Discount retailers tanked on Thursday morning, with Dollar General (DG) down -7% and Dollar Tree (DLTR) down -12%, after reporting earnings that missed Wall Street expectations.

Dollar General reported earnings per share of $1.36 and total revenue of $6.11 billion, compared to analyst expectations of $1.40 and 6.18 billion. Same store sales grew by 2.1%, below the 3.1% average estimate.

DG provided guidance for this fiscal year of $5.95 to $6.15, compared to the average analyst estimate of $6.06. Management blamed weather for this quarter’s performance shortfall.

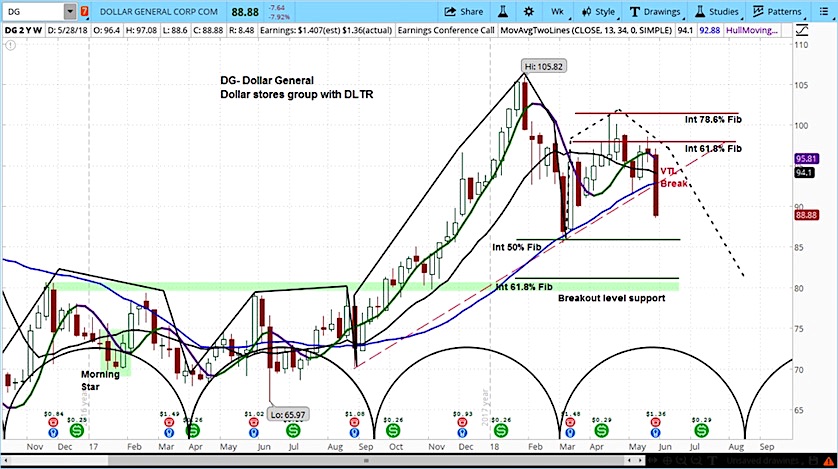

In analyzing the market cycles on the DG chart, we can see that the stock is in the middle of its current market cycle.

Our analysis is that it has now begun the declining phase for this cycle, but there may some chopping around first.

Nonetheless, our target by August of this year is $81.

Dollar General (DG) Stock Chart with Weekly Bars

Dollar Tree reported earnings per share of $1.19 and total revenue of $5.55 billion, compared to analyst expectations of $1.23 and $5.56 billion. Same store sales grew by 1.4%, below the 2.6% average estimate.

DLTR lowered guidance for this fiscal year to $4.80 to $5.10, compared to its previous estimate of $5.25 to $5.60. Management also blamed weather for its performance.

The Dollar Tree chart is much worse that of DG. This is no surprise as DLTR has been on our “Riskiest for 2018” list. While this stock is also trading in the middle of the current market cycle, it has broken the low from which it began the cycle. This is a negative indicator that puts it firmly in the declining phase of this cycle. Our target for the July-August time frame is $77.

For an introduction to cycle analysis, check out our Stock Market Cycles.

Dollar Tree (DLTR) Stock Chart with Weekly Bars

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.