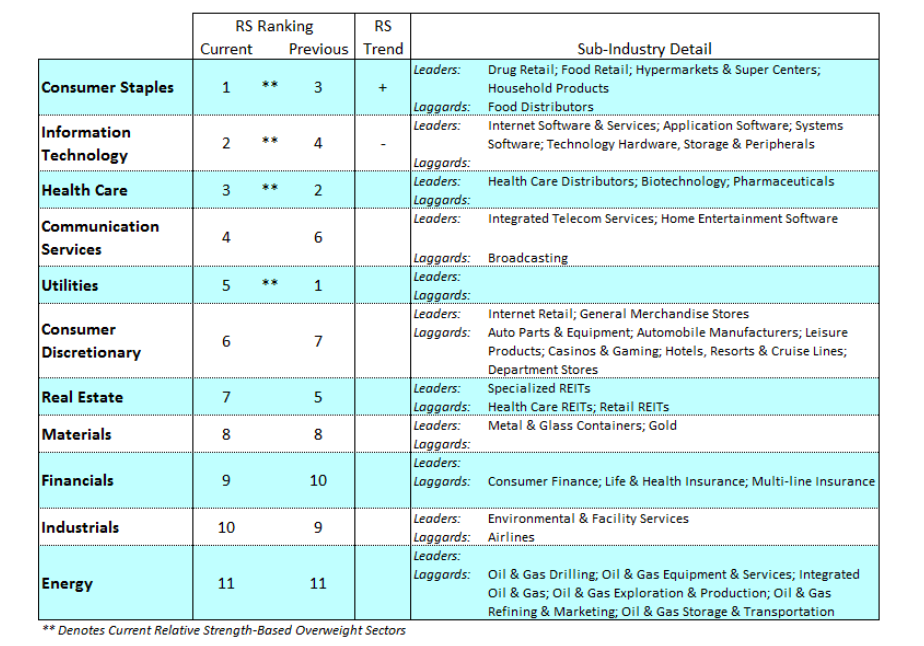

Investors may want to rebalance their portfolios on rallies to stay in line with their risk tolerance and goals. The defensive sectors of health care, consumer staples and utilities have traditionally outperformed the averages during times of stock market stress. Utilities was the best performing sector last week, increasing 17%. Warren Pierson, Senior Portfolio Manager at Baird, sees pretty compelling value in fixed income investment grade spread sectors on the short end of the yield curve.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.