S&P 500: The Path of Least Resistance Remains Higher

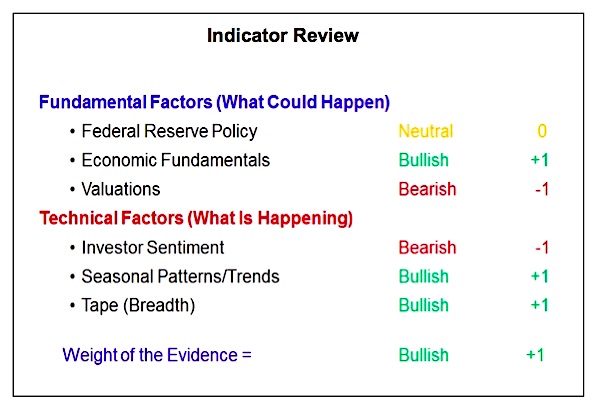

The weight of the evidence suggests that the benefit of the doubt remains with the bullish case. This does not mean that the way forward will necessarily be smooth, but for now the path of least resistance remains higher.

Stocks have been strong to begin 2017 and this strength has been accompanied by a remarkable lack of volatility. The S&P 500 (INDEXSP:.INX) has made a string of new all-time highs (as we will discuss when we turn to a look at breadth, it has not been alone in venturing into record territory), but has not seen 1% intraday move in either direction since early December, the second longest such stretch in the past 20 years. It would be surprising if this persisted, but an uptick in volatility and even a modest pullback in price would likely not signal an end to the cyclical rally that is just over one year old.

Highlights:

- Fed Looks To Increase Pace of Tightening

- Global Economy Showing Signs Of Life

- Valuations Elevated, But Earnings Growth Returns

- S&P 500 Has Lots Of Company In Record Territory

Not only does the rally enjoy broad support and improving momentum, but it has the tailwind of improving economic fundamentals. The U.S. (and global) economy appears to be improving, and the pace and likely sustainability of the improvement has caught many off guard. Fundamental improvement is critical at this juncture because stock prices have gotten ahead of corporate earnings to a degree that makes valuations a primary risk to stocks at current levels.

Economic Outlook

The Federal Reserve is likely to accelerate the pace of interest rate hikes in 2017, but elevated uncertainty surrounding economic policy could help restrain the rise bond yields and offset some of the excessive optimism that has emerged in the investor sentiment data.

Federal Reserve policy is still neutral. Published projections by the Federal Reserve suggest that after 25 basis points of tightening in both 2015 and 2016, 2017 could see a total of 75 basis points of tightening. The first 25 basis point of tightening this year could come as early as the March FOMC meeting. While a March rate hike may not yet be fully priced in, Fed speakers are doing their best prepare the market for a more assertive pace of tightening. While bond yields have moved higher over the past six months, they remain low by historical standards. The biggest near-term risk for the economy may be that bond yields move too high too fast. So far that has not been the case. Confidence that the Fed will not get behind the curve, and continued policy uncertainty out of Washington DC could help restrain the rise in yields.

