Inspire Medical Systems (INSP) Company Overview

Inspire Medical Systems (NYSE:INSP) is an $893M maker of innovative and minimally invasive solutions for patients with obstructive sleep apnea (OSA).

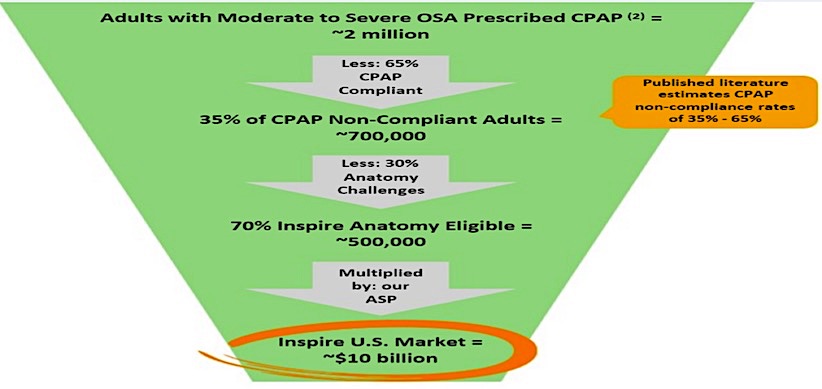

INSP is targeting a $10B market opportunity with an alternative for the estimated 35-65% of non-CPAP compliant patients.

OSA is a serious condition that can result in higher risk of stroke, cardiac death, and other issues, often going un-diagnosed. The main treatment in the past has been via a CPAP device which is uncomfortable and has limitations, so INSP’s option has a major advantage through innovation.

Sleep apnea impacts 100M people worldwide and estimated 17M individuals in the US with moderate to severe OSA. The INSP producer takes approximately 2 hours as an outpatient producer with three small incisions, and the patient controls the system.

Inspire Medical System’s Phase 3 STAR Trial showed significant reductions in AHI & ODI for sleep apnea patients, overall very impressive results delivering 80% reduction in sleep apnea events per hour and patients showing strong support for the product with 80% using nightly after 5 years.

Image above from company presentation.

Inspire Medical Systems Fundamentals

INSP shares currently trades 18X EV/Sales FY19 with 46% topline growth seen in 2018 and 34.7% growth forecasted for 2019. INSP has seen gross margins improve from 64.9% in 2015 to 78.9% in 2017 and Q4 revenues of $10M jumped substantially from the prior quarter’s $7.3M. INSP is implementing its growth strategy in the US where there is substantial upside markets to capture but also has longer term potential to penetrate international markets deeper. Note statistics source: Sentieo.

Aetna recently granted coverage for its 22M members, a big commercial win validating INSP products, and INSP likely wins more commercial coverage this year. A potential upcoming catalyst in September is the American Medical Association Meeting that will review temporary physician payment code for implantation of the sensing lead, and a positive recommendation could allow for a $500-$600 increase to what doctors make for the INSP procedure.

In closing, INSP has a procedure that will disrupt a $10B market and its threat to Res-Med (RMD) market dominance in CPAP could make it an attractive buyout target. Even without a buyout, the potential for INSP to eventually be a $1B/year in sales company is not too far-fetched, so at this market cap, a name to own for the next 5-7 years.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.