Let’s face it: There is a lot of political turmoil in the United States right now. And this has left investors uncertain for the better part of 2017.

But one thing that is certain is that stocks have ignored investors concerns thus far in 2017. The S&P 500 Index (INDEXSP:.INX) is up 12 percent YTD.

Let’s review some of these investor concerns.

It all started when candidate Donald Trump decided to enter the race for President of the United States of America. All elections seem rancorous nowadays, but the one in 2016 was particularly disruptive. His presidency has exposed and sharpened the deep political divides in this great nation. That makes investors nervous.

Those that expected him to moderate his ways and tone after winning the election have been disappointed. He is the first President to openly battle against what he considers the left-wing establishment and ‘fake news’. He uses Twitter in an attempt to communicate his thoughts directly to the American people, but his unfiltered ‘style’ is often rancorous and hard to stomach even by those that support him! The Trump political circus is bound to cause concern for investors because we never know what will happen next. That makes investors nervous.

It is common to factor in political events (changes in regulations, taxes, healthcare, etc.) in our investing theses and/or narratives. That is harder to do with this current administration because there seems to be a lack of continuity. That makes investors nervous.

Then there is the situation where the Republican Party seems to be unable to pass legislation even though they ‘control’ Congress. How many times have we been ‘reassured’ by Speaker Ryan that they have a plan for tax reform; they have a plan for repealing and a plan for replacing Obamacare, etc. Yet when the votes are tallied the Republicans fail. That makes investors nervous.

Now we see President Trump moving to the left and making deals with top Democrats in order to try to get movement on tax reform, healthcare, DACA, border security and the budget ceiling. That makes investors nervous.

Apart from the political storms, we have also witnessed the devastation of Houston by hurricane Harvey followed days later by Irma in Florida followed days by Maria. Tens of millions of people have lost their homes amidst the devastation. It will take years for them to recover physically, financially and emotionally. Our hearts and prayers go out to all of them, but that makes investors nervous.

Then there is the geo-political upheaval as Kim Jong-un (the Chairman of the Workers’ Party of Korea and supreme leader of the Democratic People’s Republic of Korea) threatens to devastate South Korea, Japan, Guam and even the mainland of the United States of America. We hear on the evening news that they just successfully tested a thermal nuclear device and that they now have intercontinental ballistic missiles that can reach North America. Understandably, that makes investors nervous!

There are a lot of things to fear in the world right now. And based on the long list of concerns I just detailed you might think that the US stock market might be down 10-15%, but that’s not the case. As I mentioned, the S&P 500 (NYSEARCA:SPY) is at all-time highs, up 12 percent on the year.

How can the US stock markets be doing so well when there are so many things to be worried about? To quote James Carville: “It’s the economy, stupid.” There are a lot of investors that have missed this 10-month-and-counting rally because they have focused on all the things that I mentioned above.

As a professional money manager, I have learned the hard way that I need to focus my research on economic data instead of some pundit’s opinion. And over the last nine months the economic data has indicated that the underlying economy has been strong. Gross domestic product (the goods and service of a nation) has been growing. In other words, U.S. businesses are doing well and their quarterly earnings and profits reflect that growth.

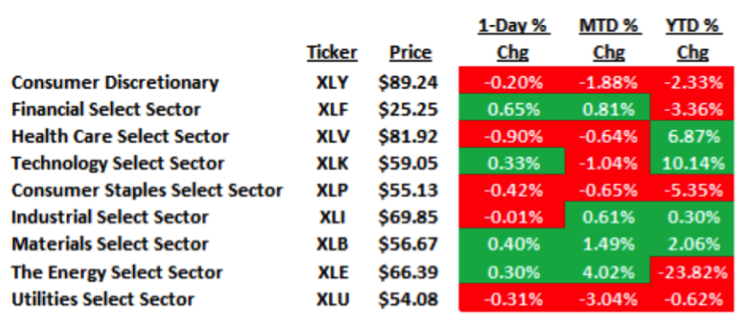

That doesn’t mean you can buy just anything. As you can see in the graphic below, there are certain sectors of the economy that are doing better and some that are doing worse. For instance, technology is up over 10%; healthcare almost 7%. Yet the Energy Sector is down 23%, Consumer Staples are down over 5% and even the financial sector is negative for the year.

In this type of environment technology stocks do very well because of their operating leverage. As a sector there are up 10% but the individual technology stocks are crushing the sector returns. Take a look at some of the largest technology firms in this list below and their year-to-date returns.

YTD Returns:

Facebook (FB): 48.73%

Amazon (AMZN): 25.44%

Apple (AAPL): 43.44%

Google (GOOGL): 48.72%

The NASDAQ 100 (NASDAQ:QQQ) is up 21.61% YTD.

Is it too late to get in?

That really depends on your situation and your risk tolerance. The data and research that I rely on indicates that the economy will continue to grow in the fourth quarter and likely in the first and second quarter of 2018. The prior-year comparisons for the first and second quarter of 2017 mean that it will be harder to show growth. That assumes that there aren’t any changes to taxes and incentives. If there is tax reform then I would expect that to increase economic growth, but it all comes down to the data.

For retired investors who have been on the sidelines I would not recommend investing 100% into equities all at once. Instead, I would suggest moving money into the markets on pullbacks in smaller increments based on your risk appetite and your ability to absorb normal fluctuation going forward.

Twitter: @JeffVoudrie

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.