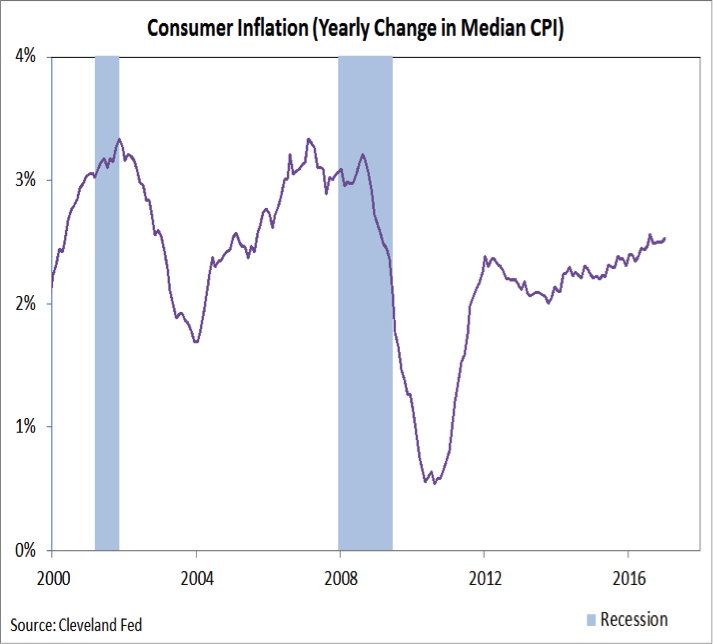

For much of the recovery, the Fed has had flexibility to focus predominantly on maximizing employment because inflation pressures have been close to non-existent. That is no longer the case. The yearly change in the median CPI (a better gauge of future inflation trends than either the overall CPI or the core CPI, which excludes food and energy prices) has drifted higher over the past year. While we do not expect inflation to runaway to the upside, the Fed will nonetheless have to spend more time focusing on this aspect of its dual mandate. An increased pace of interest rate hikes by the Fed also sends an important message of confidence in the economy, and that psychological tailwind could help offset any headwinds stemming from higher interest rates.

Economic Fundamentals are bullish. This view is not built on the hopes of future action by political leaders in Washington DC but on accumulating evidence that a global rebound in growth is emerging. The surge in economic optimism that came in late-2016 has not only been sustained, but data on actual activity has been improving as well. The pace of real improvement occurring in the economy has caught many investors off guard.

The early focus has been on increased economic optimism. The NFIB Index of Small Business Optimism has not just ticked higher; it has surged to a degree not seen since the early 1980’s. Long-dormant ‘Animal Spirits’ appear to have been awakened at a time when growth was already finding its footing. Regional manufacturing surveys show that this more hopeful feeling is been realized in increased activity.

Improving growth trends are not just a U.S phenomenon. Growth around the world is improving, with an increasing share of Purchasing Managers’ Indexes showing an expansion in economic activity (i.e. a reading above 50).

While prospective tax and regulatory reform could be an additional tailwind for the economic recovery, recent data trends suggest a meaningful upswing in economic growth has already begun to emerge. After more than a decade of consistently sub-par growth, it is not surprising that expectations have been slow to adjust. History may well show that 2016 represented a secular shift in favor of a sustained higher trend in economic growth.

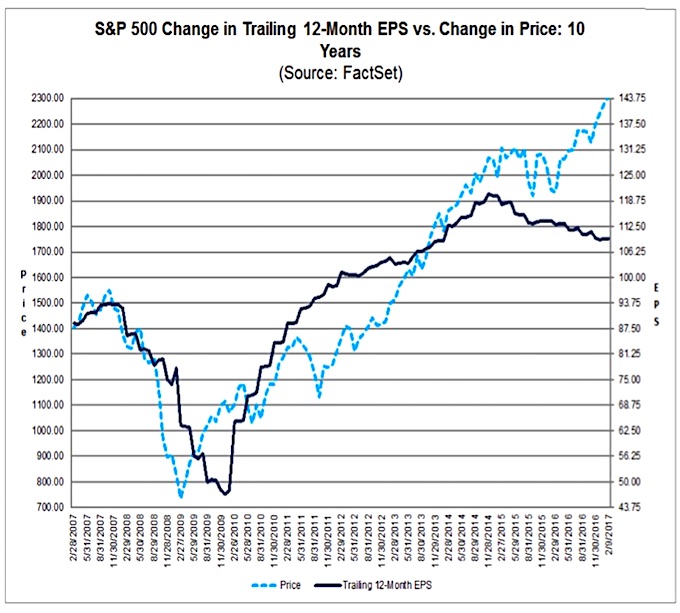

Stock Market Valuations

Valuations remain bearish. An upswing in economic growth is coming at a critical juncture. Stock market earnings peaked in 2014 and have fallen by 10% since then. During that time period stock prices have rallied by more than 10%. This divergence between prices and earnings has produced stretched valuation levels. If the stock market gains seen in late-2016 and early-2017 are going to persist, corporate sales and earnings growth is likely a necessity, not a luxury. The good news is that earnings have begun to rebound. Earnings growth returned in the third quarter of 2016 and accelerated in the fourth quarter. While we remain skeptical of forecasts, we will nonetheless watch the pattern of earnings estimates for 2017. If they can break the recent pattern of moving steadily lower over the course of the year, it may indicate welcome shift in market fundamentals.

continue reading on the next page…