We are now past the halfway point of the earnings season, and the outcomes have been robust. Companies have been outperforming expectations by an impressive margin of over 6%.

Notably, every company in our portfolio has not only exceeded its own guidance but also raised its full-year projections. It is nice to witness how companies are demonstrating their agility in boosting profits while focusing on growth.

Considering the potential of accelerating growth we could see more gains in profit margins as time pushes on.

These improvements show up in our 3 market insights for this week:

- Amazon commerce suggests strength in consumer

- ChatGPT usage is not what you think.

- CCC Credit spreads suggest less risk in credit.

Healthy Amazon Marketplace = Healthy Consumer Market

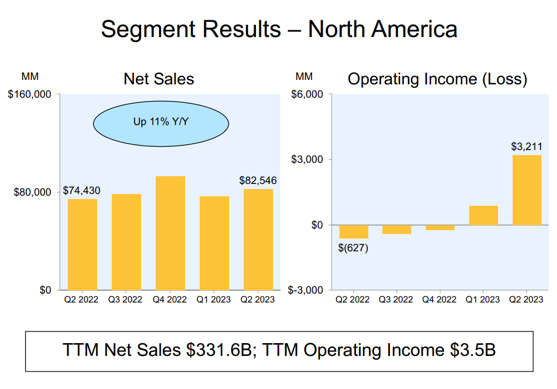

During the past couple of years, economists have been expressing alarm about the state of the economy. As we enter the second year with this perspective, there seems to be a much different development taking place as economic growth appears to be gaining momentum. The Q2 GDP surpassed 2%, and though it’s still early in Q3, it’s on track to reach a +3% growth rate. Just last night, Amazon reinforced this idea, demonstrating growth and increased profits in their marketplace business, achieving an impressive 11% growth.

** Full disclosure, my firm (Avory) is an investor in Amazon at the time of this article.

ChatGPT Being Used by Only 18% of Surveyed

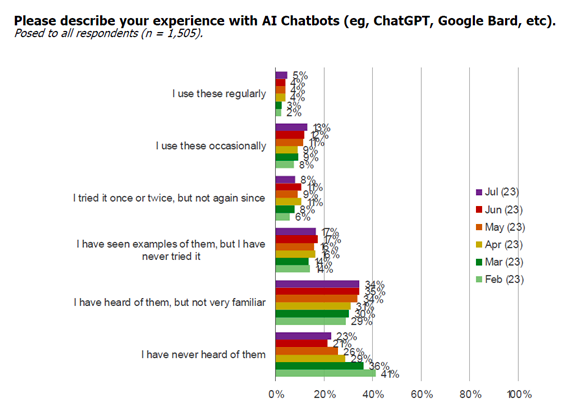

Bespoke recently conducted a revealing survey that focused on the engagement with AI ChatBots like Google’s Bard and ChatGPT. The data is quite clear, indicating that the level of regular usage is much lower than anticipated. Moreover, concerns have been raised about ChatGPT and its potential impact on specific sectors, but currently, it appears to be more of an enhancer than a threat.

The survey data showed that approximately 18% of the respondents use these AI tools regularly or occasionally, while the majority do not utilize them. While we are big believers that generative AI is transformational, the use cases will need to grow to realize the full value.

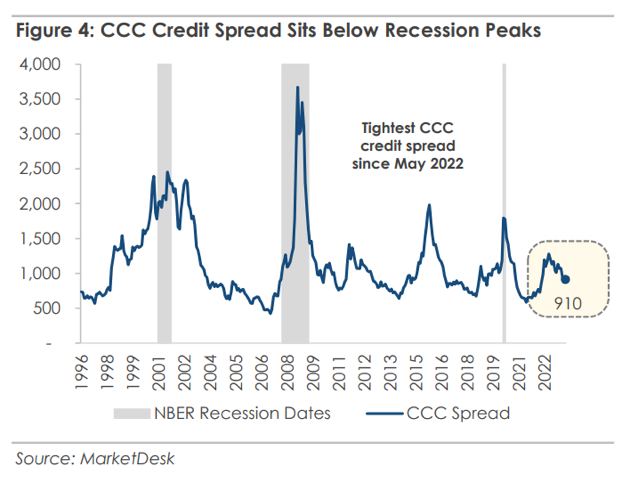

CCC Spreads (The most risky bonds) Remain low = Markets Suggesting Little Credit Risk

Occasionally, we take a moment to observe the riskiest segment of the bond market to gain insights into current risk levels. What we have observed is that CCC credit spreads remain low, indicating that the markets are relatively optimistic regarding the potential for credit risk. This serves as another positive indicator supporting our assessment.

Twitter: @_SeanDavid

The author or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.