Over the years I have seen investors make a number of mistakes with their income portfolios. Typically these range from having too much cash to being over allocated to a single asset class. However, the most egregious error that I come across all too frequently is the use of aggregate bond ETFs and funds as core fixed-income holdings.

Over the years I have seen investors make a number of mistakes with their income portfolios. Typically these range from having too much cash to being over allocated to a single asset class. However, the most egregious error that I come across all too frequently is the use of aggregate bond ETFs and funds as core fixed-income holdings.

Two of the largest aggregate bond ETFs in this arena are the iShares Core U.S. Total Bond ETF (AGG) and the Vanguard Total Bond Market ETF (BND). Both of these funds take a similar tact of investing in a broad array of treasury, corporate, mortgage, and government agency securities as a representation of a taxable bond portfolio.

The only benefit I can see to these ETFs is the underlying holdings are broadly diversified and can provide a counterweight to equities in the context of an asset allocation strategy. However, the biggest drawback is they are heavily overweight treasuries and mortgages in intermediate and long durations. This means the funds are hindered by low yields and great sensitivity to interest rate fluctuations.

In my opinion, fixed-income investors should be eschewing these aging aggregate bond dinosaurs for multi-sector or strategic income funds. This style of fund is typically designed with a “go anywhere, do anything” approach which allows the portfolio manager flexibility to select undervalued areas of the market. This in turn can produce excellent yield or capital appreciation potential above traditional aggregate bond ETFs and/or sector-specific funds.

One such ETF that was released last year is the Riverfront Strategic Income Fund (RIGS) which has the ability to actively shift its portfolio among numerous sectors with an emphasis on total return. Currently the portfolio is weighted towards short-term high yield debt which has continued to perform quite well. Over the last six months, RIGS has gained 3.51% versus 1.73% for AGG.

It will be interesting to keep track of this relatively new ETF and how the manager shifts the portfolio in relation to their security selection methodology and rising rate concerns. Currently the net expense ratio for RIGS is listed at a very reasonable 0.22% as well.

Even passive ETF experts like Blackrock realize the need for more creative fixed-income solutions, which is why they recently released the iShares Yield Optimized Bond ETF (BYLD). This ETF is a “fund of funds” that utilizes other iShares fixed-income ETFs in its asset allocation strategy.

BYLD has a very low allocation to treasuries and greater exposure to credit sensitive high yield securities than a typical aggregate bond fund. This may in turn make it less sensitive to interest rate fluctuations and more driven by fundamental credit metrics or economic data.

For investors that prefer multi-sector mutual fund with more established track records, I am a big fan of the PIMCO Income Fund (PONDX) and Loomis Sayles Bond Fund (LSBRX). Each of these funds is headed by seasoned portfolio managers with decades of experience navigating the global fixed-income markets with an eye towards risk management, income, and capital appreciation.

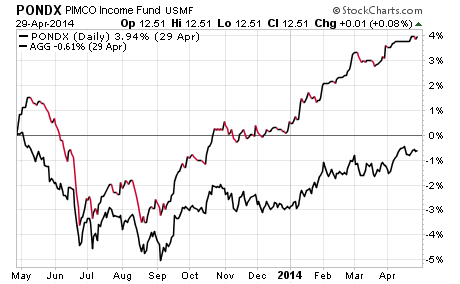

I currently own PONDX for clients in my Strategic Income portfolio as a core holding. One quick look at a comparison performance chart for PONDX versus AGG over the last year and you can quickly see how this fund has added value to shareholders.

Right now the PONDX portfolio has an effective duration of 4.09 years, yield of 3.62%, and has gained 3.77% so far this year. PIMCO also announced earlier this year that they are working on an equivalent ETF for PONDX that will hopefully be launching soon. They no doubt want to capitalize on the initial success of the PIMCO Total Return Bond ETF (BOND) with a more specialized ETF strategy.

Hundreds of billions of dollars are invested in underperforming aggregate bond ETFs and funds despite better alternatives to suit yield requirements or total return. Income investors should continue to search out strategies that are better equipped to deal with rising interest rates, credit cycles, and a host of other threats to your nest egg.

Additional changes to quantitative easing from the Fed this year along with further structural shifts in global credit valuations make this a key time to ensure you have the right fixed-income plan in place. Use this opportunity to screen the available options and make incremental changes that will enhance your returns or lower your risk. Having a plan and implementing it decisively will likely produce superior results.

Originally published as a blog on FMD Capital Management. Twitter: @fabiancapital

Author has a position in PONDX at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.