The equity markets jump-started 2017 with strong gains in first week of January. The Dow Jones Industrials (INDEXDJX:.DJI) gained 1.00% while the S&P 500 Index (INDEXSP:.INX) and NASDAQ Composite (INDEXNASDAQ:.IXIC) outperformed and set new all-time highs.

Stocks continue to benefit from the incoming pro-business administration’s position on lower corporate taxes and infrastructure spending that will likely boost earnings and raise GDP.

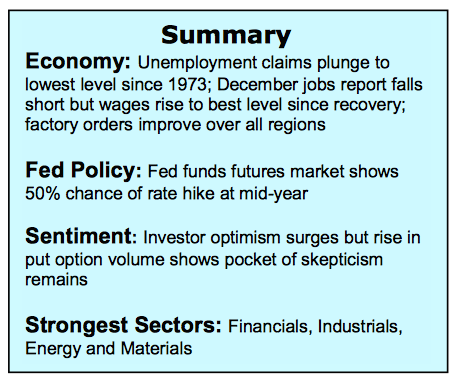

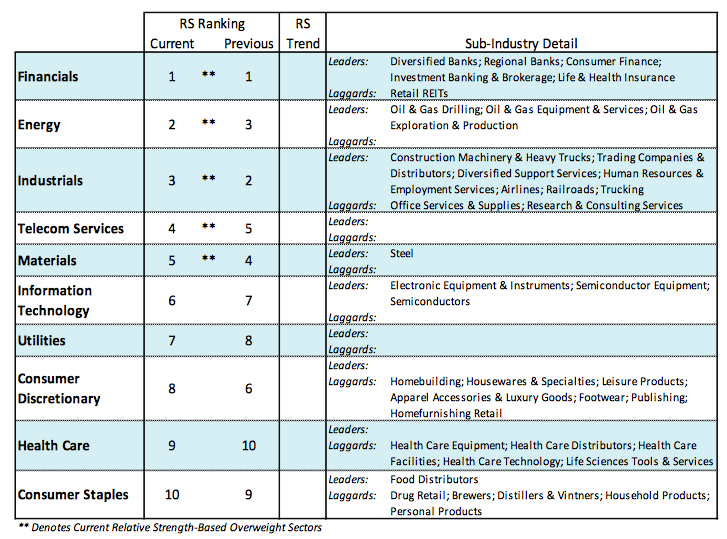

The latest ISM data on manufacturing and the service sector points to improving growth trends. In addition, the global manufacturing PMI climbed in December to its highest level since February 2014. The December jobs report included a significant jump in hourly earnings raising the year-over-year change to the strongest since 2009. The focus this week will be on fourth-quarter earnings reports. Consensus estimates are that S&P 500 earnings climbed 3.2% for the period, up from 3.1% in the third quarter. Estimates are that S&P 500 earnings will climb 12% in 2017. Intermediate term, the breakout by the popular averages from a two-year consolidation phase in the fourth quarter is expected to continue in 2017. Leadership is being supplied by the financial, industrial and material sectors that historically outperform in an improving economic and earnings environment.

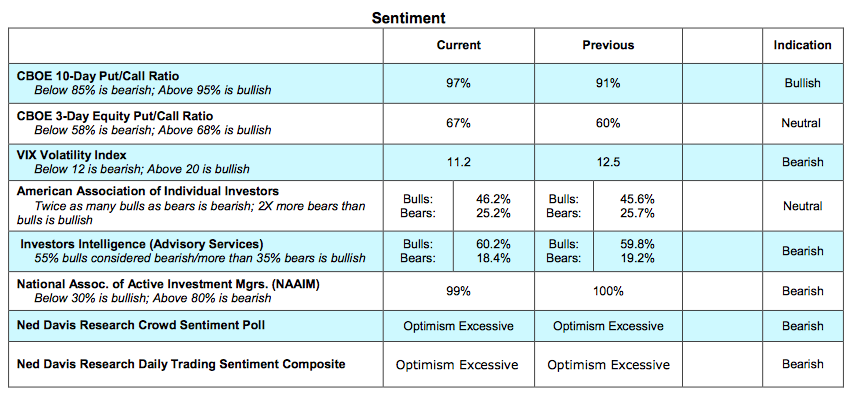

The technical backdrop on balance indicates that the path of least resistance remains to the upside as we move deeper into the first quarter. Our largest concern is the fact that investor psychology has moved from caution/skepticism before the election to excessive optimism in early 2017. Using contrary opinion, this would suggest that the stock market is vulnerable to a near-term pause or modest correction.

The NASDAQ and S&P 500 hit new record highs last week but more stocks were down than up on those record-setting sessions. This also suggests the current rally is extended and susceptible to a pullback.

The turnaround in sentiment is seen in the latest data from Investors Intelligence that shows the most bulls since the middle of 2015. The most recent Wells Fargo Gallup survey shows investors the most optimistic in nine years. The newly discovered euphoria is not limited to Wall Street but has carried over to Main Street. The Conference Board Report shows consumer confidence at its highest level since 2001. While this is bullish for the economy, stocks have tended to underperform when consumer expectations were elevated. Although sentiment could represent a headwind for stocks near term, this is counter-balanced by the strong performance of the broad market. Thus, any weakness that does develop is expected to be limited in time and price.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.