With interest rates rising and the housing market facing uncertainty (and losing momentum), it is a very interesting time for real estate and housing sales.

Today, we take a quick peak at the Philadelphia Housing Sector Index (HGX).

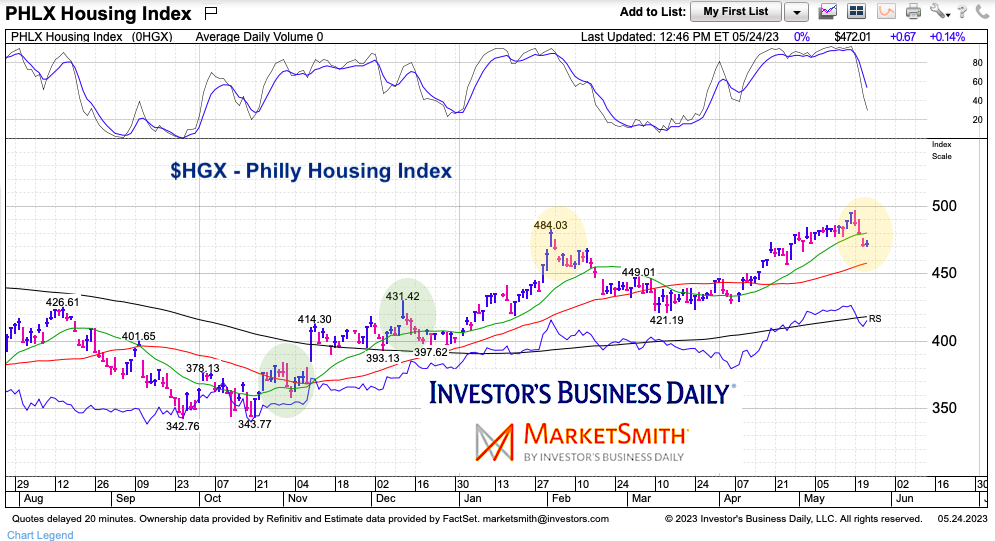

HGX is at a critical crossroads following a recent 3 day decline. 3 days doesn’t seem like much, but as the chart below will show you, it was a steep decline.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$HGX Philadelphia Housing Index “daily” Chart

The recent reversal lower is similar to 3 other reversals over the past 10 months. On came at the beginning of this year and led to a 13% decline. The other two (in green) were short-term blips in the bullish up-trend.

So the question is: Will the Housing Sector continue to slide like earlier this year? Or is the decline nearly over and ready to resume higher?

Two technical insights: If the bullish trend is to remain in place, then price needs to recoup the 20-day moving average within a few days. A concern I have is that the recent highs very briefly took out the prior highs and failed. Housing is a key cog in our economy so this is worth keeping an eye on.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.