I’ve talked about the CBOE implied correlation index a few times before, but it’s very timely to revisit this indicator as the February correction has created quite the shakeup.

Indeed we have seen a move in the index similar in magnitude to that seen in the heart of the financial crisis in 2008. So what’s going on, and how should we be thinking about it?

I covered this topic in a chart storm on the S&P 500 which focused on the VIX, volatility, and correlations.

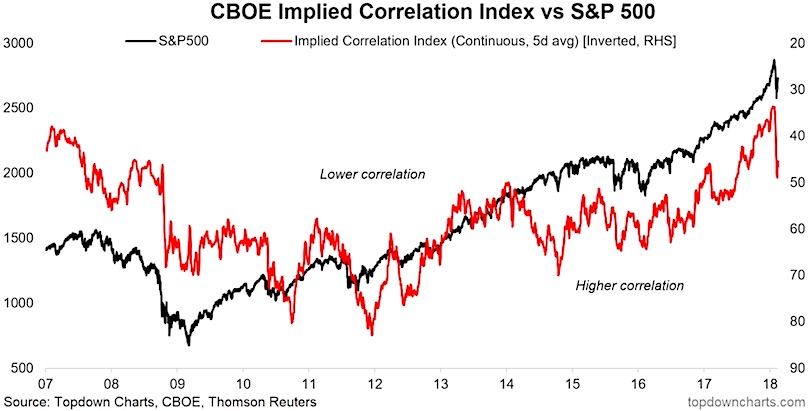

The chart in question – the implied correlation index (shown inverted) vs the S&P 500.

First, a note on methodology. The red line shown is the continuous series which I have composed from the rotating JCJ/ICJ/KCJ indexes. I discussed the full method for combining the series in a video a couple of months ago. Basically you need to switch them out as CBOE runs a separate index for each year.

Also to be clear, the implied correlation index is displayed inverted because it seems to function as a contrarian indicator in that spikes in correlation tend to coincide with market bottoms. Similarly you tend to see market tops when correlations decline and then turn up.

And that brings us to the punch line. The spike in implied correlations lined up with the market bottom that we have seen in the S&P500. Although it is worth noting that the 2008 period where a similar magnitude spike was seen took some further water to go under the bridge before the ultimate market bottom was in.

Aside from adding to the case of a market rebound there is another possibility, which I talked about in the chart storm. I also referenced realized cross-correlations within the stock market, which have turned up from decade-lows. And it’s quite possible that we are about to re-enter a period of higher correlations as macro currents take greater sway vs stock-specific or sector-specific factors. So that’s also something to keep in mind.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.